The J.M. Smucker (SJM) Boosts Share-Buyback Authorization

The J. M. Smucker Company SJM has been committed toward rewarding shareholders, through share repurchases as well as dividend payments. Progressing on these lines, The J. M. Smucker raised its share buyback authorization by 5 million common shares. Consequently, The J. M. Smucker now has shares worth nearly 7.8 million available for buyback.

Concurrently, management announced a dividend of 99 cents per share, which is payable on Dec 1 to shareholders of record as on Nov 12, 2021. The J. M. Smucker currently has a dividend payout of 42%, dividend yield of 3.2% and free cash flow yield of 7.5%. With an annual free cash flow return on investment of 8.3%, the dividend payment is likely to be sustainable.

Certainly, the company’s healthy financial status allows it to undertake such shareholder-friendly moves. We note that The J. M. Smucker’s free cash flow amounted to $70 million for the first quarter of fiscal 2022. Free cash flow is expected to be roughly $800 billion in fiscal 2022.

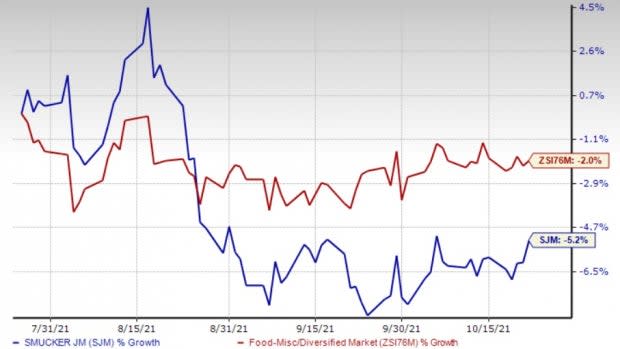

Image Source: Zacks Investment Research

What Else to Know?

The J. M. Smucker is progressing well with its core priorities, which include driving commercial excellence; reshaping the portfolio; streamlining the cost structure and unleashing its organization to win. With regard to driving commercial excellence, the company continued to see enhanced market share across its portfolio in the fiscal first quarter. Moving on, the company is committed toward exploring opportunities to optimize its on-shelf assortment and increase concentration on areas with a higher growth potential.

With regard to reshaping the portfolio, the company concluded the divestiture of the Natural Balance premium pet food business in February 2021. Also, Smucker sold its Crisco oils and shortening business to B&G Foods in December 2020. Earlier, Smucker had divested its U.S. canned milk and U.S. baking businesses. Such moves help the company focus its resources and portfolio on pet food, snacking and coffee categories.

Talking of streamlining costs, management has been optimizing its supply chain, lowering discretionary costs and expanding the network production efficiencies. A complete implementation of these efforts will help the company deliver additional cost savings of $50 million this year and in each of the next two years. Thanks to these efforts, the SD&A expenses are likely to decline 6% in fiscal 2022. As part of the company’s last above-mentioned strategy, it is committed toward prioritizing activities that are focused on delivering with excellence and leading in the marketplace.

Apart from these, the company is benefiting from the revival of the Away from Home division. With things opening up and vaccination gathering pace, consumer mobility has increased. The continuation of these trends bodes well for The J.M. Smucker’s Away from Home division. Th fiscal 2022 volume/mix is expected to benefit from additional net pricing, the away-from-home rebound and strength in the Smucker's Uncrustables brand.

However, the Zacks Rank #4 (Sell) company is encountering key commodity cost inflation, along with supply-chain volatility surrounding the availability of labor and transportation. The J.M. Smucker, on its first-quarter earnings call, stated that it expects to encounter elevated raw material and logistic costs. Management predicts supply-chain disruptions and cost inflation to prevail throughout the rest of fiscal 2022. Shares of the company have declined 5.2% in the past three months compared with the industry’s depreciation of 2%.

Solid Food Picks

United Natural Foods, Inc. UNFI, currently sporting a Zacks Rank #1, has a trailing four-quarter earnings surprise of 13.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Kraft Heinz Company KHC, currently carrying a Zacks Rank of 2 (Buy), has a trailing four-quarter earnings surprise of 11.5%, on average.

General Mills, Inc. GIS, currently carrying a Zacks Rank of 2, has a trailing four-quarter earnings surprise of 7.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research