Jack in the Box (JACK) Rises 30% in 3 Months: More Room to Run?

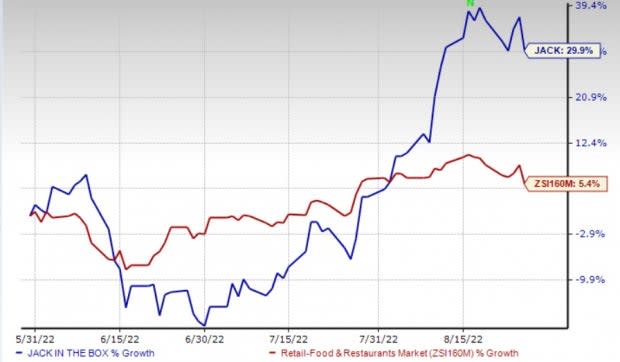

Shares of Jack in the Box Inc. JACK have gained 29.9% in the past three months compared with the industry’s increase of 5.4%. Emphasis on initiatives like menu innovations, delivery channels, Del Taco acquisition and marketing strategies bode well. However, the rise in commodity costs and wage inflation remains a concern. Let’s delve deeper and find out, whether the company’s bull run will continue or not.

Growth Drivers

Menu innovation is one of the primary characteristics of Jack’s brand. Jack in the Box is one of the nation’s largest hamburger chains. The company makes regular menu innovations and provides limited period offers (LPO) at both its flagship restaurants to drive long-term customer loyalty. With focused menu inventions around premium products like Buttery Jack Burgers, sauced & Loaded Fries, munchie mash-ups and teriyaki bowls running currently, the company is witnessing comps growth. The company is continuously working on maintaining the uniqueness of its brand, menu and premium food offerings.

Jack in the Box is also increasingly focusing on delivery channels, which is a growing area for the industry. Given the high demand for this service, the company has undertaken third-party delivery channels to bolster transactions and sales. The company partnered with DoorDash, Postmates, Grubhub and Uber Eats. It is expanding its mobile application in a few markets that support order-ahead functionality and payment. In the third quarter of fiscal 2022, the company’s digital sales increased 30% year over year.

On Mar 8, 2022, this Zacks Rank #3 (Hold) company completed its previously announced acquisition of Del Taco Restaurants for approximately $585 million. The move is in sync with its strategy of expanding the customer base. Del Taco, which has nearly 600 restaurants, serves more than three million guests every week. During third-quarter 2022, Del Taco’s same-store sales rose 3.5%, comprising franchise same-store sales growth of 4.8% and company-operated same-store sales growth of 2.3%. During the quarter, the company closed five restaurants.

Image Source: Zacks Investment Research

Concerns

High costs remain a major concern for the company. During the fiscal third quarter, restaurant-level adjusted margin came in at 15.8% compared with the 25.4% reported in the prior-year quarter. The downside was led by a rise in food and packaging costs, wage inflation of 13.2%, and higher utilities and maintenance and repair costs.

Food and packaging costs (as a percentage of company restaurant sales) rose 120 bps year over year to 30.6%. Commodity costs during the quarter increased 16.8% year over year. The upside can be attributed to a rise in the price of proteins, sauces, oil and beverages. The franchise level margin was 41.4% in the fiscal third quarter compared with the 43.3% reported in the prior-year quarter.

Key Picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are Potbelly Corporation PBPB, Arcos Dorados Holdings Inc. ARCO and Dollar Tree Inc. DLTR.

Potbelly has a Zacks Rank #2 (Buy), at present. PBPB has a trailing four-quarter earnings surprise of 26.2%, on average. Shares of PBPB have declined 12.8% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Potbelly’s 2022 sales and EPS suggests growth of 17.5% and 100%, respectively, from the corresponding year-ago period’s levels.

Arcos Dorados carries a Zacks Rank #2. ARCO has long-term earnings growth of 34.4%. Shares of the company have increased 38.9% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 27.1% and 104.2%, respectively, from the year-ago period’s levels.

Dollar Tree carries a Zacks Rank #2. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average. The stock has gained 64% in the past year.

The Zacks Consensus Estimate for Dollar Tree’s 2022 sales and EPS suggests growth of 6.7% and 40.9%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research