JPMorgan (JPM) Q4 Earnings Beat on Reserve Release, Fee Income

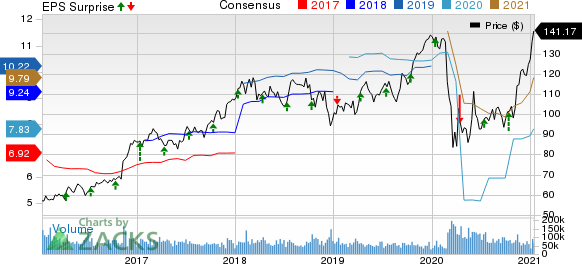

Unexpected large reserve releases, along with solid capital markets performance, drove JPMorgan’s JPM fourth-quarter 2020 earnings of $3.79 per share. The bottom line handily outpaced the Zacks Consensus Estimate of $2.72.

Results included credit reserve releases. Excluding these, earnings amounted to $3.07 per share. The company had earned $2.57 in the prior-year quarter.

Shares of JPMorgan gained 1.1% in pre-market trading as investors reacted positively to solid fee income and reserve releases. A full day’s trading session will depict a better picture.

During the quarter, the company reported credit reserve releases, which led to net benefit of $1.9 billion. In a statement, the CEO Jamie Dimon said, “While positive vaccine and stimulus developments contributed to these reserve releases this quarter, our credit reserves of over $30 billion continue to reflect significant near-term economic uncertainty and will allow us to withstand an economic environment far worse than the current base forecasts by most economists.”

As expected, fixed income markets revenues increased 15%, driven by strong performance across products. Likewise, equity markets revenues jumped 32% on the back of solid client activities. Also, historically lower rates drove mortgage fees and related income to $767 million, up 62%.

Further, equity and debt underwriting fees surged 88% and 23%, respectively. Additionally, a significant rebound in deal making activities during the quarter led JPMorgan to record a 19% rise in advisory fees. Hence, investment banking fees jumped 34% from the prior-year quarter.

Also, operating expenses witnessed a fall. Among other positives, Commercial Banking average loan balances were up 1%, and Asset & Wealth Management average loan balances grew 15% from the year-ago quarter.

However, low interest rates and soft loan demand hurt interest income. Credit card sales volume declined 4% from the prior-year quarter.

Overall quarterly performance of JPMorgan’s business segments, in terms of net income generation, was decent. All segments, except Asset & Wealth Management, reported an increase in net income on a year-over-year basis. Even the Corporate segment’s loss narrowed.

Net income increased 42% from the prior-year quarter to $12.1 billion.

Fee Income Aids Revenues, Costs Fall

Net revenues as reported were $29.22 billion, up 3% from the year-ago quarter. The improvement reflects higher trading, mortgage and investment banking fees, while lower interest rates were an offsetting factor. However, the top line marginally missed the Zacks Consensus Estimate of $29.28 billion.

Net interest income declined 6% year over year to $13.3 billion. Conversely, non-interest income grew 13% to $16 billion, mainly driven by mortgage banking, investment banking and principal transactions performance.

Non-interest expenses (on managed basis) were $16 billion, down 1% from the year-ago quarter. The fall was primarily due to lower volume- and revenue-related expenses, partly offset by rise in investments in business.

Credit Quality: Mixed Bag

Provision for credit losses was a net benefit $1.9 billion compared with provision of $1.4 billion in the prior-year quarter. Further, net charge-offs decreased 30% to $1.1 billion.

As of Dec 31, 2020, non-performing assets were $10.9 billion, which was up substantially from $5.1 billion recorded as of Dec 31, 2019.

Solid Capital & Liquidity Position

Tier 1 capital ratio (estimated) was 15% at fourth quarter-end compared with 14.1% on Dec 31, 2019. Tier 1 common equity capital ratio (estimated) was 13.1%, up from 12.4%. Total capital ratio was 17.3% (estimated) compared with 16.0% as of Dec 31, 2019.

Book value per share was $81.75 as of Dec 31, 2020 compared with $75.98 in the corresponding period of 2019. Tangible book value per common share was $66.11 at the end of December, up from $60.98.

JPMorgan ended 2020 with $1.4 trillion of cash and marketable securities, which as pointed by Dimon “is currently over $450 billion in excess of what is required.”

Our View

Branch expansion efforts, and solid trading as well as mortgage banking and underwriting performances are likely to continue supporting JPMorgan’s revenues. However, lower interest rates, economic slowdown and coronavirus-related ambiguity are near-term concerns.

JPMorgan currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Date of Other Major Banks

Bank of America BAC is scheduled to come out with quarterly numbers on Jan 19, while U.S. Bancorp USB and Truist Financial TFC is set to report on Jan 20 and Jan 21, respectively.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Click to get this free report JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report U.S. Bancorp (USB) : Free Stock Analysis Report Bank of America Corporation (BAC) : Free Stock Analysis Report Truist Financial Corporation (TFC) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research