Juniper's (JNPR) Q3 Earnings Match Estimates, Revenues Miss

Juniper Networks, Inc. JNPR reported modest third-quarter 2021 results, wherein the bottom line matched the Zacks Consensus Estimate but the top line missed the same.

Investments in customer solutions and sales organizations are enabling the company to capitalize on the solid demand across each of its end markets.

Of the top 10 customers in the quarter, six were Cloud, three were Service Provider, and one was an Enterprise. The top 10 customers accounted for 31% of total revenues, consistent with the third quarter of 2020.

Net Income

On a GAAP basis, net income in the September quarter fell to $88.9 million or 27 cents per share from $145.4 million or 43 cents per share in the prior-year quarter. The decline was mainly due to lower operating income and a provision for income tax.

Non-GAAP net income was $152 million or 46 cents per share (in line with the company’s guidance) compared with $144.4 million or 43 cents per share in the year-ago quarter. The bottom line matched the Zacks Consensus Estimate.

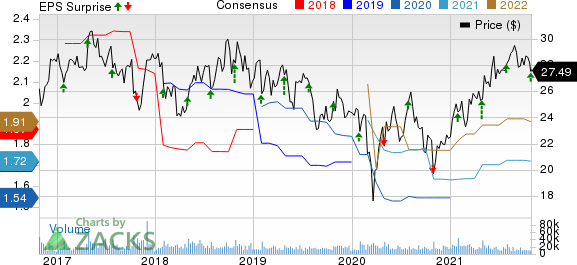

Juniper Networks, Inc. Price, Consensus and EPS Surprise

Juniper Networks, Inc. price-consensus-eps-surprise-chart | Juniper Networks, Inc. Quote

Revenues

Quarterly total revenues increased to $1,188.8 million (slightly below the mid-point of the company’s guidance due to the negative impact of supply chain constraints) from $1,138.2 million in the prior-year quarter driven by solid demand. Order momentum was strong across verticals, customer solutions, and geographies. The top line, however, missed the consensus estimate of $1,206 million.

Product revenues (contributing 64.9% to total revenues) improved 5.2% year over year to $771.9 million, reflecting healthy demand across the MX and PTX product families with the adoption of newer products and the automation software portfolio. Service revenues (contributing 35.1% to total revenues) increased 3.1% to $416.9 million, led by renewals and service attach rates.

By vertical, revenues in Cloud increased to $303.3 million from $253.1 million. This reflects early adoption of the 400-gig capable platform driven by the strength of the Junos Evolved operating system, differentiated silicon capabilities, and deep engagement with important customers. These factors are not only enabling Juniper to maintain its core franchises but also to secure a new footprint, including a large new hyperscale WAN deployment that should act as a tailwind for its business over the next few years.

Revenues in Service Provider decreased to $445.8 million from $475.1 million in the year-ago quarter, mainly due to supply chain constraints. Revenues in Enterprise improved to $439.7 million from $410 million, as customers are increasingly recognizing the value of platforms such as Mist and Apstra that significantly reduce deployment time.

By region, revenues improved to $336.3 million from $321.1 million in the year-ago quarter in Europe, the Middle East and Africa. Revenues in the Americas increased to $664.8 million from $624.3 million. In the Asia Pacific, revenues were down 2.6% to $187.7 million.

Other Details

Gross profit was $692.2 million compared with $657.8 million in the year-ago quarter. Total operating expenses increased to $572.1 million from $532.7 million, primarily due to higher research and development as well as sales and marketing expenses. Operating income was $120.1 million compared with $125.1 million a year ago. Non-GAAP operating income was $197.8 million, up from $194.7 million, with respective margins of 16.6% and 17.1%.

Cash Flow & Liquidity

During the first nine months of 2021, Juniper generated $573.7 million of cash from operating activities compared with $486.2 million in the prior-year period.

As of Sep 30, 2021, the company had $1,010.7 million in cash and cash equivalents with $1,692 million of long-term debt.

Outlook

Due to the worldwide shortage of semiconductors, Juniper is experiencing a component scarcity, which is resulting in extended lead times and elevated costs of certain products. However, the company continues to resolve supply chain challenges and increase inventory levels to limit disruptions.

For the fourth quarter, it expects revenues of $1,265 million (+/- $50 million). Non-GAAP gross margin is estimated to be between 58% and 60%. Non-GAAP operating expenses are expected to be $525 million (+/- $5 million). The company anticipates non-GAAP operating margin to be about 17.6% at the mid-point of the revenue guidance. Non-GAAP net income is expected to be 53 cents per share (+/- 5 cents), assuming a share count of almost 330 million.

Zacks Rank & Stocks to Consider

Juniper currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry are Clearfield, Inc. CLFD, Ubiquiti, Inc. UI, and SeaChange International, Inc. SEAC. While Clearfield sports a Zacks Rank #1 (Strong Buy), Ubiquiti and SeaChange carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered a trailing four-quarter earnings surprise of 49%, on average.

Ubiquiti pulled off a trailing four-quarter earnings surprise of 20.5%, on average.

SeaChange delivered a trailing four-quarter earnings surprise of 28.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research