Ken Heebner's Firm Exits Zebra Technologies, Phillips 66

Ken Heebner (Trades, Portfolio)'s Capital Growth Management sold shares of the following stocks in the second quarter.

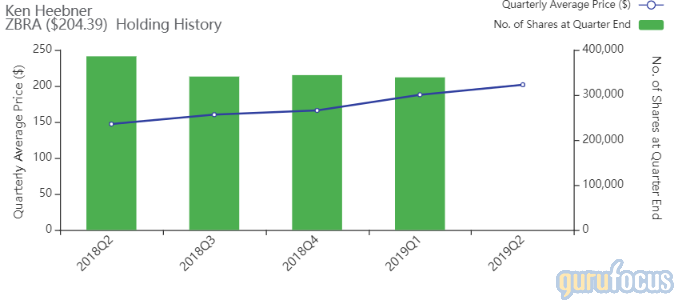

The firm exited its Zebra Technologies Corp. (NASDAQ:ZBRA) position. The trade had an impact of -4.38% on the portfolio.

The company, which provides products for the automatic identification and data capture market, has a market cap of $11.13 billion and an enterprise value of $12.92 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 36.18% and return on assets of 10.79% are outperforming 93% of companies in the Communication Equipment industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.02 is below the industry median of 1.58.

The company's largest guru shareholder is John Rogers (Trades, Portfolio) with 1.33% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.77% and Pioneer Investments (Trades, Portfolio) with 0.21%.

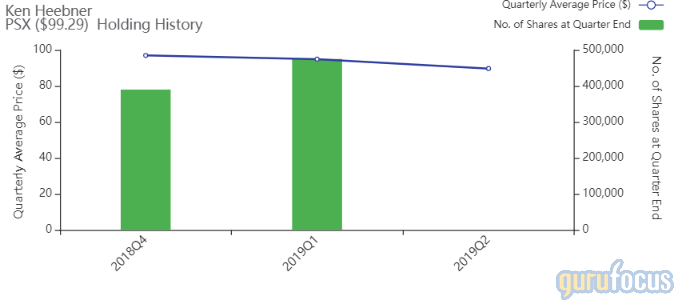

Heebner's firm sold out of its Phillips 66 (NYSE:PSX) holding. The portfolio was impacted by -2.78%.

The independent oil refiner has a market cap of $45.05 billion and an enterprise value of $57.23 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 22.41% and return on assets of 9.55% are outperforming 79% of companies in the Oil and Gas - Refining and Marketing industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.16 is below the industry median of 0.36.

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 3.14% of outstanding shares, followed by Warren Buffett (Trades, Portfolio) with 1.22% and Pioneer Investments with 0.19%.

The investment firm exited his Valero Energy Corp. (NYSE:VLO) position. The portfolio was impacted by -2.61%.

The oil refiner has a market cap of $32.68 billion and an enterprise value of $40.62 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 11.85% is underperforming the sector, the return on assets of 4.99% is outperforming 57% of companies in the Oil and Gas - Refining and Marketing industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.21 is below the industry median of 0.36.

The company's largest guru shareholder is Barrow, Hanley, Mewhinney & Strauss with 1.41% of outstanding shares, followed by Pioneer Investments with 0.78%, Steven Cohen (Trades, Portfolio) with 0.32% and Ken Fisher (Trades, Portfolio) with 0.02%.

Capital Growth divested of PagSeguro Digital Ltd. (NYSE:PAGS), impacting the portfolio by -2.51%.

The company, which provides financial technology solutions, has a market cap of $15.04 billion and an enterprise value of $14.41 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 17.32% and return on assets of 10.23% are outperforming 65% of companies in the Application Software industry. Its financial strength is rated 9 out of 10 with no debt.

The company's largest guru shareholder is Ron Baron (Trades, Portfolio) with 1.17% of outstanding shares, followed by Cohen with 0.60% and Pioneer Investments with 0.18%

The holding of CBRE Group Inc. (NYSE:CBRE) was closed. The trade had an impact of -2.44% on the portfolio.

The provider of real estate services has a market cap of $17.90 billion and enterprise value of $22.22 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 21.85% and return on assets of 7.84% are outperforming 82% of companies in the Real Estate Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.27.

Jeff Ubben (Trades, Portfolio)'s ValueAct is the company's largest guru shareholder with 3.92% of outstanding shares, followed by Baron with 0.68%, Rogers with 0.54% and Pioneer Investments with 0.18%.

The Companhia Siderurgica Nacional (NYSE:SID) stake was reduced by 82.76%. The trade had an impact of -2.43% on the portfolio.

The steel producer has a market cap of $5.09 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 47.21% and return on assets of 7.84% are outperforming 73% of companies in the Steel industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.31.

Simons' firm is the company's largest guru shareholder with 0.26% of outstanding shares, followed by Heebner with 0.14%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Stocks With Low Price-Sales Ratios

Largest Insider Trades of the Week

6 Underperforming Stocks in Gurus' Portfolios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.