Juniper (JNPR) Q4 Earnings Beat Estimates, Revenues Up Y/Y

Juniper Networks, Inc. JNPR reported decent fourth-quarter 2020 results wherein both the top and bottom lines surpassed the Zacks Consensus Estimate. Driven by higher revenues, the Sunnyvale, CA-based network products and services provider witnessed robust demand for Routing products during the quarter followed by strength across Enterprise vertical.

Of the top 10 customers, three were Cloud, six were Service Provider and one was an Enterprise. In fact, the top 10 customers contributed 30% to net revenues in the fourth quarter of 2020 compared with 33% in the prior-year quarter.

Net Income

On a GAAP basis, net income in the December quarter decreased to $30.8 million or 9 cents per share from $168.4 million or 49 cents per share in the prior-year quarter. The drastic year-over-year deterioration was primarily due to higher restructuring and strategic investment charges. Loss on extinguishment of debt during the quarter was a contributing factor as well.

In 2020, net income was $257.8 million or 77 cents per share compared with $345 million or 99 cents per share in 2019. The fall was mainly due to higher operating expenses coupled with lower interest income and gross margin. However, it was partially offset by a lower tax rate.

Quarterly non-GAAP net income was $181.8 million or 55 cents per share (above the mid-point of the company’s guidance) compared with $198.7 million or 58 cents per share in the year-ago quarter. In 2020, net income was $519.7 million or $1.55 per share compared with $597.5 million or $1.72 per share in 2019. The bottom line beat the Zacks Consensus Estimate by a penny.

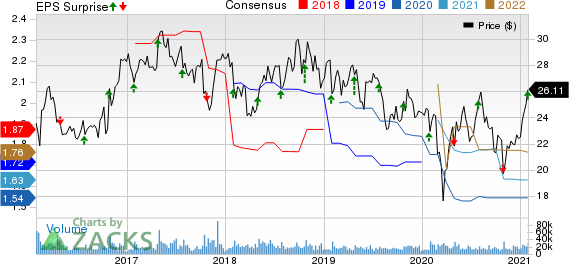

Juniper Networks, Inc. Price, Consensus and EPS Surprise

Juniper Networks, Inc. price-consensus-eps-surprise-chart | Juniper Networks, Inc. Quote

Revenues

Quarterly total revenues aggregated $1,222.6 million (above the mid-point of the management-provided guidance) compared with $1,208.1 million reported in the year-ago quarter. The year-over-year growth, despite coronavirus-led adversities leading to supply constraints and extended lead times, was largely driven by healthy momentum across all verticals. Notably, Juniper experienced strong demand in the Enterprise vertical with 7% rise on a year-over-year basis, mainly driven by Routing product revenues. The top line beat the consensus mark of $1,194 million. In 2020, revenues declined to $4,445.1 million.

Product revenues (comprising Routing, Switching and Security and contributing 66.3% to net revenues) in the quarter grew 2.3% year over year to $810.2 million. Despite healthy momentum in Routing products, Switching and Security business were affected by Cloud and Service Provider verticals amid the virus outbreak. Service revenues (contributing 33.7% to net revenues) slipped 0.9% to $412.4 million due to timing of renewals.

By vertical, revenues in Cloud increased to $280.7 million from $279.8 million, primarily driven by strength in Routing. However, it was partially offset by softness in Switching and Security business. Revenues in Service Provider decreased to $474.9 million from $492.5 million in the year-ago quarter due to decline in service revenues. Revenues in Enterprise improved to $467 million from $435.8 million, bolstered by higher Routing revenues. Nevertheless, the segment was partially offset by weak Security business.

Region wise, revenues improved to $363.6 million from $335.7 million in the year-ago quarter in Europe, the Middle East, and Africa. Quarterly revenues in the Americas declined 6.5% to $632.5 million. In the Asia-Pacific, net revenues increased 15.8% to $226.5 million.

Other Details

Overall, gross profit came in at $717 million compared with $719.3 million in the year-ago quarter. Total operating expenses increased from $540.7 million to $618.9 million due to one-time expenses related to recent acquisitions and restructuring charges. However, it was partially offset by lower travel expenses due to the COVID-19 turmoil. Operating income was $98.1 million compared with $178.6 million in the year-ago quarter. Non-GAAP operating income declined to $236.3 million from $246.5 million, with a margin of 19.3% and 20.4%, respectively.

Cash Flow & Liquidity

In 2020, Juniper generated $612 million of net cash from operations compared with $528.9 million in 2019. As of Dec 31, 2020, the computer network equipment maker had $1,361.9 million in cash and equivalents with $1,705.8 million of long-term debt compared with the respective tallies of $1,215.8 million and $1,683.9 million a year ago.

Q1 Outlook

Juniper provided guidance for the first quarter of 2021. It expects revenues of $1,055 million (+/- $50 million). Non-GAAP gross margin is anticipated to be 59% (+/- 1%). Non-GAAP operating expenses are expected to be $510 million (+/- $5 million).

The company estimates non-GAAP operating margin to be nearly 10.6% at the midpoint of revenue guidance. Non-GAAP net income is expected to be 25 cents per share (+/- 5 cents), assuming a share count of about 333 million. Non-GAAP operating expenses are expected to increase sequentially, mainly due to the inclusion of nearly $20 million related to recent acquisitions of Apstra, 128 Technology and Netrounds.

Markedly, the sequential revenue and earnings growth as exhibited in the guidance is primarily driven by strong order backlog and healthy momentum across the core industry verticals despite the ongoing COVID-19 challenges. This, in turn, is likely to reinforce Juniper’s go-to-market organization and technology portfolio, while driving profitability in the long run.

Zacks Rank & Stocks to Consider

Juniper currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the industry are Comtech Telecommunications Corp. CMTL, Qualcomm Incorporated QCOM and Sonim Technologies, Inc. SONM. While Comtech sports a Zacks Rank #1 (Strong Buy), Qualcomm and Sonim carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Comtech pulled off a trailing four-quarter positive earnings surprise of 2%, on average.

Qualcomm pulled off a trailing four-quarter positive earnings surprise of 17.3%, on average.

Sonim pulled off a trailing four-quarter positive earnings surprise of 2.2%, on average.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Sonim Technologies, Inc. (SONM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research