ITT Q2 Earnings & Revenues Beat Estimates, Increase Y/Y

ITT Inc.’s ITT second-quarter 2022 adjusted earnings (excluding 9 cents from non-recurring items) of 98 cents per share surpassed the Zacks Consensus Estimate by 2 cents. This compares with our estimate of 96 cents. The bottom line increased 4.3% year over year, owing to higher revenues.

Total revenues of $733.3 million also outperformed the Zacks Consensus Estimate of $710.6 million. This compares with our estimate of $711.9 million. The top line increased 6% year over year, owing to strong demand in Connect & Control Technologies and Industrial Process segments and pricing actions. The acquisition of Habonim contributed 2.2% to the top line. Organic sales rose 9.6% year over year.

In the reported quarter, total orders climbed 10% year over year, thanks to strong demand for pumps, connectors and aerospace components. The metric increased 13% on an organic basis.

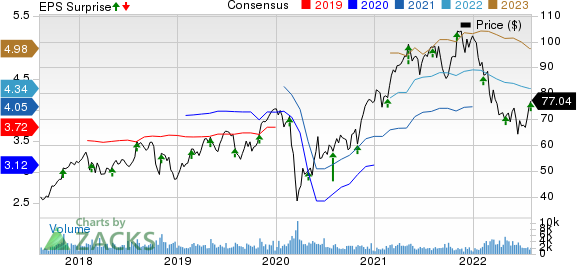

ITT Inc. Price, Consensus and EPS Surprise

ITT Inc. price-consensus-eps-surprise-chart | ITT Inc. Quote

Segmental Results

Revenues from Industrial Process totaled $239.6 million, up 12% year over year. The Zacks Consensus Estimate for Industrial Process segment revenues was $236 million. Our estimate for the quarter was $215.1 million. Growth in short-cycle business boosted segmental revenues. Organic sales increased 8.1%. Organic orders jumped 26%. Adjusted operating income augmented 27.6% year over year.

Revenues from Motion Technologies totaled $331.3 million, reflecting a year-over-year decline of 3.6%. The Zacks Consensus Estimate for Motion Technologies revenues was $365 million. Our estimate for the quarter was $348.9 million. The downside was due to unfavorable foreign currency translation of $28.6 million. Organic revenue rose 5% owing to growth in Friction, strength in Wolverine sealings, and pricing actions. Adjusted operating income fell 25.5% year over year due to high raw material costs.

Revenues from Connect and Control Technologies totaled $163.2 million, up 21.3% year over year and up 25%, organically. The Zacks Consensus Estimate for Connect and Control Technologies revenues was $165 million. Our estimate for the quarter was $148.3 million. Strong performance in industrial connectors and strength in aerospace components drove segmental revenues. Adjusted operating income soared 56.1% year over year owing to productivity improvement, higher sales and pricing actions. Organic orders in the segment rose 17%.

Margin Profile

During the second quarter, ITT’s cost of revenues increased 9.4% year over year to $511.1 million. Gross profit decreased marginally to $222.2 million.

General and administrative expenses decreased 5.5% year over year to $57 million, while sales and marketing expenses rose 5.5% to $40.4 million. Research and development expenses inched up 4.7% to $24.3 million.

Adjusted segmental operating income in the quarter increased 2% year over year to $116.5 million. Margin decreased 60 basis points (bps) to 15.9%. Supply-chain woes, inflation in raw material costs and expenses were a spoilsport. However, results benefited from higher sales volume and pricing actions.

Balance Sheet and Cash Flow

Exiting the second quarter, ITT had cash and cash equivalents of $525.7 million, compared with $647.5 million. Its commercial paper and current maturities of long-term debt were $551.4 million compared with $197.6 million at the end of December 2021.

In the first half of 2022, ITT generated net cash of $54.2 million from operating activities compared with $231.6 million used in the year-ago period. At the end of the first six months of 2022, capital expenditure was $47.5 million, up 35.3% year over year. Free cash flow was $6.7 million in the first half of 2022 compared with free cash outflow of $266.7 million at the end of the year-ago period.

During the first six months of 2022, ITT paid out dividends of $44.3 million, up 16.3% year over year. Share repurchases were $240.9 million in the same period, reflecting an increase of more than 300% year over year.

2022 Outlook

ITT continues to expect revenues to increase 7-9% year over year in 2022. On an organic basis, the same is estimated to increase 10-12% (9-10% increase expected earlier). The company expects the Russia-Ukraine war to impact sales to the tune of approximately $80 million. Segment operating margin is predicted to be 17.5-18.4%, while adjusted segment operating margin is estimated to be 17.6-18.5%.

For the full year, ITT expects free cash flow of $250-$300 million. The company forecasts earnings of $4.12-$4.45 for 2022. Adjusted earnings are expected to be $4.35-$4.65 ($4.30-$4.70 expected earlier). The Zacks Consensus Estimate for the same stands at $4.34.

Zacks Rank & Key Picks

ITT carries a Zacks Rank #4 (Sell).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). GEF delivered a trailing four-quarter earnings surprise of 22.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Greif has an estimated earnings growth rate of 36.8% for the current year. Shares of the company have gained 21% in the past six months.

Titan International, Inc. TWI presently flaunts a Zacks Rank of 1. Its earnings surprise in the last four quarters was 47%, on average.

Titan International has an estimated earnings growth rate of 157.7% for the current year. Shares of the company have rallied 43.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ITT Inc. (ITT) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.