Juniper (JNPR) Surpasses Earnings & Revenue Estimates in Q4

Juniper Networks, Inc. JNPR reported healthy fourth-quarter 2021 results, wherein both the bottom and the top lines beat the Zacks Consensus Estimate.

Net Income

On a GAAP basis, net income in the quarter jumped to $132.9 million or 40 cents per share from $30.8 million or 9 cents per share in the prior-year quarter. The improvement was mainly led by higher operating income and zero loss on extinguishment of debt which was $55 million in the fourth quarter of 2020.

In 2021, net income was $252.7 million or 76 cents per share compared with $257.8 million or 77 cents per share in 2020.

Quarterly non-GAAP net income was $184.7 million or 56 cents per share compared with $181.8 million or 55 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 3 cents.

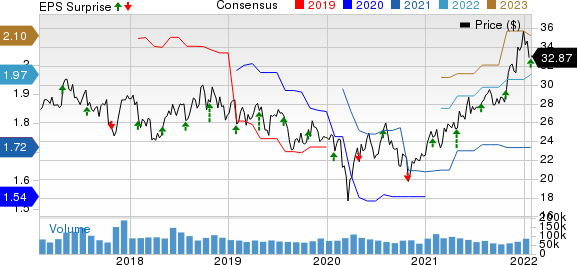

Juniper Networks, Inc. Price, Consensus and EPS Surprise

Juniper Networks, Inc. price-consensus-eps-surprise-chart | Juniper Networks, Inc. Quote

Revenues

Despite the challenging supply chain environment, Juniper’s quarterly revenues increased to $1,299.9 million from $1,222.6 million in the prior-year quarter, driven by strong demand. The company witnessed double-digit order growth across verticals, customer solutions and regions. The top line beat the consensus estimate of $1,272 million.

Product revenues (contributing 67.3% to total revenues) improved 7.9% year over year to $874.6 million, reflecting healthy demand across the MX and PTX product families with the adoption of newer products and the automation software portfolio. Service revenues (contributing 32.7% to total revenues) increased 3.1% to $425.3 million, led by renewals and service attach rates.

By vertical, revenues in Cloud increased to $333.4 million from $280.7 million. This reflects the adoption of the 400-gig capable platform driven by the strength of the Junos Evolved operating system, differentiated silicon capabilities and deep engagement with important customers. These factors not only enable Juniper to maintain its core franchises but also secure a new footprint, including a large new hyperscale WAN deployment that should act as a tailwind for its business over the next few years.

Revenues in Service Provider increased to $511.4 million from $474.9 million in the year-ago quarter, thanks to its focus on delivering a superior end-user experience. Revenues in Enterprise declined to $455.1 million from $467 million.

By region, revenues declined to $343.2 million from $363.6 million in the year-ago quarter in Europe, the Middle East and Africa. Revenues in the Americas increased to $748.6 million from $632.5 million. In the Asia Pacific, revenues were down 8.1% to $208.1 million.

Other Quarterly Details

Gross profit was $750.4 million compared with $717 million in the year-ago quarter. Total operating expenses decreased to $596.5 million from $618.9 million, mainly due to lower restructuring charges. Operating income was $153.9 million compared with $98.1 million a year ago. Non-GAAP operating income was $238.1 million, up from $236.3 million, with respective margins of 18.3% and 19.3%.

Cash Flow & Liquidity

In 2021, Juniper generated $689.7 million of cash from operating activities compared with $612 million in 2020. As of Dec 31, 2021, the company had $922.5 million in cash and cash equivalents with $1,686.8 million of long-term debt.

Outlook

Juniper is experiencing significant supply-chain headwinds related to rising component costs and shortages, as well as elevated freight costs, which are expected to continue at least through the first half of 2022.

For the ongoing quarter, the company expects revenues of $1,150 million (+/- $50 million). Non-GAAP gross margin is estimated to be 58% (+/- 1%). Non-GAAP operating expenses are expected to be $532 million (+/- $5 million). It anticipates non-GAAP operating margin to be about 11.8% at the mid-point of the revenue guidance. Non-GAAP net income is expected to be 31 cents per share (+/- 5 cents), assuming a share count of almost 332 million. Non-GAAP tax rate is likely to be around 20%.

Zacks Rank & Other Stocks to Consider

Juniper currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vocera Communications, Inc. VCRA is another top-ranked stock in the broader Zacks Computer and Technology sector that sports a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised 6.2% upward over the past 60 days.

Vocera Communications delivered a trailing four-quarter earnings surprise of 109.6%, on average. The stock has returned 79.5% in the past year.

SeaChange International, Inc. SEAC carries a Zacks Rank #2. The consensus estimate for current-year earnings has been revised 10% upward over the past 60 days.

SeaChange International delivered a trailing four-quarter earnings surprise of 37.2%, on average. The stock has, however, moved down 7.6% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2, is also a solid pick for investors. The consensus estimate for current-year earnings has been revised 0.7% upward over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has appreciated 3.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Vocera Communications, Inc. (VCRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research