John Paulson's Top 5 Buys of the 4th Quarter

- By James Li

Paulson & Co., the firm led by John Paulson (Trades, Portfolio), disclosed this week that its top five buys during the fourth quarter of 2020 were in Horizon Therapeutics PLC (NASDAQ:HZNP), Barrick Gold Corp. (NYSE:GOLD), Thryv Holdings Inc. (NASDAQ:THRY), Alexion Pharmaceuticals Inc. (NASDAQ:ALXN) and RealPage Inc. (NASDAQ:RP).

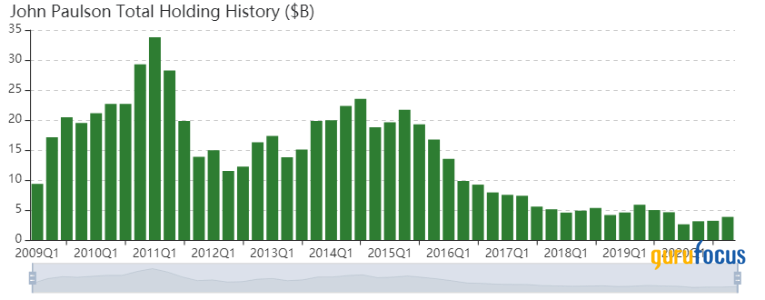

The New York-based firm seeks long-term capital appreciation through merger arbitrage, seeking value in situations in which a company announces plans to acquire a second company. Paulson & Co. primarily studies equity markets although the firm may also research opportunities in credit default swaps.

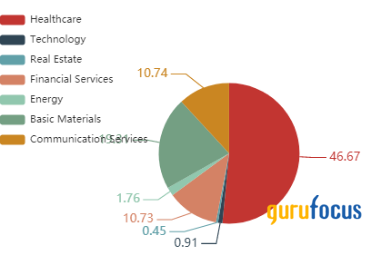

As of the quarter-end, the firm's $3.85 billion equity portfolio contains 36 stocks, with eight new positions and a turnover ratio of 11%.. The top three sectors in terms of weight are health care, materials and communication services, representing 46.67%, 19.31% and 10.74% of the equity portfolio.

Horizon Therapeutics

Paulson purchased 1,300,001 shares of Horizon Therapeutics (NASDAQ:HZNP), increasing the position 19.43% and the equity portfolio 2.47%. Shares averaged $74.23 during the fourth quarter.

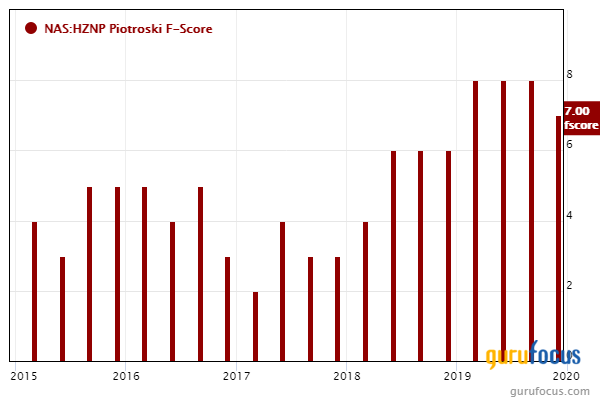

GuruFocus ranks the Dublin-based drug manufacturer's financial strength 7 out of 10 on the back of a high Piotroski F-score of 7 and a strong Altman Z-score of 6.62 despite debt ratios underperforming more than half of global competitors.

Barrick Gold

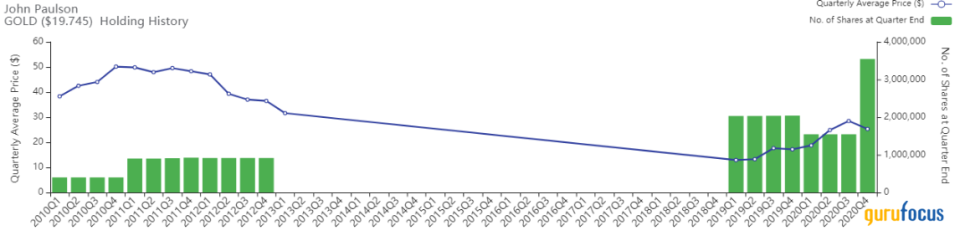

Paulson purchased 2 million shares of Barrick Gold, boosting the position 129.3% and the equity portfolio 1.18%. Shares averaged $25.29 during the fourth quarter.

GuruFocus ranks the Toronto-based gold producer's financial strength 6 out of 10: Barrick Gold has a high Piotroski F-score of 7 and a debt-to-Ebitda ratio that outperforms over 70% of global competitors despite interest coverage ratios underperforming over 76% of global metals and mining companies.

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) sold its 12 million shares in Barrick Gold during the fourth quarter of 2020.

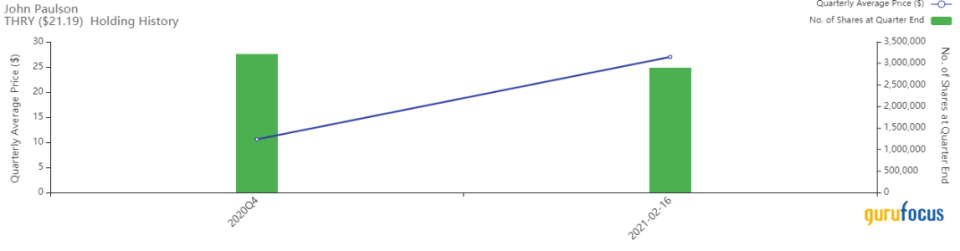

Thryv Holdings

Paulson purchased during the fourth quarter 3,216,437 shares of Thryv Holdings (NASDAQ:THRY), allocating 1.13% of the equity portfolio to the position. The firm then sold 315,302 shares on Feb. 16 according to GuruFocus Real-Time Picks, a Premium feature. Shares increased from the fourth-quarter average price of $10.58 to $27.

The Dallas-based company provides digital marketing and software as a service management tools to small and medium-sized businesses. According to GuruFocus, Thryv's interest coverage and debt ratios underperform over 70% of global competitors, suggesting low financial strength.

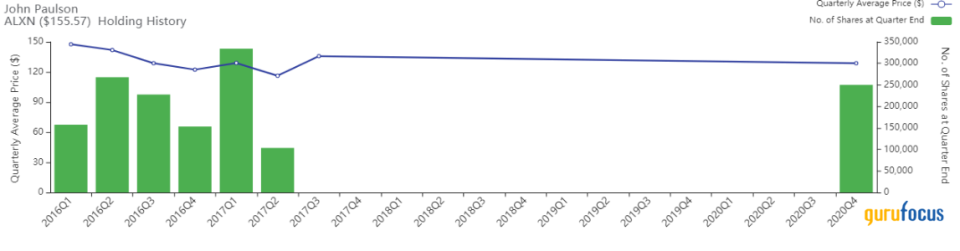

Alexion

Paulson purchased 250,000 shares of Alexion (NASDAQ:ALXN), giving the position 1.01% equity portfolio space. Shares averaged $128.71 during the fourth quarter.

GuruFocus ranks the Boston-based biotech company's profitability 9 out of 10 on several positive investing signs, which include a three-star business predictability rank and an operating margin that is near a 10-year high of 47.12% and outperforms over 96% of global competitors.

Realpage

Paulson purchased 400,000 shares of Realpage (NASDAQ:RP), giving the position 0.91% equity portfolio weight. Shares averaged $65.65 during the fourth quarter; the stock is modestly overvalued based on Friday's price-to-GF Value ratio of 1.21.

The Richardson, Texas-based company provides on-demand software solutions for the rental housing industry. GuruFocus ranks Realpage's financial strength 5 out of 10: Although the company has a strong Altman Z-score of 3.34, debt ratios are underperforming over 80% of global competitors.

See also

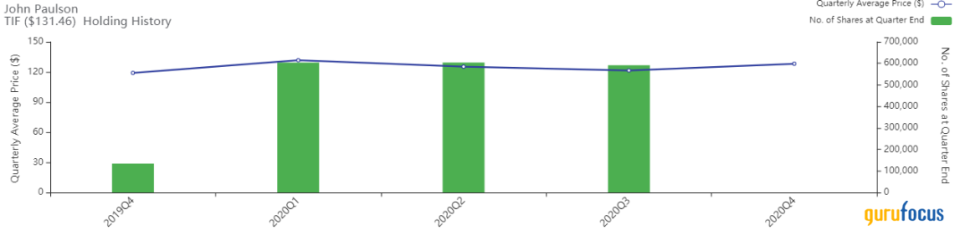

Paulson & Co. also reported that it cleansed its holding in Tiffany & Co. (TIF) during the fourth quarter. The New York-based jeweler announced on Jan. 7 that French luxury goods company LVMH Moet Hennessy Louis Vuitton SE (XPAR:MC) completed the acquisition of Tiffany at the Oct. 29, 2020, agreed price of $131.50 per Tiffany share.

Disclosure: No positions.

Read more here:

Top 5 4th-Quarter Sells of Chase Coleman's Tiger Global

David Tepper's Top 6 Trades of the 4th Quarter

Li Lu Buys Buffett's Apple, Reduces Facebook in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.