JinkoSolar (JKS) Q4 Earnings Miss Estimates, Revenues Down Y/Y

Shares of JinkoSolar Holding Co., Ltd. JKS decline 5.9% to reach $36.36 on Apr 12, reflecting investors' skepticism following the company's fourth-quarter results.

The company reported fourth-quarter 2020 earnings per American depositary share (ADS) of 3 cents, which missed the Zacks Consensus Estimate of 43 cents by 93%. Additionally, the bottom line declined a whopping 97% when compared with the year-ago quarter’s 96 cents.

For 2020, the company posted earnings per ADS of 82 cents compared with the year-ago figure of $2.79.

Total Revenues

In the quarter under review, JinkoSolar’s total revenues of $1.44 billion (RMB 9.42 billion) missed the Zacks Consensus Estimate of $1.51 billion by 4.6%. The top line declined 1.1% on a year-over-year basis from $1.37 billion.

For 2020, the company reported revenues of $5.38 billion, up 18.1% year over year.

Quarterly Highlights

In the fourth quarter, JinkoSolar’s total solar module shipments were 5,774 megawatts (MW), up 27.2% year over year from 3,618 MW.

The company’s total operating expenses rose 26.5% year over year to $220 million. This increase stemmed from an increase in disposal and impairment loss on property, plant and equipment, as a result of the company's upgrade of production equipment in the fourth quarter of 2020, and also due to an increase in shipping costs and research & development expenditures.

The company incurred $17.6 million as interest expenses, up 37.4% year over year from $12 million. The increase was due to elevated interest expenses with increased interest-bearing debts.

As of Dec 31, 2020, the company's in-house annual mono wafer, solar cell and solar module production capacity was 22 GW, 11GW (10.2 GW for PERC cells and 800 MW for N type cells) and 31 GW, respectively.

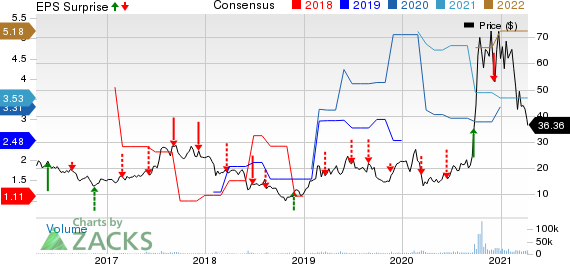

JinkoSolar Holding Company Limited Price, Consensus and EPS Surprise

JinkoSolar Holding Company Limited price-consensus-eps-surprise-chart | JinkoSolar Holding Company Limited Quote

Financial Condition

As of Dec 31, 2020, JinkoSolar had cash and cash equivalents of $1,146.6 million, up from $812.1 million as of Dec 31, 2019.

Total interest-bearing debts as of Dec 31, 2020, were $2.8 billion compared with $1.93 billion as of Mar 31, 2020.

Strategic Business Updates

As of the end of 2020, JinkoSolar became the world's largest PV manufacturer, with an aggregate module of 70GW. We expect shipments to sustain a growth rate of more than 30% in 2021. The company's new-generation Tiger Pro flagship products are expected to account for 40-50% of total shipments in 2021, with cumulative orders of more than 10 GW.

Q1 and Full-Year 2021 Guidance

The company expects total revenues for first-quarter 2021 in the range of $1.18-$1.30 billion. The Zacks Consensus Estimate for the same is pegged at $1.34 billion, which lies well above the company’s guided range. For the first quarter, JinkoSolar expects total solar module shipments of 4.5-5 GW.

For full-year 2021, JinkoSolar estimates total shipments (including solar cell and wafer) to be 25-30 GW. It expects its annual mono wafer, solar cell and solar module production capacity to reach 33 GW, 27 GW (including 800 MW N-type cells) and 37 GW, respectively, by the end of 2021.

Zacks Rank

JinkoSolar currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Solar Releases

Enphase Energy ENPH reported fourth-quarter 2020 adjusted earnings of 51 cents per share, which surpassed the Zacks Consensus Estimate of 40 cents by 27.5%.

SolarEdge Technologies SEDG reported fourth-quarter 2020 adjusted earnings of 98 cents per share, which surpassed the Zacks Consensus Estimate of 87 cents by 12.6%.

SunRun Inc. RUN incurred fourth-quarter 2020 loss of 6 cents per share, which missed the Zacks Consensus Estimate of earnings of 7 cents.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research