KB Home Shares Spike as Investors Realize Potential

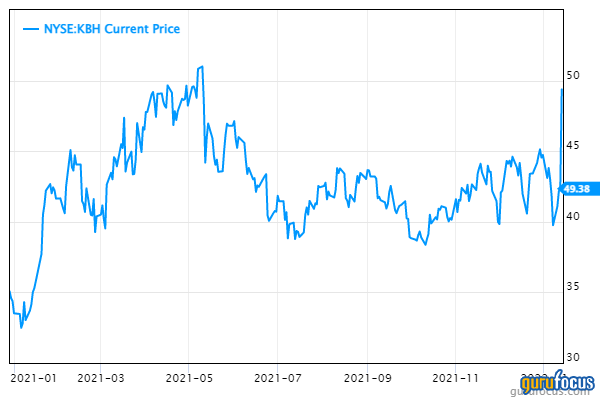

Following an encouraging earnings beat for the fourth quarter of 2021 and a positive outlook for 2022, shares of California-based homebuilder KB Home (NYSE:KBH) spiked more than 16% on Thursday to close the trading session at $49.38.

This may seem like a big jump, but it is likely due in part to KB Homes underperformance of the broader homebuilding and construction sector throughout 2021. Investors have been dismissing its built-to-order business model as inferior to homebuilders who build in advance. Thus, while fellow homebuilders D.R. Horton (DHI) and Lennar (LEN) were both up more than 50% in 2021, KB Homes shares rose only 33%, barely beating the S&P 500s 27% gain.

The long-term trend of underbuilding in the U.S., combined with other macro factors such as low interest rates and inflation, has resulted in a combination of rapidly rising home prices and limited homes for sale, especially in the market for first-time buyers of single-family homes. Since this is K.B. Homes main market, its previously underestimated built-to-order model is beginning to look more attractive.

With housing prices expected to continue their double-digit increases in 2022, could K.B. Homes business model end up outperforming competitors?

Recent results

After the market closed on Wednesday, KB Home reported its earnings results for its fourth quarter of 2021, which ended on Nov. 31.

Diluted earnings per share came in at $1.91 for the quarter, up 71% year over year and beating Wall Streets prediction of $1.77. While revenue of $1.68 billion was lower than the $1.71 billion that analysts had called for, it was still a 40% increase from the prior-year quarter.

Aside from the earnings beat, KB Homes 2022 outlook also contributed to investor optimism. The company targets revenue in the range of $7.2 billion to $7.6 billion for full-year 2022 compared to the $5.72 billion in revenue it recorded in fiscal 2021. Wall Street is expecting $7.27 billion in 2022 revenue, falling at the low end of the companys own guidance.

We delivered outstanding growth in revenues and margins in our 2021 fourth quarter, leading to a more than 70% year-over-year increase in earnings per share. With the strong finish to 2021, we generated a full-year return on equity of approximately 20%, CEO Jeffrey Mezger said. During the past year, we significantly expanded our production capabilities as we scale our business to meet the healthy demand that is driving the housing market and align our starts to net orders. Although operating conditions in 2021 were extremely challenging, with labor shortages and supply chain disruptions, along with municipal and related delays, our teams remained resilient in working through solutions with our trade partners and suppliers.

Homebuilding market outlook

The key driving factor behind KB Homes success is naturally the strong housing market. U.S. homebuilders have been underbuilding for years, with new starts tanking a few years before the financial crisis and never really recovering to the levels that the growing population needs.

This issue really came into the limelight in recent years due to rock-bottom mortgage rates creating a surge in homebuyer activity. Not only did this cause more young people to take the leap and buy property rather than renting, it also incentivized existing homeowners to sell their homes and move up. It also led droves of real estate investors to snap up properties for home-flipping and rental purposes.

Even with mortgage rates on the rise again, its unlikely this will hurt housing prices due to undersupply. Buyers are finding it especially difficult to find entry-level single-family homes. It would be hard for established homebuilders like KB Home to do badly in this kind of market, unless they found themselves with a critical shortage of materials and labor.

The built-to-order difference

Both KB Homes recent results and the decade-long underbuilding problem in the U.S. seem to support predictable long-term growth potential for the company. Will the build-to-order model work to the companys advantage in this type of environment, or do competitors who build in advance have better prospects?

The strong demand appears to be keeping KB Homes order volume high enough to avoid losing out to advance-building competitors. This is shown clearly by the fact that KB Homes fastest-growing market is the one with the most severe underbuilding problems: first-time single-family homes.

The advantage of building in advance is that homes can sell faster when demand outpaces supply, but when advance building is not keeping up with demand, then this advantage begins to disappear. This is when the cost-saving potential of the built-to-order model gets a chance to shine. Building the home that the customer wants results in greater operational efficiency and higher absorption rates. It also helps mitigate risk, because if supply someday begins to outpace demand again, KB Home wont be stuck with as much unsold inventory.

Valuation

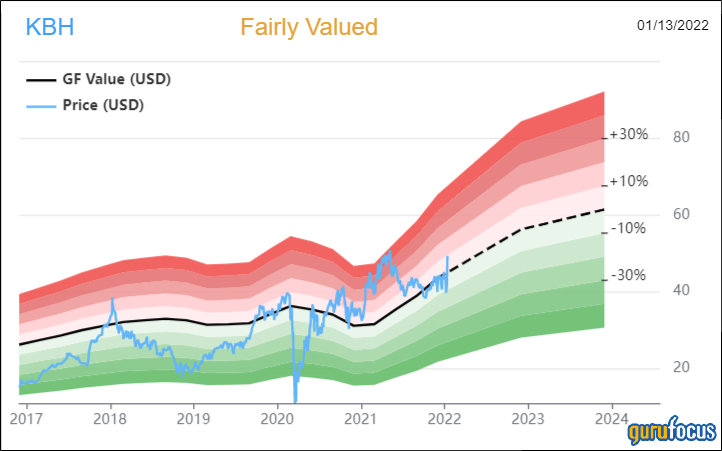

In light of its recent earnings results and positive outlook, the market has rapidly reassessed KB Homes stock price. Following its more than 16% gain on Thursday, the stock is now fairly valued according to the GF Value Line:

However, its price-earnings ratio of 9.44 is below the industry median of 10.84, and its price-earnings-to-growth (PEG) ratio is 0.4, which indicates undervaluation relative to recent growth trends.

With cyclical stocks, investors have to be cautious of low valuation multiples since they can often signal that earnings are reaching a peak and a cyclical downturn could begin soon. However, the decade of underbuilding isnt even close to being corrected. Even if mortgage rates rise, any downwards pressure on prices from this source will likely be mitigated by inflation.

Overall, it seems like KB Home could still be undervalued even after its recent rise. As long as demand continues to grow faster than supply, its built-to-order model provides it an advantage that the market has been slow to recognize until now.

On the other hand, if the housing market were to suffer a downturn, KB Home would likely have more early warning signs in its earnings results, making it a practical stock for real estate investors to keep an eye on.

This article first appeared on GuruFocus.