JTC's (LON:JTC) Shareholders Will Receive A Bigger Dividend Than Last Year

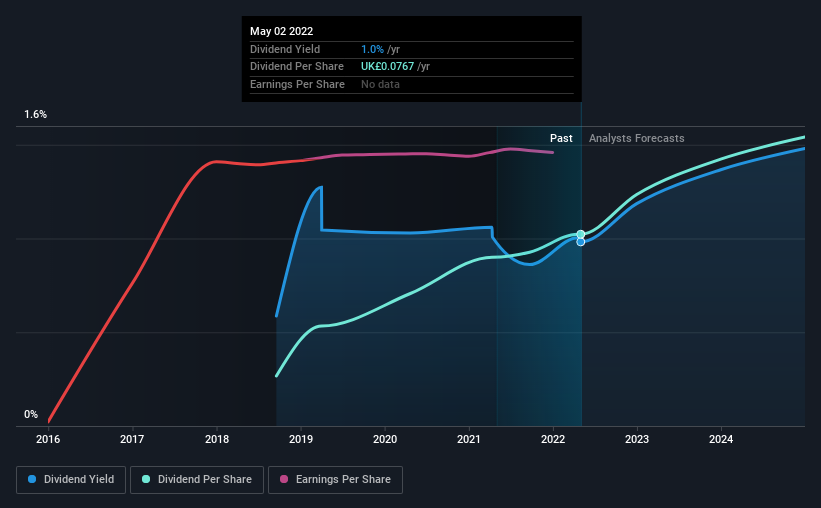

JTC PLC's (LON:JTC) dividend will be increasing to UK£0.051 on 8th of July. This takes the annual payment to 1.0% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for JTC

JTC's Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, JTC's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Looking forward, earnings per share is forecast to rise by 37.1% over the next year. If the dividend continues on this path, the payout ratio could be 42% by next year, which we think can be pretty sustainable going forward.

JTC Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The first annual payment during the last 4 years was UK£0.02 in 2018, and the most recent fiscal year payment was UK£0.077. This means that it has been growing its distributions at 40% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that JTC has grown earnings per share at 113% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

The company has also been raising capital by issuing stock equal to 21% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

JTC Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for JTC that investors should take into consideration. Is JTC not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.