KBR Gains From Government Unit & Buyouts Amid Competition

KBR, Inc. KBR is expected to gain from the U.S. administration’s focus on infrastructural development. The company’s solid prospects of the Government Solutions (“GS”) business, growing backlog level and acquisitions are adding to KBR’s bliss.

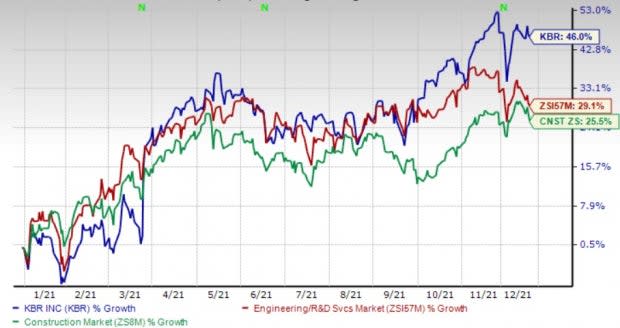

The company’s shares have gained 46% year to date, outperforming the Zacks Engineering - R and D Services industry’s 29.1% rally. The impressive performance was backed by a solid contract wining spree, strong project execution, backlog level, and potential government and technology businesses. It has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in each of the trailing 15 quarters. Meanwhile, revenues topped the consensus mark in 11 of the trailing 12 quarters.

Although stiff competition, volatility of commodity prices and uncertainty in the global market are potential risks, high-end, technically differentiated businesses will certainly drive growth.

Image Source: Zacks Investment Research

Let’s delve deeper into the factors that justify its current Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Drivers

Biden’s Infrastructural Push: The U.S. administration’s major focus on infrastructural enhancement has been creating the need for advanced construction and engineering solutions. KBR is well positioned to gain from the renewable energy drive of the pro-environmental Biden administration. Development and deployment of technology solutions across the full spectrum of decarbonization efforts, including carbon management mitigation and compliance consulting as well as all facets of infrastructure for providing carbon-free energy solutions, will benefit KBR going forward.

Robust Backlog: KBR’s solid backlog level of $14.8 billion (as of Sep 30, 2021) highlights its underlying strength. Nearly 84% of the backlog represents work in Government Solutions. The majority of these are long-term reimbursable service annuity-type contracts that have significantly lower risks than some of the other projects. The company believes that this will ultimately help in margin expansion and considerably de-risk the business. Going forward, KBR expects broad-based growth across all segments. Primary growth drivers include high-end and differentiated government business work, strong margin performance, and technology and consulting business.

Contribution From GS Business: The GS business, which accounted for 70.3% of KBR's 2020 revenues, is one of the major contributing units of KBR. The business has been riding on on-contract growth in logistics and engineering, take-away wins alongside new work awarded under the company’s portfolio of well-positioned contracting vehicles.

Inorganic Moves: KBR has a penchant for acquisitions and strategic alliances for bolstering inorganic growth as well as expanding market share. In July 2021, KBR acquired certain businesses of Harmonic Limited. The acquired business of Harmonic provides transformation and delivery consultancy project services to U.K. businesses and is reported within its GS business segment. In October 2021, KBR wrapped up the acquisition of Frazer-Nash Consultancy Limited — a leading provider of systems engineering, assurance and technology advisory services — from Babcock International Group PLC. This buyout enabled KBR to expand its international advisory footprint.

Some Better-Ranked Stocks From the Broader Construction Sector

Beazer Homes USA, Inc. BZH currently sports a Zacks Rank #1. This Atlanta-based homebuilder continues to gain from strong operational execution and continued strength in the housing market.

Beazer Homes has gained 38.5% year to date (YTD). Earnings are expected to grow 23.7% in fiscal 2022.

Meritage Homes Corporation MTH currently sports a Zacks Rank #1. Based in Scottsdale, AZ, Meritage Homes is one of the leading designers and builders of single-family homes. Its focus on entry-level LiVE.NOW homes has been a major driving factor.

Meritage Homes has gained 35.7% YTD. Earnings are expected to grow 74.4% in 2021 and 22.2% in the next.

Altair Engineering Inc. ALTR currently carries a Zacks Rank #2 (Buy). Based in Troy, MI, this global technology company provides software and cloud solutions in areas of simulation, high-performance computing, data analytics as well as artificial intelligence.

Altair Engineering shares have gained 24% YTD. Earnings are expected to grow 12.3% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research