John Bean (JBT) Q3 Earnings Miss Estimates, Trims '21 View

John Bean Technologies Corporation JBT reported adjusted earnings of $1.02 per share in third-quarter 2021, which missed the Zacks Consensus Estimate of $1.19. The adjusted earnings per share in the quarter also fell short of the company’s quarterly guidance of $1.10-$1.20. However, the bottom line improved 23% from 83 cents reported in the prior-year quarter, driven by increased demand. Improved orders and demand in the quarter helped offset the impact of material cost inflation, supply chain and logistics disruptions, and labor cost inflation and shortages.

On a reported basis, the company’s earnings per share was 91 cents compared with the prior-year quarter’s 54 cents.

Revenues of $477 million missed the Zacks Consensus Estimate of $499 million. However, the top line improved 14% from the prior-year quarter.

In the reported quarter, the company’s total orders surged 24% year over year to a record $521 million. Orders in the JBT FoodTech segment shot up 23% year over year to $382 million. This can be attributed to demand between retail and foodservice-oriented customers, growth across all geographic regions, and strong demand for automation solutions that cut down labor. In the JBT AeroTech segment, orders climbed 25% to $138.7 million from the prior-year quarter, reflecting healthy demand from infrastructure projects, cargo and defense markets with incremental improvement from commercial airlines.

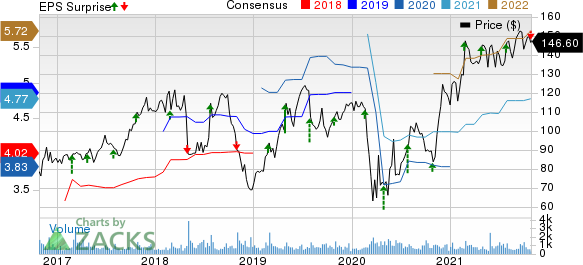

John Bean Technologies Corporation Price, Consensus and EPS Surprise

John Bean Technologies Corporation price-consensus-eps-surprise-chart | John Bean Technologies Corporation Quote

Backlog in the FoodTech segment increased 45% from the year-ago quarter to $545 million as of Sep 30, 2021. The AeroTech segment’s backlog was $369 million at the end of the reported quarter, up 34% year over year. Total backlog at the end of the third quarter was $914 million, up 40% year over year.

Cost and Margins

Cost of sales increased 14.7% year over year to $335 million during the third quarter. Gross profit was up 12% year over year to $142 million. Gross margin came in at 29.8% compared with the year-earlier quarter’s 30.3%.

Selling, general and administrative expenses were up 10% year over year to $101 million. Adjusted operating profit improved 8% year over year to $45 million. Adjusted operating margin was 9.5% in the third quarter compared with the prior-year quarter’s 9.9%. In the quarter under review, adjusted EBITDA was around $65 million, reflecting year-over-year growth of 9%. Adjusted EBITDA margin was 13.7% compared with the year-ago quarter’s 14.2%.

Segment Performance

JBT FoodTech: Net sales were $359 million compared with $301 million in the prior-year quarter. Adjusted operating profit amounted to $49 million compared with the year-ago quarter’s $39 million.

JBT AeroTech: Net sales were $118 million, in-line with the prior-year quarter. The segment’s adjusted operating profit slumped 47% year over year to $7 million.

Financial Performance

John Bean reported cash and cash equivalents of around $58.2 million at the end of the third quarter of 2021, up from $47.5 million at the end of 2020. The company generated around $163 million of cash from operating activities in the first nine-month period of 2021, compared with $161 million in the prior-year comparable period. The company’s total debt rose to $653 million as of Sep 30, 2021 from $525 million as of Dec 31, 2020.

During the quarter, John Bean completed the acquisition of Prevenio, a leading provider of innovative food safety solutions, primarily for the poultry industry. This expands the company’s recurring revenue stream and enhances its ability to address critical food safety issues for customers. Prevenio is expected to generate annualized run rate revenues of approximately $50 million by end of this year and will be accretive to FoodTech segment’s EBITDA margins.

Guidance

John Bean anticipates adjusted earnings per share between $1.05 and $1.15 for the fourth quarter.

The company expects revenues to improve 9-10% year over year in 2021. Revenue growth is projected at 13.5-14.5% for the FoodTech segment, which includes 1-2% each from acquisitions and foreign currency translation. Meanwhile, the AeroTech segment’s revenues are expected to decline approximately 3% from 2020 levels.

For the FoodTech segment, operating margins are projected at 13.75-14.0% with adjusted EBITDA margins expected in the range of 18.75 to 19.0%. For the AeroTech segment, the company’s operating and adjusted EBITDA margin guidance is at 7.75-8.25% and 8.75-9.25%, respectively.

Citing impact from supply chain disruptions and labor challenges, John Bean lowered adjusted earnings per share guidance for 2021 to $4.15-$4.25 from the prior range of $4.60 to $4.80.

Price Performance

John Bean’s shares have gained 72.9% in the past year compared with the industry’s rally of 73%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

John Bean carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector include The Manitowoc Company, Inc. MTW, Nordson Corporation NDSN and DXP Enterprises, Inc. DXPE. All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Manitowoc has an anticipated earnings growth rate of 340% for fiscal 2021. The company’s shares have soared around 164% in a year.

Nordson has an estimated earnings growth rate of 45% for the ongoing fiscal year. The company’s shares have gained 30% in the past year.

DXP Enterprises has a projected earnings growth rate of 78% for the current year. The stock has appreciated around 104% in a year’s time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research