Jones Lang LaSalle (JLL) Down 5.5% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Jones Lang LaSalle Incorporated JLL. Shares have lost about 5.5% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is JLL due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Jones Lang LaSalle Q1 Earnings, Revenues Top Estimates

Jones Lang LaSalle reported first-quarter 2018 adjusted earnings of 97 cents per share, comfortably outpacing the Zacks Consensus Estimate of 60 cents. The bottom line also compared favorably with the year-ago adjusted earnings of 37 cents per share.

Revenues for the reported quarter came in at $3.56 billion, surpassing the Zacks Consensus Estimate of $3.17 billion. The figure was up 14% year over year. Fee revenues were up 14% year over year to $1.28 billion.

Results highlight robust organic growth and strong cash flows from operations. The company experienced growth in Real Estate Services revenue, which was mainly organic. Moreover, the company achieved improvement in margin across the Americas and LaSalle.

Behind the Headline Numbers

During the first quarter, Jones Lang LaSalle’s Real Estate Services revenues climbed 13% year over year to $3.4 billion. In the Americas, revenues and fee revenues came in at $1.9 billion and $623.5 million, respectively, indicating 8% and 5% year-over-year growth. Results were driven by Property & Facility Management, and Advisory, Consulting and Other fee revenues segments. Leasing was also strong amid favorable market conditions.

Revenues and fee revenues of the EMEA segment were $783.6 million and $350.4 million, both up 30% from the year-ago period. This was backed by growth across all service lines.

For the Asia Pacific segment, revenues and fee revenues came in at $711.3 million and $194.4 million, respectively, marking a jump of 14% and 8% from the last year. Robust performance in Project & Development Services in Australia attributed to this growth. Further, upswing was driven by an increase in leasing in the markets of Beijing and Tokyo.

Revenues from the LaSalle Investment Management segment witnessed rise of 35% year over year to $119.3 million. Strong incentive fees due to real estate dispositions in the Asia Pacific along with rise in transaction fees & other, and advisory fees led to the increase. At the end of the first quarter, assets under management were $59 billion, up from $58.1 billion recorded at the end of the prior quarter.

Liquidity

Jones Lang exited the reported quarter with cash and cash equivalents of $292.8 million, up from $268 million as of Dec 31, 2017. At the end of first-quarter 2018, the company’s net debt totaled $910.1 million, up $323.9 million from the end of the prior quarter. However, this reflects the annual first-quarter payment of variable compensation to employees because of strong results delivered in 2017.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to two lower.

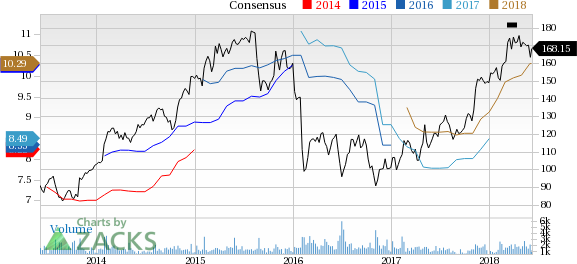

Price and Consensus

Price and Consensus | Quote

VGM Scores

At this time, JLL has a subpar Growth Score of D, however its Momentum is doing a lot better with a B. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions looks promising. Notably, JLL has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research