JP Morgan's (NYSE:JPM) Decline on Earnings Looks like an Overreaction

This article first appeared on Simply Wall St News.

JPMorgan Chase & Co. (NYSE: JPM) kicked off the first earnings round in 2022 with the largest single-day decline in almost 2 years.

While the bank sees the boost to the net interest income, a hike in the adjusted noninterest expenses of almost 10% has undoubtedly spooked the market.

Check out our latest analysis for JPMorgan Chase

Earnings Results

Q4 2021 revenue: US$29.3b (miss by US$520m, -3%Y/Y)

Q4 GAAP EPS: US$3.33 (beat by US$0.33)

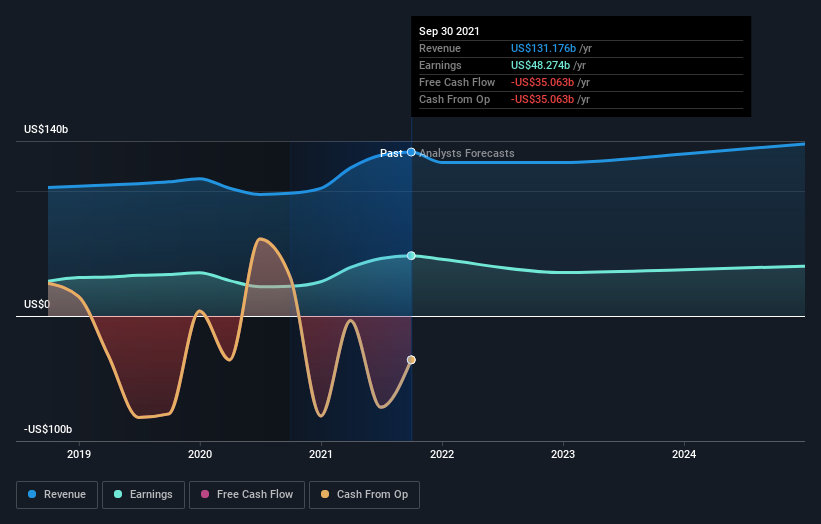

FY 2021 profits: US$48.33b

Despite the Q4 profits falling 14% Y/Y, the company posted record profits in 2021. However, trading revenues fell 17% Y/Y as the bank blamed a challenging trading environment in bonds and currency trading.

CFO Jeremy Barnum took note of higher expenses, stating that the labor market is tight and there is labor inflation present. For 2022, the bank expects adjusted noninterest expense of US$77b, compared to US$70.9b in 2021.

This prompted the Wells Fargo analyst Mike Mayo to downgrade JPM from Overweight to Equal Weight, quoting "front-loaded spending for less certain back-ended benefits. " Mr.Mayo believes that other banks might provide better opportunities in the sector, trimming JPMorgan's price target to US$180 from US$210.

What's the opportunity in JPMorgan Chase?

According to our valuation, the intrinsic value for the stock is $212.64, but it is currently trading at US$158 on the share market. What's more interesting is that JPMorgan Chase's share price is quite volatile, which gives us more chances to buy if the share price sinks lower in the future.

This is based on its high beta, which is a good indicator of how much the stock moves relative to the rest of the market.

What does the future of JPMorgan Chase look like?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price. However, with negative profit growth of -19% expected over the next couple of years, near-term growth certainly doesn't appear to be a driver for a buy decision for JPMorgan Chase. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? Although JPM is currently undervalued and inclines you to hold, the adverse prospect of negative growth brings about some degree of risk. In this situation, advanced investors can look into options strategies like covered calls - to negate the downside risks.

Are you a potential investor? If you've been keeping tabs on JPM for some time but are hesitant about making the leap, we recommend you dig deeper into the stock. There might be good opportunities in the financial sector, but it is a question of whether they fit into your portfolio. For example, JPM scores excellent in our dividend risk assessment.

Keep in mind, when it comes to analyzing a stock, it's worth noting the risks involved. At Simply Wall St, we found 1 warning sign for JPMorgan Chase, and we think it deserves your attention.

If you are no longer interested in JPMorgan Chase, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.