Italian Bonds Rise After Avoiding Downgrade from Fitch Ratings

This article was originally published on ETFTrends.com.

Italian bonds surged on Monday after Fitch Ratings decided to keep the country's bond ratings unchanged, avoiding a potential downgrade to junk status.

Italian bond yields reached a fresh low within the past week as Fitch Ratings decided to keep the current BBB rating intact. However, the ratings company didn't shy away from affirming that significant risks are still present as Italy's high debt levels remain and its fiscal standing remains tenuous.

“Fitch’s affirmation of Italy on Friday evening should take the edge out of downgrade fears for the upcoming Moody’s and S&P reviews,” wrote Commerzbank strategists led by Michael Leister.

In recent months, Italy and the EU haven’t been seeing eye to eye on the country’s proposed budgetary plans, causing the EU to reject the proposals due to its excessive spending, which has caught the ire of Italy’s leaders in the process. However, Italy’s deputy Prime Minister Matteo Salvini is showing signs that the country could succumb to increased pressure from the EU by lowering its deficit budget.

Forthcoming ratings decisions are looming, which could pose additional risks to the country's bonds. Moody’s Investors Service is scheduled to review the bonds on March 15 and S&P Global Ratings is slated for April 26.

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

Conversely, if investors believe that international markets will outperform U.S. domestic markets, the Direxion FTSE International Over US ETF (RWIU) provides a means to not only see international markets perform well, but a way to capitalize on their outperformance compared to the U.S. markets.

Related: Lessons From How Pros Use Bond ETFs

Treasury Yields Rise on U.S.-China Trade Progress

Leveraged Treasury bull ETFs like the Direxion Daily 7-10 Year Treasury Bull 3X ETF (TYD) and Direxion Daily 20+ Year Treasury Bull 3X ETF (TMF) fell on Monday as yields rose on optimism of a U.S.-China trade deal. TYD edged 0.67 percent lower while TMF declined 1.40 percent.

The benchmark 10-year yield rose to 2.682 while the 30-year yield ticked higher to 3.045,

TYD seeks daily investment results equal to 300% of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. TYD invests in securities of the index and ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years.

TMF seeks daily investment results worth 300% of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. The fund invests at least 80% of its net assets in securities of the index and ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than 20 years.

U.S. markets rose on Monday as U.S. President Donald Trump said he would delay any additional tariffs on Chinese goods while negotiations are still underway for a permanent trade deal.

Trump took to Twitter to punctuate progress in negotiations with the world’s second largest economy, but a definitive trade deadline has yet to be established.

I am pleased to report that the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues. As a result of these very……

— Donald J. Trump (@realDonaldTrump) February 24, 2019

….productive talks, I will be delaying the U.S. increase in tariffs now scheduled for March 1. Assuming both sides make additional progress, we will be planning a Summit for President Xi and myself, at Mar-a-Lago, to conclude an agreement. A very good weekend for U.S. & China!

— Donald J. Trump (@realDonaldTrump) February 24, 2019

“The market seems to expect a grand ‘trade deal’ soon that marks a NAFTA2 -like quiet end to President Trump’s trade actions,” wrote Barry Bannister, head of institutional equity strategy at Stifel, in a note.

Trump Threating EU with Car Tariffs

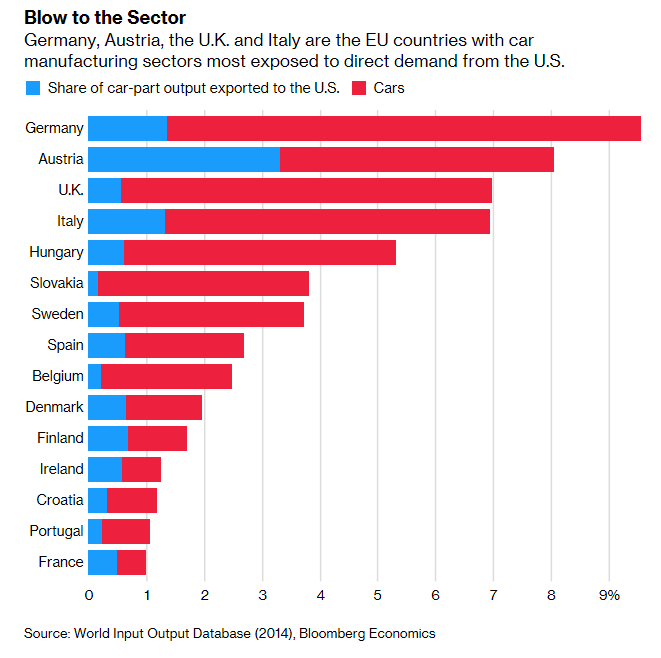

As negotiations with China are underway to settle their trade differences, U.S. President Donald Trump turned his attention to Europe with threats to impose car tariffs on the EU–notably Germany, Austria, the U.K. and Italy.

Last month, the EU said it would impose $22.7 billion of tariffs on U.S. products if Trump follows through on imposing duties on European automotive goods the same way he imposed tariffs on tax foreign steel and aluminum last year. The EU retaliated with levies on U.S. products like motorcycles, jeans and bourbon whiskey.

“Should there be tariffs on car and car parts, which we don’t want, we have started internally to prepare a list of re-balancing measures,” EU Trade Commissioner Cecilia Malmstrom told reporters on Friday in Bucharest after a meeting of the bloc’s commerce ministers. “There is full support to do this.”

For more market trends, visit ETF Trends.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

An Alternative ETF to Hedge Against Further Market Volatility

Indonesia ETFs Slip After Credit Suisse Downgrades the Developing Economy

A One-ETF-Fits-All Solution in Today’s Challenging Fixed Income Market

Fidelity Expands Its Commission-Free ETF Platform to Include Over 500 Options

Schwab ETF OneSource Doubles Lineup to 500+ Commission-Free ETFs