J&J (JNJ) to Set the Stage for Pharma Sector Q4 Earnings

Johnson & Johnson JNJ will report fourth-quarter and full-year 2021 results on Jan 25, before market open. In the last-reported quarter, the company delivered an earnings surprise of 9.7%.

The healthcare bellwether’s performance has been pretty impressive, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 8.34%, on average.

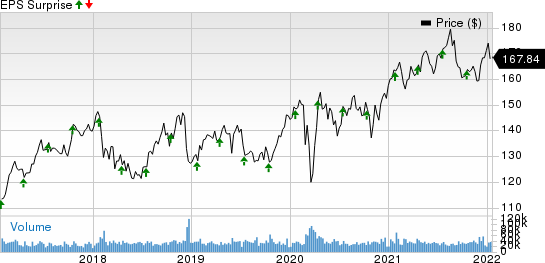

Johnson & Johnson Price and EPS Surprise

Johnson & Johnson price-eps-surprise | Johnson & Johnson Quote

J&J’s stock has risen 4.8% this year so far compared with an increase of 17.2% for the industry.

Image Source: Zacks Investment Research

Factors to Consider

J&J’s Pharma segment is expected to have continued to outperform the market led by increased penetration and new indications across key products such as Darzalex, Imbruvica, and Stelara. J&J markets Imbruvica in partnership with AbbVie ABBV.

The Zacks Consensus Estimate for Imbruvica, Darzalex and Stelara is pegged at $1.15 billion, $1.61 billion and $2.46 billion, respectively.

Other core products like Invega Sustenna/Xeplion/Invega Trinza/Trevicta, J&J’s PAH drugs and new drugs, Erleada and Tremfya might have contributed significantly to sales growth.

Improvement in sales of some other key drugs like Xarelto, as seen in the past few quarters, is likely to have continued into the fourth quarter. Last quarter, temporary COVID-19 impacts on new patient starts and modest share loss in the United States to new oral competition hurt sales of J&J and AbbVie’s Imbruvica to an extent. It remains to be seen if these trends improved in the fourth quarter.

J&J’s single-dose COVID-19 vaccine, which is approved for emergency use in some countries, generated sales of $502 million in the third quarter. Sales of the vaccine are likely to have been higher in the fourth quarter. A booster shot of the vaccine was authorized in October 2021, which is likely to have boosted sales in the fourth quarter.

Generic/biosimilar competition to drugs like Zytiga, Procrit/Eprex and Remicade and some negative impact of COVID-19 is likely to have hurt the top line.

Also, some volatility in sales mainly due to the recent surge of infections due to the Delta and Omicron variants is expected to have affected sales of some drugs in the fourth quarter.

The Zacks Consensus Estimate for J&J’s Pharmaceuticals unit is $14.58 billion.

Medical Devices segment sales are likely to have benefited from an ongoing recovery after being hurt significantly in the early stages of the pandemic. However, the Delta variant and healthcare staff shortage led to a sequential step down in procedure volume trends in the third quarter. Though elective procedure volumes are likely to have recovered in the fourth quarter, the pace of recovery and the impact of Delta/Omicron-related rising infection rates create uncertainty.

The Zacks Consensus Estimate for J&J’s Medical Devices segment is $6.9 billion.

In the Consumer Healthcare segment, the improving trend seen in the last couple of quarters is likely to have continued.

The Zacks Consensus Estimate for J&J’s Consumer Healthcare segment is $3.73 billion.

Importantly, J&J is likely to announce its financial guidance for 2022 on the fourth-quarter conference call.

Key Update in Q4

In November 2021, J&J announced plans to separate its Consumer Health segment into a new publicly-traded company, leaving behind a new J&J with its Pharmaceuticals and Medical Device units.

J&J believes the Consumer Health unit’s separation would drive growth and unlock significant value as the Pharmaceutical and Medical Devices units are relatively higher growth, higher-margin businesses. The separation of the Consumer Health unit is expected to be completed in the next 18 to 24 months, pending necessary board and regulatory approval. The remaining Pharmaceutical and Medical Devices company will continue to use the name Johnson & Johnson and will be led by a new chief executive officer, Joaquin Duato. J&J may announce the new Consumer Health publicly-traded company’s name on the fourth-quarter conference call.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for J&J this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: J&J’s Earnings ESP is 0.00% as the Zacks Consensus Estimate as well as the Most Accurate Estimate stand at $2.12 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: J&J has a Zacks Rank #4 (Sell) currently.

Stocks to Consider

Here are some large drug/biotech stocks that have the right combination of elements to beat on earnings this time around:

Glaxo GSK with an Earnings ESP of +5.41% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Glaxo’s stock has surged 25.6% in the past year. Glaxo topped earnings estimates in three of the last four quarters. Glaxo has a four-quarter earnings surprise of 15.28%, on average.

Amgen AMGN has an Earnings ESP of +1.20% and a Zacks Rank #3.

Amgen also topped earnings estimates in three of the last four quarters. Amgen has a four-quarter earnings surprise of 5.65%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research