Banks face $10bn hit from Archegos selloff

The implosion of Bill Hwang's trading empire could trigger $10bn (£7.3bn) of losses across the financial system, analysts warned, as watchdogs around the world launched an investigation into how banks handled the controversial fund.

Experts at JP Morgan doubled their estimate for losses by major banks from the liquidation of Mr Hwang's firm Archegos to between $5bn to $10bn as the scale of the carnage became clear.

Meanwhile regulators in the US and UK have reportedly asked for details from the lenders involved in the disaster to determine if they acted inappropriately, according to the Financial Times. Some officials are also concerned the crisis has exposed wider risks in global finance.

The chaos started on Friday when bankers acting for Archegos launched a $20bn fire sale of its shareholdings to raise cash so it could cover losses from bets on the markets which went badly wrong. The massive sell orders were placed by two of Archegos's banks, Morgan Stanley and Goldman Sachs, and wiped around $35bn off the stocks involved.

Fellow lenders Credit Suisse, Nomura and Mitsubishi UFJ Financial (MUFG) did not immediately sell and have been landed with a huge bill.

Credit Suisse, which has also been battling with the fallout from the collapse of finance firm Greensill Capital, has warned that the impact could be "significant" while Nomura said it is braced for a $2bn hit.

Analysts estimate that Credit Suisse's losses could reach up to $3.5bn and said its share buyback programme may now be at risk.

JP Morgan analysts said: "We expect full disclosure by the end of the week at the latest from Credit Suisse.

"We suspect potentially poor risk management being an issue here."

MUFG, Japan's biggest bank, could also face a potential $300m loss, sources told Bloomberg on Tuesday.

JP Morgan said that overall losses for all involved could hit 11 figures.

Bankers at several rival firms acting for Mr Hwang met last week to try and agree an orderly sale of his assets so that market turmoil could be avoided, a source told the FT. No official agreement was reached although a source said that firms involved appeared to have decided they would try to avoid a fire sale before markets opened on Friday.

Goldman - which subsequently triggered much of the day's ructions when it then launched a massive share-off its own on Friday morning - is said to have listened to the discussions without committing to an agreement.

Banks involved are now reportedly being investigated by the US Securities and Exchange Commission and Britain's Financial Conduct Authority.

The crisis has raised fears that so-called family offices such as Mr Hwang’s are operating with little oversight and have dangerous ties to the wider banking system. Family offices manage the wealth of just a few ultra-rich individuals and are not held to the same strict rules as firms which look after money on behalf of larger groups.

According to UBS, 121 of the world’s largest single-family offices have assets of $142.4bn, with each families’ net worth averaging $1.6bn.

The Financial Stability Board (FSB), which was set up to co-ordinate global bank regulation after the G20 financial crisis meeting in 2009, has spent months looking at whether reforms are needed to rein in non-bank traders. Insiders said the latest events have demonstrated the importance of speeding this process up.

Alex Brazier, the Bank of England’s executive director for financial stability strategy and risk, said at an event on Monday that "guardrails" may be needed to prevent the actions of a few traders from contaminating the wider market.

He said: "The non-bank system and the banking system are not too hermetically sealed separate things. What happens in one affects the other."

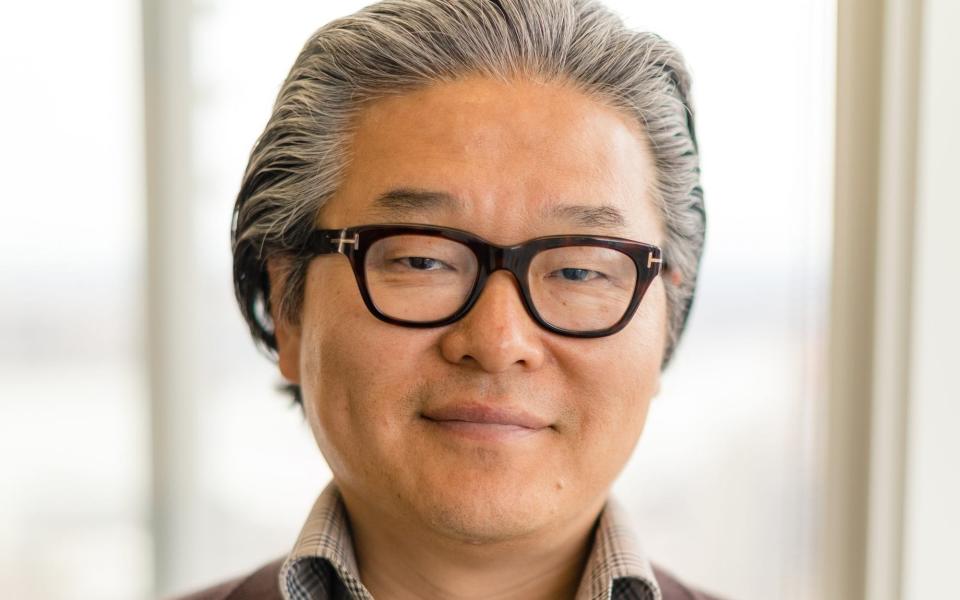

Mr Hwang's rise began in the Nineties when he was hired by legendary hedge fund Tiger Management. He was later given money to start Tiger Asia, which in 2012 was charged with illegal trading involving Chinese bank stocks. He agreed to criminal and civil settlements and later closed down the fund.

Michael Oliver, the co-founder of the Global Partnership Family Offices, argued that Archegos is "far from a typical family office, even in the context of the old adage ‘each family office is unique’, as highly levered trading strategies are not synonymous with intergenerational wealth preservation".

He said: "At the end of the 2010s, the USA saw an increase in hedge funds restructuring under the guise of ‘family offices’, some in the form of running similar strategies without external capital, others with external capital in order to adjust their regulatory burden."