Jacobs Engineering Group Inc (JEC) Hedge Funds Are Snapping Up

At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we've gathered as a result gives us access to a wealth of collective knowledge based on these firms' portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Jacobs Engineering Group Inc (NYSE:JEC) makes for a good investment right now.

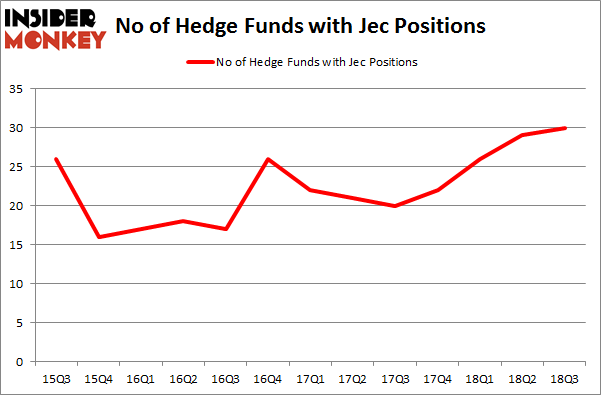

Is Jacobs Engineering Group Inc (NYSE:JEC) a bargain? The smart money is in an optimistic mood. The number of bullish hedge fund positions rose by 1 in recent months. Our calculations also showed that Jec isn't among the 30 most popular stocks among hedge funds. JEC was in 30 hedge funds' portfolios at the end of September. There were 29 hedge funds in our database with JEC positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let's review the latest hedge fund action encompassing Jacobs Engineering Group Inc (NYSE:JEC).

What have hedge funds been doing with Jacobs Engineering Group Inc (NYSE:JEC)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in JEC over the last 13 quarters. With hedgies' positions undergoing their usual ebb and flow, there exists an "upper tier" of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

The largest stake in Jacobs Engineering Group Inc (NYSE:JEC) was held by Citadel Investment Group, which reported holding $187.1 million worth of stock at the end of September. It was followed by Alyeska Investment Group with a $139.8 million position. Other investors bullish on the company included Select Equity Group, Millennium Management, and Point72 Asset Management.

As industrywide interest jumped, key hedge funds were leading the bulls' herd. Columbus Circle Investors, managed by Principal Global Investors, assembled the biggest position in Jacobs Engineering Group Inc (NYSE:JEC). Columbus Circle Investors had $21.1 million invested in the company at the end of the quarter. Vikas Lunia's Lunia Capital also made a $7.9 million investment in the stock during the quarter. The following funds were also among the new JEC investors: Jeffrey Talpins's Element Capital Management, Gregg Moskowitz's Interval Partners, and John Brandmeyer's Cognios Capital.

Let's check out hedge fund activity in other stocks similar to Jacobs Engineering Group Inc (NYSE:JEC). We will take a look at Trimble Inc. (NASDAQ:TRMB), Snap Inc. (NYSE:SNAP), Albemarle Corporation (NYSE:ALB), and Fidelity National Financial Inc (NYSE:FNF). This group of stocks' market caps are closest to JEC's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TRMB,17,606646,-2 SNAP,17,514140,2 ALB,22,353670,-5 FNF,29,491965,3 Average,21.25,491605,-0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $492 million. That figure was $730 million in JEC's case. Fidelity National Financial Inc (NYSE:FNF) is the most popular stock in this table. On the other hand Trimble Inc. (NASDAQ:TRMB) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Jacobs Engineering Group Inc (NYSE:JEC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index