ITT Q2 Earnings & Revenues Beat Estimates, Decrease Y/Y

ITT Inc. ITT reported better-than-expected results in second-quarter 2020, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

In the reported quarter, the company pulled off an earnings surprise of 58.3%. Quarterly adjusted earnings were 57 cents per share, outpacing the Zacks Consensus Estimate of 36 cents. However, the bottom line declined 38.7% from the year-ago figure.

Revenues of $514.7 million were down 29% year over year. However, the top line surpassed the consensus mark of $507 million by 1.5%. Also, revenues fell 27.6% on an organic basis.

Segmental Breakup

Second-quarter revenues of Industrial Process were $193.3 million, down 16.9% year over year. Organic sales declined 16.6%, owing to lower revenues from pump projects and weakness across the short-cycle business.

Quarterly revenues of Motion Technologies declined 37.3% year over year to $199.3 million. Organic sales decreased 34.7% in the quarter mainly due to lower Friction sales on account of soft demand, owing to the coronavirus outbreak.

Connect & Control Technologies generated $122.9 million revenues, down 27.8% year over year. Organic sales dipped 29.3%, owing to weakness across aerospace and defense end markets amid the coronavirus outbreak.

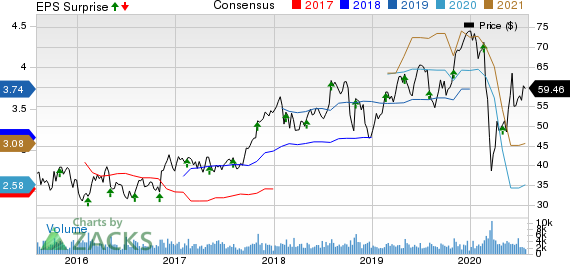

ITT Inc. Price, Consensus and EPS Surprise

ITT Inc. price-consensus-eps-surprise-chart | ITT Inc. Quote

Costs/Margins

Cost of sales in the second quarter was $351.1 million, down 28.1% year over year. Sales and marketing expenses were $35.7 million compared with $42.7 million in the year-ago quarter.

Gross profit margin was 31.8%, down 40 basis points.

In the quarter, income tax benefits were $28.1 million compared with income tax expenses of $19.3 million in the year-ago quarter.

Balance Sheet/Cash Flow

Exiting the second quarter, ITT had cash and cash equivalents of $819.1 million, up from $612.1 million as of Dec 31, 2019. Short-term debt and current maturities of long-term debt were $247.5 million compared with $86.5 million at the end of 2019.

In the first six months of 2020, the company generated $203.1 million in cash from operating activities, higher than $101.1 million recorded in the year-ago comparable period. Capital expenditure totaled $34.3 million, declining from $45.8 million spent in the year-ago comparable period.

2020 Guidance

ITT expects the pandemic to continue impacting its businesses throughout 2020. It believes that the reduction in demand for automotive and aerospace components will continue to hurt its top-line performance. In addition, volatile oil and gas market, and weak capital expenditure might affect its performance.

On uncertainties, regarding the impacts of the coronavirus outbreak on financial and operating results, ITT has not provided its earnings and revenues guidance for 2020.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are AGCO Corporation AGCO, Avery Dennison Corporation AVY and Berry Global Group, Inc. BERY. While AGCO sports a Zacks Rank #1 (Strong Buy), Avery Dennison and Berry Global carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO delivered an earnings surprise of 409.54%, on average, in the trailing four quarters.

Avery Dennison delivered an earnings surprise of 7.70%, on average, in the trailing four quarters.

Berry Global delivered an earnings surprise of 16.34%, on average, in the trailing four quarters.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research