Kakatiya Cement Sugar and Industries (NSE:KAKATCEM) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Kakatiya Cement Sugar and Industries Limited (NSE:KAKATCEM) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Kakatiya Cement Sugar and Industries

What Is Kakatiya Cement Sugar and Industries's Debt?

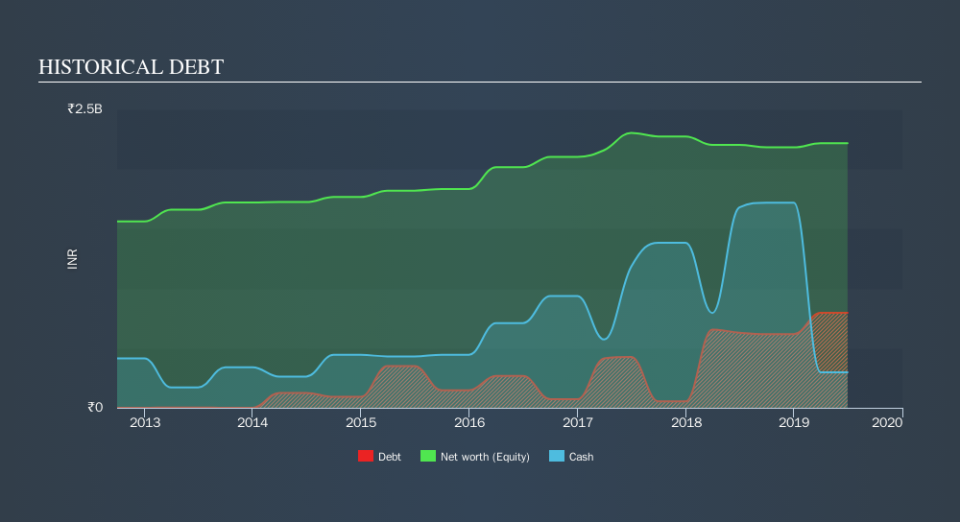

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Kakatiya Cement Sugar and Industries had ₹795.9m of debt, an increase on ₹628.8m, over one year. However, it also had ₹297.8m in cash, and so its net debt is ₹498.2m.

How Healthy Is Kakatiya Cement Sugar and Industries's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kakatiya Cement Sugar and Industries had liabilities of ₹999.5m due within 12 months and liabilities of ₹111.7m due beyond that. Offsetting these obligations, it had cash of ₹297.8m as well as receivables valued at ₹251.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹562.3m.

Kakatiya Cement Sugar and Industries has a market capitalization of ₹1.39b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Strangely Kakatiya Cement Sugar and Industries has a sky high EBITDA ratio of 6.5, implying high debt, but a strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! We also note that Kakatiya Cement Sugar and Industries improved its EBIT from a last year's loss to a positive ₹52m. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Kakatiya Cement Sugar and Industries will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Kakatiya Cement Sugar and Industries burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Kakatiya Cement Sugar and Industries's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Kakatiya Cement Sugar and Industries stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Kakatiya Cement Sugar and Industries insiders have sold any shares recently. You click here to find out if insiders have sold recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.