Julian Robertson's Top 1st-Quarter Buys

- By Margaret Moran

Julian Robertson (Trades, Portfolio)'s Tiger Management recently disclosed its portfolio updates for the first quarter of 2021, which ended on March 31.

Often called the "father of the hedge fund," Julian Robertson (Trades, Portfolio) founded Tiger Management in 1980, turning an initial $8 million into over $22 billion by the late 1990s. After losing 4% in 1998 and 19% in 1999 as rivals rode the dot-com bubble to its peak, he shut down the fund in 2000, and Tiger Management now only manages money from internal sources (mainly Robertson's personal wealth). Robertson's long-short strategy is based on investing in the best companies and shorting the worst companies, and he is known for "betting the farm" on his best ideas. Robertson also mentored a number of young hedge fund managers known as the "Tiger Cubs," a group that includes Andreas Halvorsen (Trades, Portfolio), Chase Coleman (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), John Griffin (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and Steve Mandel (Trades, Portfolio).

Robertson's top new buys for the quarter were Mastercard Inc. (NYSE:MA) and Caesars Entertainment Inc. (NASDAQ:CZR). He also made significant additions to the positions in Microsoft Corp. (NASDAQ:MSFT) and SLM Corp. (NASDAQ:SLM).

Mastercard

Tiger Management picked up a new stake in Mastercard (NYSE:MA) worth 11,000 shares, which had a 0.77% impact on the equity portfolio. During the quarter, shares traded for an average price of $348.78.

Mastercard is a financial services company that provides tech-based payment solutions to consumers, business, merchants, card issuers and governments around the world. It is one of the largest such companies in the U.S., alongside Visa Inc. (NYSE:V).

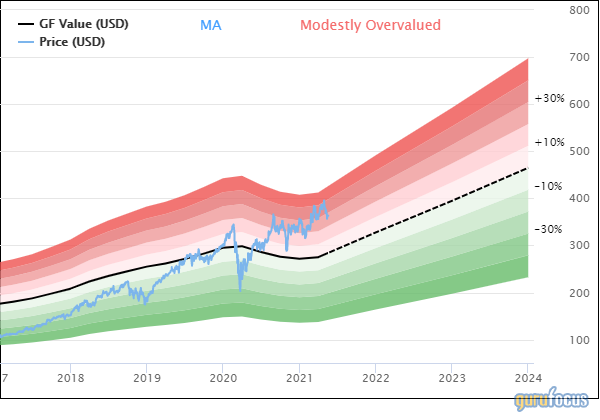

On May 18, shares of Mastercard traded around $363.07 for a market cap of $359.82 billion and a price-earnings ratio of 55.61. According to the GuruFocus Value chart, the stock is modestly overvalued.

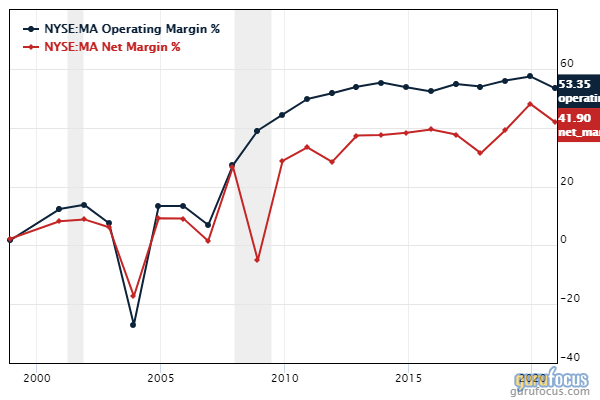

The company has a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The Piotroski F-Score of 5 out of 9 and Altman Z-Score of 10.64 indicate good financial stability. The operating margin and net margin have been on a general uptrend over the years, though both declined in 2020 to their present values of 53.35% and 41.90%, respectively.

Caesars Entertainment

The guru also established a 37,200-share holding in Caesars Entertainment (NASDAQ:CZR), impacting the equity portfolio by 0.64%. Shares traded for an average price of $83.86 during the quarter.

Caesars owns and operates more than 55 casino properties worldwide. In the fourth quarter of 2020, Caesars Entertainment was acquired by Eldorado Resorts, but the merged company took on the more famous Caesars name to form Caesars Entertainment Inc.

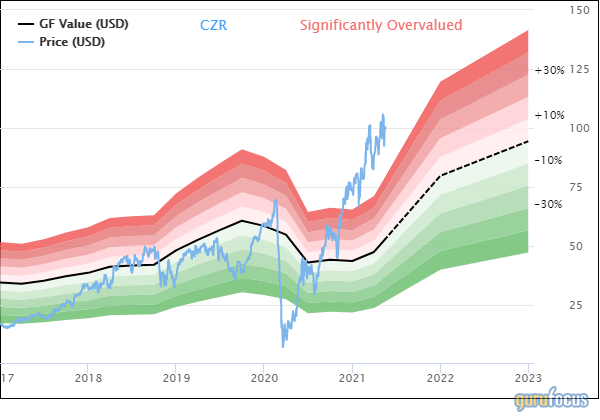

On May 18, shares of Caesars traded around $100.15 for a market cap of $29.90 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio of 0.07 is lower than 85% of competitors, and the Altman Z-Score of 0.64 indicates the company could face liquidity issues in the next couple of years. The weighted average cost of capital was often higher than the return on invested capital even before the merger, suggesting the company struggles with growing in a profitable way.

Microsoft

The guru added 41,700 shares, or 25.61%, to the Microsoft (NASDAQ:MSFT) holding for a total of 204,500 shares. The trade had a 1.93% impact on the equity portfolio. During the quarter, shares traded for an average price of $232.23.

Microsoft is a multinational tech giant headquartered in Redmond, Washington. The company develops, manufactures, licenses, sells and supports PCs, consumer software, consumer electronics and related services.

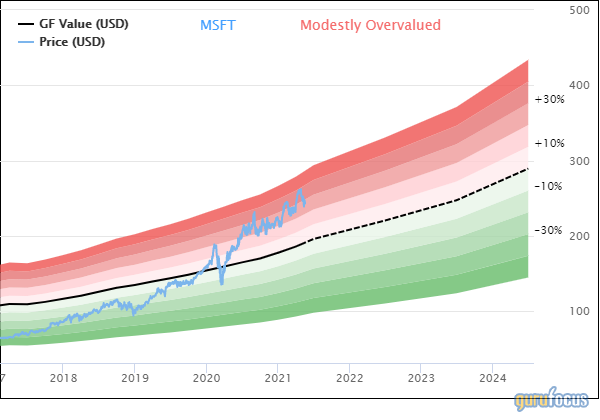

On May 18, shares of Microsoft traded around $243.08 for a market cap of $1.83 trillion and a price-earnings ratio of 33.11. According to the GF Value chart, the stock is modestly overvalued.

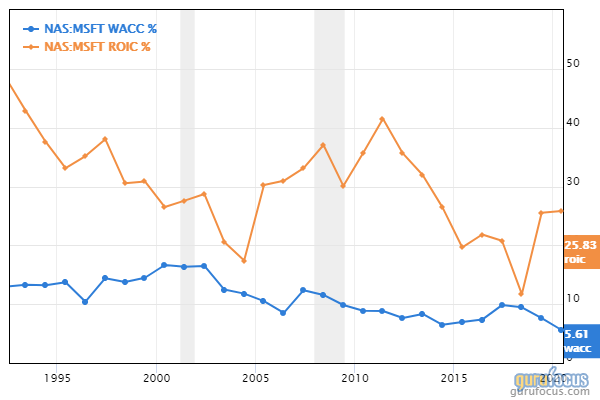

The company has a financial strength rating of 7 out of 10 and a profitability rating of 9 out of 10. The Piotroski F-Score of 8 out of 9 and Altman Z-Score of 8.19 indicate a fortress-like balance sheet. The ROIC is consistently higher than the WACC, meaning the company is creating value for shareholders as it grows.

SLM

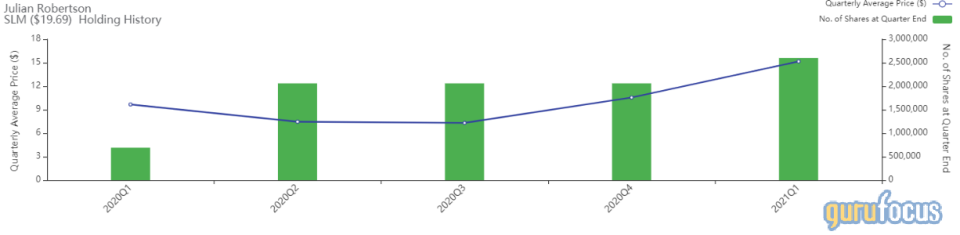

Tiger Management also increased its SLM (NASDAQ:SLM) investment by 538,900 shares, or 26.16%, for a total of 2,598,555 shares. The trade had a 1.90% impact on the equity portfolio. Shares traded for an average price of $15.16 during the quarter.

Based in Newark, Delaware, SLM, or Sallie Mae, was originally a government entity providing federal student loans. The company has undergone many changes since the financial crisis, becoming a broader financial services company providing private loans, insurance and banking services to students.

On May 18, shares of SLM traded around $19.69 for a market cap of $6.21 billion and a price-earnings ratio of 6.34. According to the GF Value chart, the stock is significantly overvalued.

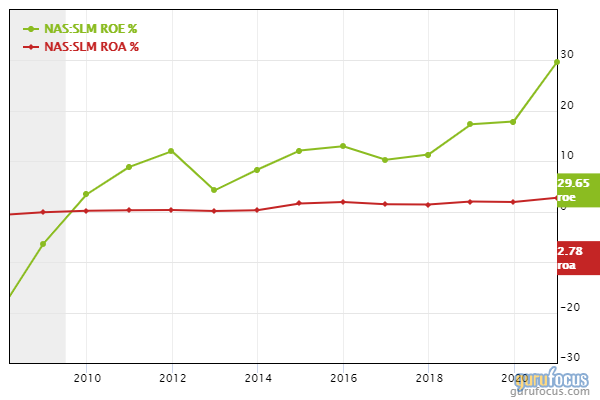

The company has a financial strength rating of 2 out of 10 and a profitability rating of 5 out of 10. The debt-to-equity ratio of 1.89 is underperforming 65% of industry peers, though the Piotroski F-Score of 5 out of 9 indicates the company likely has the ability to remain financially stable. The return on equity of 29.65% and return on assets of 2.78% are both significantly higher than their respective industry medians.

Portfolio overview

During the quarter, Tiger Management established 10 new holdings, sold out of another 14 stocks and added to or reduced several other positions for a turnover rate of 10%. As of the quarter's end, Tiger Management held shares of 37 stocks in an equity portfolio valued at $509 million.

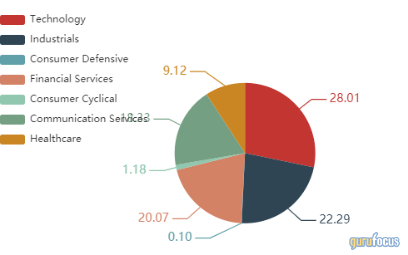

The firm's top holdings were AerCap Holdings NV (NYSE:AER) with 17.66% of the equity portfolio, Microsoft with 9.48% and SLM with 9.18%. In terms of sector weighting, the firm was most invested in technology, industrials and financial services.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.