Joel Greenblatt's Top 3 New Stocks for the 1st Quarter

- By Sydnee Gatewood

Gotham Asset Management's Joel Greenblatt (Trades, Portfolio) gained 268 new holdings in the first quarter. His top three new positions are The Kroger Co. (KR), VF Corp. (VFC) and Ancher Daniels Midland Co. (ADM).

Warning! GuruFocus has detected 3 Warning Sign with KR. Click here to check it out.

The intrinsic value of KR

Known for creating Magic Formula investing, Greenblatt invests in companies with high returns on capital and earnings yield. The firm invests in companies trading at the biggest discount to their value. The current portfolio is composed of 975 stocks and is valued at $7.8 billion.

After exiting his position in Kroger in second-quarter 2015, Greenblatt established a new stake of nearly 1.3 million shares for an average price of $31.95 per share, giving it 0.5% portfolio space.

The supermarket chain operator has a market cap of $26.2 billion; its shares were trading around $28.72 on Wednesday with a price-earnings (P/E) ratio of 14.1, a price-book (P/B) ratio of 3.9 and a price-sales (P/S) ratio of 0.24.

The Peter Lynch chart below shows the stock is trading slightly below its fair value.

GuruFocus ranked Kroger's financial strength 5 of 10 and its profitability and growth 7 of 10. The company pays a quarterly dividend of 12 cents. The trailing dividend yield and forward dividend yield are both 1.6%. Over the past five years, the company has grown its dividend at a rate of 16% per year.

With his trade, Greenblatt became Kroger's largest guru shareholder with 0.14% of its outstanding shares. In all, seven other gurus hold the stock.

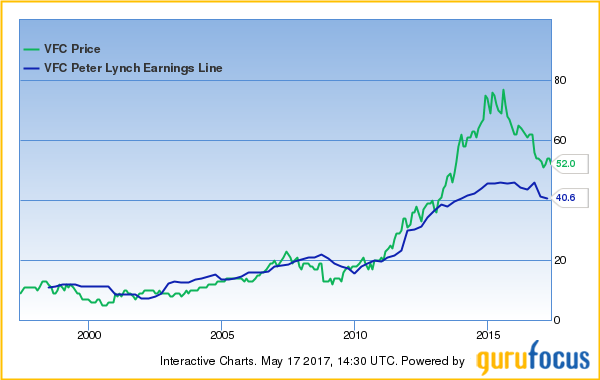

Having previously sold out of VF in third-quarter 2016, Greenblatt purchased 661,877 shares for an average price of $52.39 per share. The trade had an impact of 0.46% on the portfolio.

The apparel and footwear manufacturer has a market cap of $20.7 billion; its shares were trading around $51.74 on Wednesday with a P/E ratio of 21.2, a P/B ratio of 4.9 and a P/S ratio of 1.8.

According to the Peter Lynch chart below, the stock is trading above its fair value.

GuruFocus ranked VF's financial strength 6 of 10 and its profitability and growth 8 of 10. The company pays a quarterly dividend of 42 cents. The trailing dividend yield is 2.9%, and the forward dividend yield is 3.12%. The company has grown its dividend by 19.2% per year over the past five years.

Diamond Hill Capital is VF's largest guru shareholder with 0.88% of outstanding shares. In all, 10 gurus have positions in the stock.

After selling out of Archer Daniels Midland in fourth-quarter 2016, Greenblatt initiated a new holding of 729,153 shares for an average price of $44.8 per share, expanding the portfolio 0.43%.

The food processing company has a market cap of $23.8 billion; its shares were trading around $41.99 on Wednesday with a P/E ratio of 17.7, a P/B ratio of 1.4 and a P/S ratio of 0.4.

Based on the Peter Lynch chart below, the stock appears to be trading slightly above its fair value.

GuruFocus ranked Archer Daniels Midland's financial strength 6 of 10 and its profitability and growth 5 of 10. The company pays a quarterly dividend of 32 cents. The trailing dividend yield is 2.9%, and the forward dividend yield is 3.04%. Over the past five years, the company has grown its dividend by 15.4% per year.

The T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest shareholder among the gurus with 1.03% of its outstanding shares. In total, eight gurus own the stock.

Other stocks Greenblatt bought during the quarter include Newell Brands Inc. (NWL), McCormick & Co. Inc. (MKC), Mylan NV (MYL), Western Digital Corp. (WDC), Royal Caribbean Cruises Ltd. (RCL), Albemarle Corp. (ALB) and Magna International Inc. (MGA).

Disclosure: I do not own any stocks mentioned in the article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with KR. Click here to check it out.

The intrinsic value of KR