June Best Value-Adding Stocks

Companies such as goeasy and Loblaw Companies are potentially attractive investments. This is because their stocks have desirable characteristics in terms of, for example, stock value, past track record, or future growth potential. I’ve composed a list of companies which delivered strong outcome for two or more fundamental aspects, causing them to be sought-after investments for any portfolio.

goeasy Ltd. (TSX:GSY)

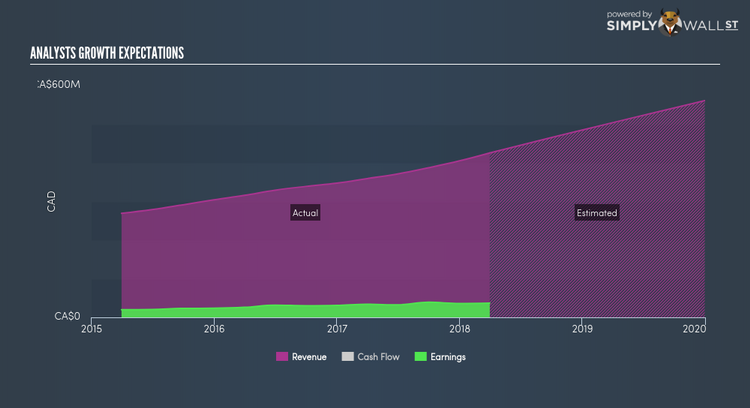

goeasy Ltd. provides goods and alternative financial services in Canada. Started in 1990, and now led by CEO David Ingram, the company currently employs 1,729 people and with the company’s market cap sitting at CAD CA$559.18M, it falls under the small-cap stocks category.

Furthermore, GSY’s profit levels are sufficient enough to reinvest and payout as dividends, which has been climbing over a long period of time. More on goeasy here.

Loblaw Companies Limited (TSX:L)

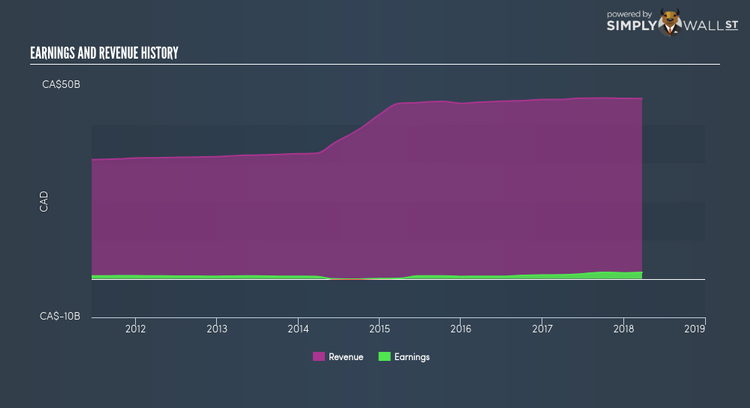

Loblaw Companies Limited, a food and pharmacy company, provides grocery, pharmacy, health and beauty, apparel, general merchandise, credit card, insurance brokerage, gift card, and telecommunication services in Canada. Established in 1919, and currently lead by Galen Weston, the company currently employs 200,000 people and has a market cap of CAD CA$25.29B, putting it in the large-cap group.

L’s previous bottom-line expansion of 61.96% in the prior year, beating the consumer retailing industry’s growth of 35.21%, is a rewarding treat for company shareholders. L has ample cash coverage over its short term liabilities, and its total debt is well-covered by its cash flows, demonstrating financial stability and good capital management. Likewise, L has been able to reinvest its profits, as well as pay some out as dividends, which has been impressively growing over the past decade. Interested in Loblaw Companies? Find out more here.

ICC Labs Inc. (TSXV:ICC)

ICC Labs Inc., through its subsidiaries, produces and sells cannabis in Uruguay. The company currently employs 18 people and with the market cap of CAD CA$176.70M, it falls under the small-cap group.

ICC has ample cash coverage over its short term liabilities, and the business has no debt on its books, portraying its strong financial capacity. Last but not least, ICC is currently trading below its true value in terms of its discounted cash flows, and also on its price-to-book metric, which gives investors an opportunity to accumulate the stock at a low price. Continue research on ICC Labs here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, explore this interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.