Ketterer's Causeway International Value Buys 5 Stocks in 3rd Quarter

The Causeway International Value (Trades, Portfolio) Fund disclosed this week that it established five new positions during the third quarter: Siemens AG (XTER:SIE), Bayer AG (XTER:BAYN), Sinopharm Group Co. Ltd. (HKSE:01099), Air France-KLM (XPAR:AF) and Infineon Technologies AG (XTER:IFX).

The fund managers, which include Causeway co-founder Sarah Ketterer (Trades, Portfolio), seek long-term capital appreciation through a value-oriented, bottom-up stock selection. The fund said in its commentary section of its website that it outperformed the benchmark during November due primarily to stock selection.

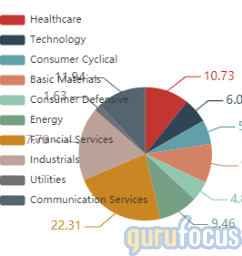

As of quarter-end, the fund's $6.25 billion equity portfolio contains 59 stocks with a turnover ratio of 9%. The financial services sector, one of several sectors that contributed to portfolio performance, has the largest portfolio weight at 22.31%. Other sectors with a high portfolio weight include industrials and communication services, with weights of 17.79% and 11.94%.

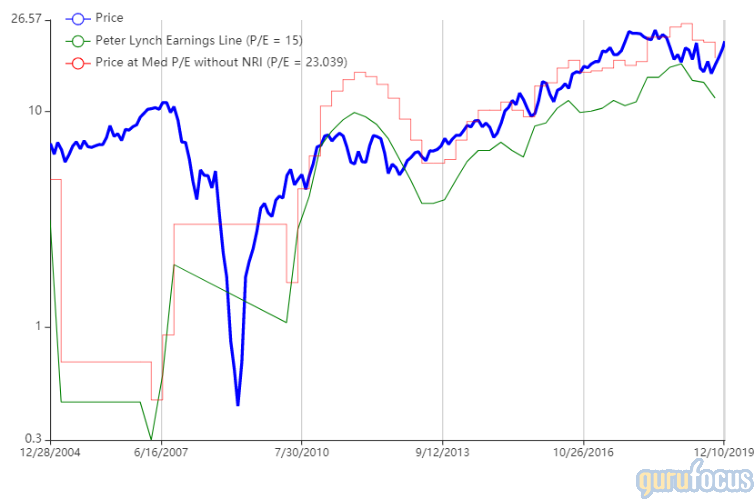

Siemens

The fund purchased 971,916 shares of Siemens, giving the position 1.66% equity portfolio weight. Shares averaged 95.38 euros ($106.40) during the quarter.

The Munich-based company manufactures industrial products across a wide range of sectors, including power and gas, wind power and renewables, energy management and building technologies. GuruFocus ranks Siemens' profitability 7 out of 10: Even though operating margins outperform just 57.43% of global competitors, Siemens' return on equity and Joel Greenblatt (Trades, Portfolio) return on capital outperform 69% and 89% of global industrial manufacturers.

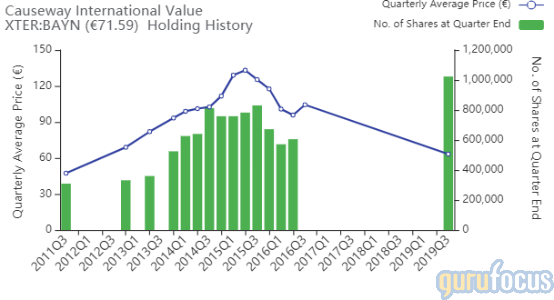

Bayer

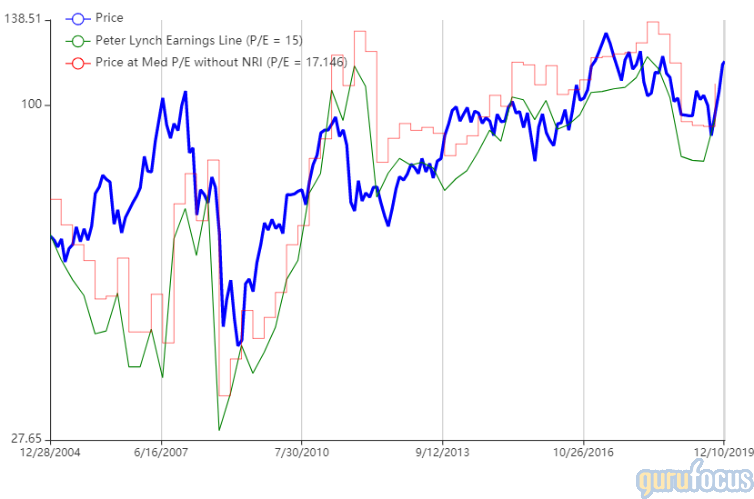

The fund purchased 1,023,066 shares of Bayer, giving the stake 1.15% weight in the equity portfolio. Shares averaged 63.27 euros during the quarter.

The German health care and chemical conglomerate manufactures a wide range of pharmaceutical drugs and chemical products like pesticides, herbicides and fungicides. GuruFocus ranks Bayer's financial strength 3 out of 10 on several weak signs, which include a low Piotroski F-score of 3 and debt ratios that underperform over 83% of global competitors.

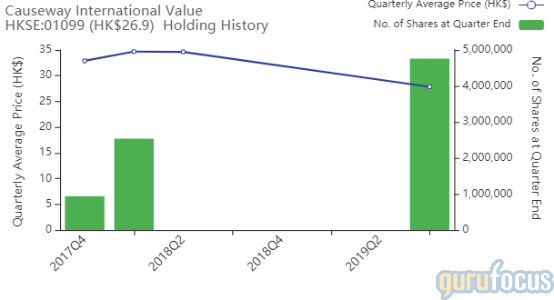

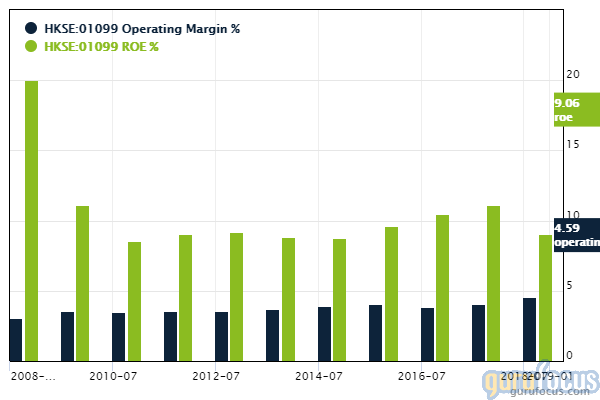

Sinopharm

The fund purchased 4,758,342 shares of Sinopharm, giving the position 0.24% equity portfolio weight. The stock averaged 27.84 Hong Kong dollars ($3.57) per share during the quarter.

The Shanghai-based company distributes pharmaceutical and health care products through its network of supply chain services across China. GuruFocus ranks Sinopharm's profitability 8 out of 10 on several positive investing signs, which include expanding profit margins, a three-star predictability rank and a return on equity that outperforms 80.33% of global competitors.

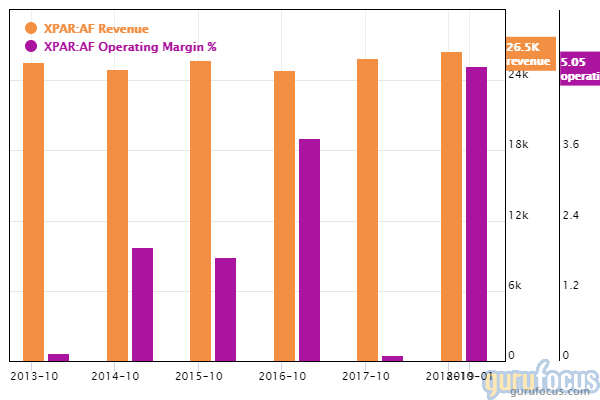

Air France

The fund purchased 1,142,904 shares of Air France, giving the stake 0.19% equity portfolio space. Shares averaged 9.49 euros during the quarter.

GuruFocus ranks the French airline's profitability 4 out of 10 on several weak indicators, which include a three-year revenue decline rate of 10.6%, a rate that underperforms 86.69% of global competitors. Despite this, operating margins have increased over 25% per year on average over the past five years albeit underperforming approximately 70% of global airlines.

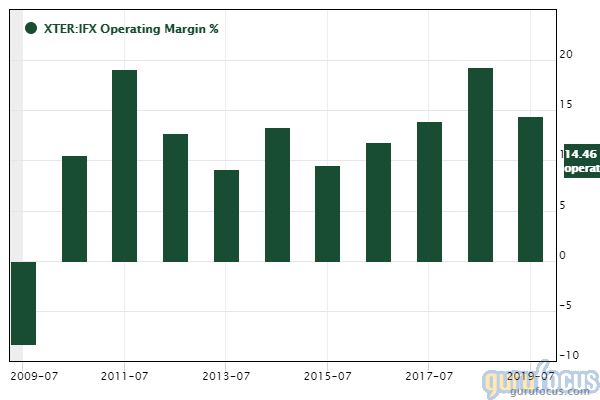

Infineon

The fund purchased 496,487 shares of Infineon, giving the holding 0.14% equity portfolio weight. Shares averaged 16.54 euros during the quarter.

A Siemens spinoff, Munich-based Infineon manufactures semiconductor chips for identification cards and other security products. GuruFocus ranks Infineon's profitability 8 out of 10 on several positive investing signs, which include operating margins that have increased approximately 7.9% per year on average over the past five years and are outperforming 76.48% of global competitors.

Disclosure: No positions.

Read more here:

5 Top-Performing Chinese Stocks in 2019

Michael Burry's Top 5 Holdings

Top 4 Holdings of Howard Marks' Oaktree

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.