Kahn Brothers Trims Merck, Exits Sterling Bancorp

Investment firm Kahn Brothers (Trades, Portfolio) & Co. Inc. sold shares of the following stocks during the third quarter.

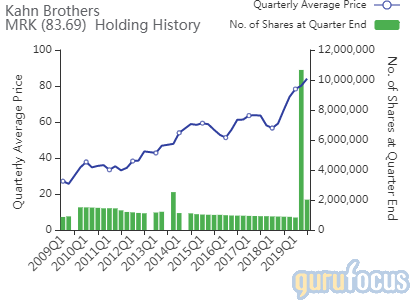

Merck

The firm curbed its Merck & Co. Inc. (NYSE:MRK) stake by 81.05%. The portfolio was impacted by -9.07%.

The pharmaceutical products manufacturer has a market cap of $212.31 billion and an enterprise value of $231.89 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 31.71% and return on assets of 11.11% are outperforming 83% of companies in the Drug Manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.33 is below the industry median of 0.62.

The largest guru shareholder of the company is the Vanguard Health Care Fund (Trades, Portfolio) with 0.48% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.35% and Ken Fisher (Trades, Portfolio) with 0.35%.

Sterling Bancorp

The firm exited its Sterling Bancorp (NYSE:STL) position. The portfolio was impacted by -1.39%.

The financial and bank holding company has a market cap of $4.19 billion and an enterprise value of $3.76 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 9.59% and return on assets of 1.42% are outperforming 52% of companies in the Banks industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.21 is below the industry median of 1.19.

The largest guru shareholder of the company is Diamond Hill Capital (Trades, Portfolio) with 2.48% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio) with 0.52% and Pioneer Investments with 0.05%.

New York Times

The New York Times Co. (NYSE:NYT) holding was trimmed by 27.83%, impacting the portfolio by -0.54%.

The American media company has a market cap of $5.30 billion and an enterprise value of $4.87 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 13.11% and return on assets of 6.25% are outperforming 76% of companies in the Publishing industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 2.69 is above the industry median of 2.12.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.71% of outstanding shares, followed by Kahn Brothers with 0.24% and Paul Tudor Jones (Trades, Portfolio) with 0.04%.

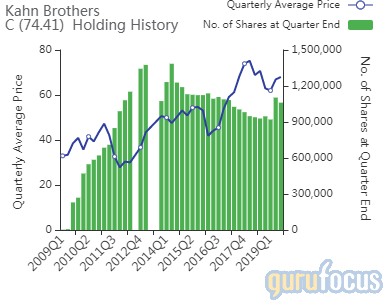

Citigroup

The firm reduced the Citigroup Inc. (NYSE:C) stake by 3.81%. The trade had an impact of -0.37% on the portfolio.

The financial services company has a market cap of $163.37 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 8.86% and return on assets of 0.96% are underperforming 52% of companies in the Banks industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.79 is below the industry median of 1.19.

The largest guru shareholder of the company is Jeff Ubben (Trades, Portfolio)'s ValueAct with 1.40% of outstanding shares, followed by Diamond Hill Capital with 0.45% and Bill Nygren (Trades, Portfolio) with 0.39%.

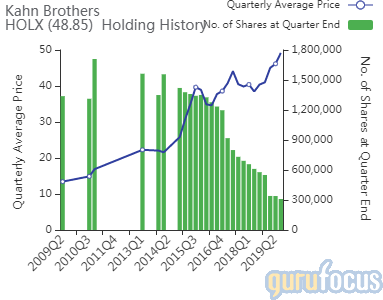

Hologic

The fund trimmed its Hologic Inc. (NASDAQ:HOLX) position by 8.79%. The portfolio was impacted by -0.18%.

The company, which provides products for the health care needs of women, has a market cap of $12.86 billion and an enterprise value of $15.51 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -1.27% and return on assets of -0.43% are underperforming 63% of companies in the Medical Instruments and Equipment industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.14 is below the industry median of 1.05.

The largest guru shareholder of the company is Larry Robbins (Trades, Portfolio) with 3.66% of outstanding shares, followed by the Parnassus Endeavor Fund (Trades, Portfolio) with 0.67% and the Vanguard Health Care Fund with 0.65%.

IDT

The IDT Corp. (NYSE:IDT) holding was reduced by 18.95%. The portfolio was impacted by -0.16%.

The telecommunications services provider has a market cap of $169.61 million and an enterprise value of $78.54 million.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 0.29% and return on assets of 0.03% are outperforming 68% of companies in the Communication Services industry. Its financial strength is rated 8 out of 10 with no debt.

Simons' firm is the largest guru shareholder of the company with 7.68% of outstanding shares, followed by Kahn Brothers with 2.79% and Chuck Royce (Trades, Portfolio) with 0.49%.

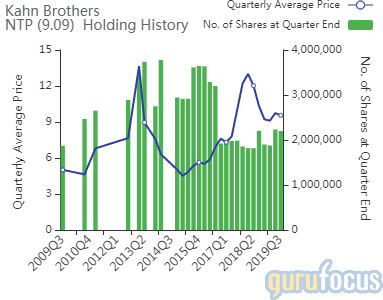

Nam Tai Property

The fund trimmed its Nam Tai Property Inc. (NYSE:NTP) stake by 1.57%. The portfolio was impacted by -0.04%.

The property development and management company has a market cap of $349.44 million and an enterprise value of $289.60 million.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -7.89% and return on assets of -5.7% are underperforming 89% of companies in the Real Estate Services industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 9.45 is above the industry median of 0.26.

The largest guru shareholder of the company is Kahn Brothers with 5.72% of outstanding shares.

Disclosure: I do not own any stocks mentioned.

Read more here:

Donald Smith Trims Kinross Gold, Micron Technology Positions

Tom Gayner Continues to Buy Alphabet, Amazon

Smead Value Fund Exits Johnson & Johnson, Trims Paypal

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.