JetBlue (JBLU) Unveils Improved Q3 Unit Revenue View

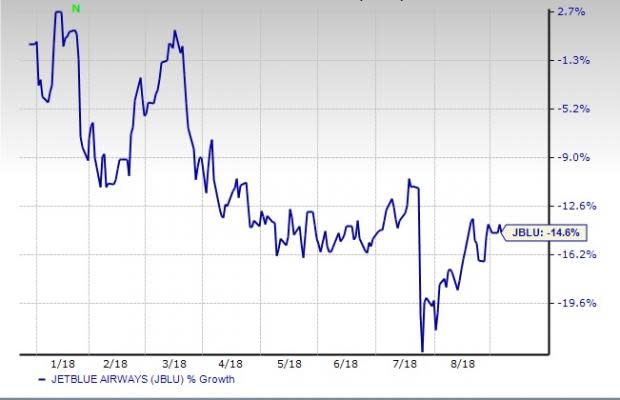

Shares of JetBlue Airways Corporation JBLU have been struggling this year mainly due to high fuel costs and have shed 14.6% on a year-to-date basis.

However, this Long Island City, New York based company received some encouraging news on Sep 5, when it unveiled an improved projection for current-quarter revenue per available seat mile (RASM: a key measure of unit revenues). The carrier now anticipates RASM to grow between 1% and 3% for the third quarter of 2018 (the earlier view had called for the key metric to grow in the 0-3% range). JetBlue cited robust close-in demand as one of the factors behind its decision to issue an improved guidance.

Expansion Plan

Apart from issuing a fresh unit revenue guidance, JetBlue was also in the news when it announced its decision to add transcontinental routes. As part of its expansion initiative, the carrier started operating non-stop flights connecting New York’s John F. Kennedy Airport and Southern California’s Ontario International Airport.

Ontario is the tenth city to be served in California by JetBlue. Moreover, the destination is the 73rd nonstop one from New York-JFK as far as this Zacks Rank #4 (Sell) low-cost carrier is concerned. All flights on the new route are being operated by its Airbus A320 aircraft. The jets are equipped with all modern facilities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We note that JetBlue served Ontario in the 2000-2008 duration. The carrier has decided to return a decade later, primarily in response to a surge in demand. This low-cost carrier stated that it offers service to more cities in California than any other airline courtesy of its nonstop flights to New York. We believe that the addition of the above new route is a prudent move by JetBlue as transcontinental flights, which account for approximately 15% of its operations, have boosted its profitability.

We remind investors that JetBlue apart, other U.S. carriers including Delta Air Lines, Inc. DAL, United Continental Holdings, Inc. UAL and American Airlines Group Inc. AAL announced their decisions to broaden network over the past month.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

United Continental Holdings, Inc. (UAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.