January Growth Stock Picks

Why invest in a stock whose growth outlook that lags behind the market? Investors looking for companies with extraordinary future prospects in terms of profitability and returns should look at the following high-growth stocks. If a buoyant growth prospect is what you’re after in your next investment, I’ve put together a list of high-growth stocks you may be interested in, based on the latest financial data from each company.

The North West Company Inc. (TSX:NWC)

The North West Company Inc., through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in Canada, Alaska, the South Pacific, and the Caribbean. Started in 1668, and now run by Edward Kennedy, the company employs 7,597 people and has a market cap of CAD CA$1.46B, putting it in the small-cap stocks category.

NWC’s projected future profit growth is a robust 31.51%, with an underlying 9.49% growth from its revenues expected over the upcoming years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with top-line expansion. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 24.86%. NWC ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about NWC? Have a browse through its key fundamentals here.

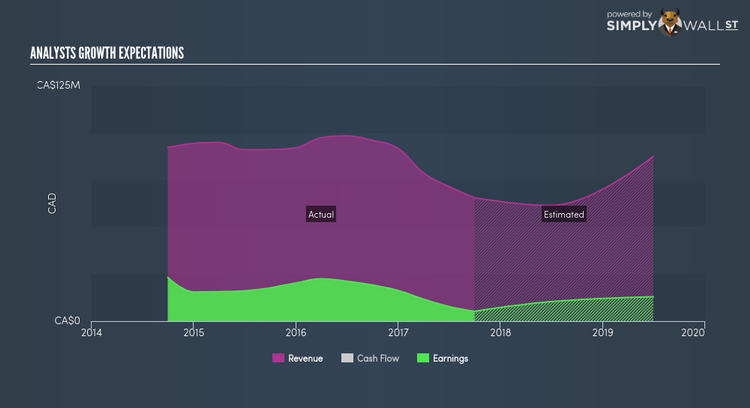

Vecima Networks Inc. (TSX:VCM)

Vecima Networks Inc. provides technology solutions that empower network service providers to connect people and enterprises to information and entertainment worldwide. Started in 1988, and now run by Sumit Kumar, the company provides employment to 334 people and with the market cap of CAD CA$213.52M, it falls under the small-cap stocks category.

Should you add VCM to your portfolio? Take a look at its other fundamentals here.

SEMAFO Inc. (TSX:SMF)

SEMAFO Inc., a mining company, engages in the exploration and production of gold properties in West Africa. Founded in 1994, and now run by Benoit Desormeaux, the company size now stands at 1,695 people and with the company’s market cap sitting at CAD CA$1.16B, it falls under the small-cap category.

SMF’s projected future profit growth is a robust 40.68%, with an underlying 97.32% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 13.44%. SMF’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add SMF to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.