Karoon Energy (ASX:KAR) pulls back 9.1% this week, but still delivers shareholders decent 8.6% CAGR over 5 years

It hasn't been the best quarter for Karoon Energy Ltd (ASX:KAR) shareholders, since the share price has fallen 15% in that time. On the bright side the share price is up over the last half decade. Unfortunately its return of 39% is below the market return of 54%.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Karoon Energy

Given that Karoon Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Karoon Energy can boast revenue growth at a rate of 95% per year. That's well above most pre-profit companies. It's good to see that the stock has 7%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at Karoon Energy. Opportunity lies where the market hasn't fully priced growth in the underlying business.

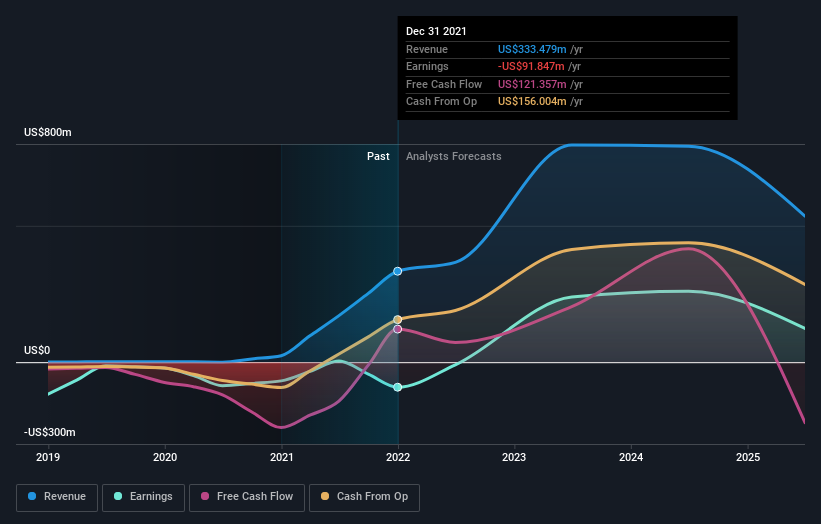

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Karoon Energy's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Karoon Energy hasn't been paying dividends, but its TSR of 51% exceeds its share price return of 39%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Karoon Energy has rewarded shareholders with a total shareholder return of 37% in the last twelve months. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on Karoon Energy it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here