Ken Fisher on the Recovery: Likely Swifter Than Many Assume

It can be difficult to be an optimist during a typical bear market. Tack on the Covid-19 crisis, widespread business closures and stay-at-home orders, and that light at the end of the tunnel can feel like it's a million miles away. During tumultuous times like these, investors are often left in a state of despair, frustration and impatience. Those are all feelings that can trick investors into making short-term mistakes that could affect their long-term financial goals. But Ken Fisher (Trades, Portfolio), long-term investor and founder of Fisher Investments, has some thoughts and an optimistic message: The recovery will arrive and it may be swifter than many expect.

Stock market signals of a recovery

"Stocks move before reality does," Fisher says. "So look for rising stock prices as a signal that the economic recovery is getting underway."

Stocks advancing ahead of the economy may seem like the tail wagging the dog, but many investors forget that the forward-looking stock market almost always incorporates future expectations into its pricing.

"Think of the stock market like a future-focused, data-processing machine," Fisher says. "When any new information appears, the stock market incorporates it and pre-prices a future that's between 3 and 30 months out." It's impossible to say with any certainty how far forward the market is pricing at any given time, but it's constantly adjusting prices to reflect the potential future.

The lesson for investors is that stock prices can increase even when the economy seems to be getting worse. So if you're waiting for the economy to signal "all clear" before you're comfortable with stocks, you might be waiting too long.

The cause of the crash and the road to recovery

The deep, systemic economic issues that usually accompany bear markets often take a long time to resolve before markets begin to recover. However, the current bear market is a different species than others from the last 100 or so years of modern market history.

"This is not like in a normal recession," says Fisher, "where prior problems have to be fixed and overcome." While most market recoveries depend on overcoming some sort of imbalance or defect in the markets (like the dotcom mania in the late 1990s or sub-prime mortgages in 2008), we believe the current bear was caused by the clampdown efforts to slow the spread of Covid-19.

Think of the economy like a car that's come to a complete stop. Is the car stopped because there's something broken in the engine or the electrical system? That could take time to repair before you're on your way again. Or is the car stopped because you've got your foot on the brake? In that case, you can get underway fairly quickly once you remove your foot from the brake and put it back on the gas pedal.

Without any underlying systemic problems, the economy can spring back more quickly than during prior downturns, when businesses and the government take their feet off the brakes. That said, the longer the shutdown remains in place, the longer it will likely take the economy to get back up to speed.

Be ready to capture the new bull market

All of this has a big implication for investors who've gone defensive, have moved away from stocks or are just nervous about the current state of the market: If you wait for an economic recovery to arrive before getting back into stocks, you risk missing out on potentially strong returns at the start of the next bull market.

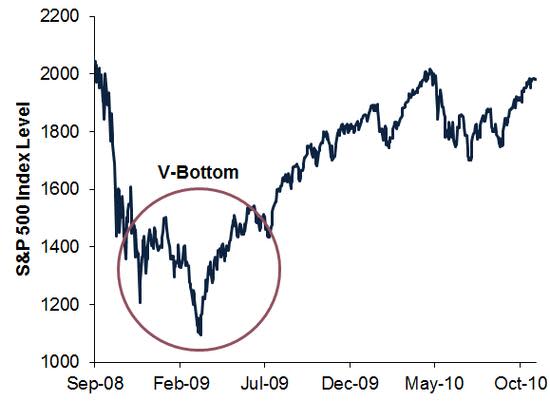

The end of the last bear market in 2009 is a great example. The exhibit below shows the S&P 500's quick V-shaped bounce in the spring of 2009 that signaled the end of the bear market. Investors who waited for the end of the recession in June 2009 missed out on significant positive returns. That swift initial recovery can go a long way to help offset bear market declines. And remember, the S&P 500's long-term annualized average return of about 10% includes bear markets and corrections, suggesting timing the market is unnecessary for long-term investors.[i]

Exhibit: Don't Miss the Start of a Bull

Source: FactSet, as of 10/07/2019. S&P 500 Total Return Index Level from 09/01/2008-10/31/2010.

Further, markets don't recover evenly in all situations. For example, during a typical bear market, economically sensitive stocks tend to fall the most, but then recover the most during the new bull. However, in a market correction, those stocks that were leading going into the correction tend to hold up better through the correction and resume their dominance once the correction is over. We believe the current market is a correction masquerading as a bear, rather than a traditional bear market. As such, we think that if shutdowns end relatively soon, markets after the bear should look much like they did just before the downturn began.

"Even if you didn't avoid the downside," Fisher says, "I believe the most important thing is to stay invested, position for a correction-like recovery and stay on track."

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

[i] Source: Global Financial Data, as of 04/14/2020. Actual return is 10.08%, based on annualized S&P 500 Total Return Index returns from 12/31/1925-12/31/2019.

This article first appeared on GuruFocus.