June Top Dividend Paying Stocks

Dividend stocks such as TELUS and Rogers Communications can help diversify the constant stream of cash flows from your portfolio. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

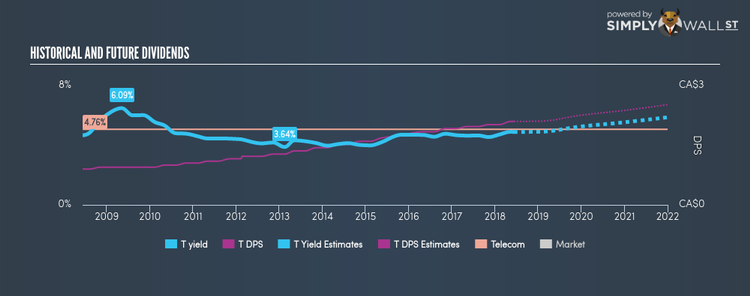

TELUS Corporation (TSX:T)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications products and services in Canada. Started in 1993, and currently run by Darren Entwistle, the company employs 53,630 people and with the market cap of CAD CA$27.25B, it falls under the large-cap category.

T has a sumptuous dividend yield of 4.59% and pays 81.39% of its earnings as dividends . The company’s dividends per share have risen from CA$0.90 to CA$2.10 over the last 10 years. The company has been a reliable payer too, not missing a payment during this time. Continue research on TELUS here.

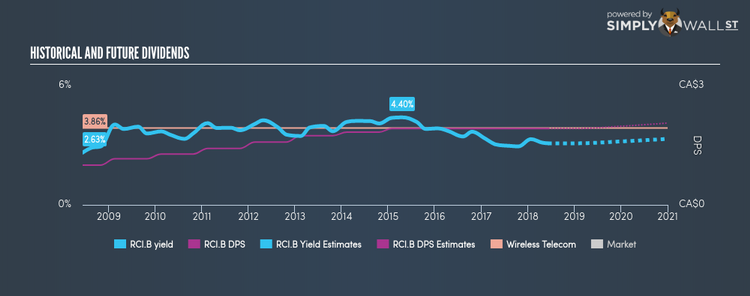

Rogers Communications Inc. (TSX:RCI.B)

Rogers Communications Inc. operates as a communications and media company in Canada. Started in 1920, and now run by Joseph Natale, the company provides employment to 24,500 people and with the market cap of CAD CA$32.05B, it falls under the large-cap group.

RCI.B has a solid dividend yield of 3.10% and is paying out 54.15% of profits as dividends . In the case of RCI.B, they have increased their dividend per share from CA$1.00 to CA$1.92 so in the past 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. More detail on Rogers Communications here.

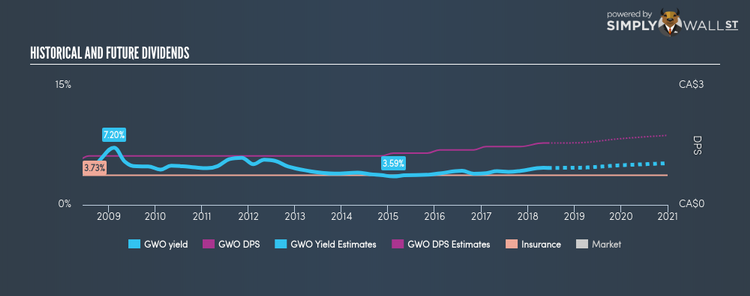

Great-West Lifeco Inc. (TSX:GWO)

Great-West Lifeco Inc., a financial services holding company, engages in life and health insurance, asset management, investment and retirement savings, and reinsurance businesses in Canada, the United States, Europe, and Asia. Formed in 1891, and now led by CEO Paul Mahon, the company now has 23,300 employees and with the stock’s market cap sitting at CAD CA$33.05B, it comes under the large-cap category.

GWO has an alluring dividend yield of 4.66% and pays out 64.41% of its profit as dividends . GWO’s last dividend payment was CA$1.56, up from it’s payment 10 years ago of CA$1.17. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Over the next 12 months, analysts are predicting double digit earnings growth of 33.74%. Dig deeper into Great-West Lifeco here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.