Key Factors to Impact Essex Property's (ESS) Q1 Earnings

Essex Property Trust, Inc. ESS is scheduled to report first-quarter 2021 results on Apr 27, after the closing bell. The company’s results will likely reflect year-over-year declines in revenues and funds from operations (FFO) per share.

In the last reported quarter, this San Mateo, CA-based residential real estate investment trust (REIT) reported a negative surprise of 3.21% in terms of FFO per share. Results reflected the adverse impact of the pandemic on the company’s business. Concessions and delinquencies hurt same-property revenues during the quarter.

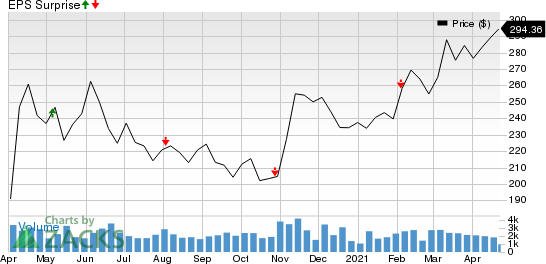

Over the trailing four quarters, the company beat the Zacks Consensus Estimate on one occasion and missed in the other three, the average negative surprise being 1.36%. This is depicted in the graph below:

Essex Property Trust, Inc. Price and EPS Surprise

Essex Property Trust, Inc. price-eps-surprise | Essex Property Trust, Inc. Quote

Let’s see how things have shaped up prior to this announcement.

Factors to Consider

For the U.S. apartment market, the first quarter, which typically remains a slow leasing period in other years, appeared to be a solid one this year, with impressive demand for rental units. Thanks to employment growth that spurs household formation and housing absorption, demand for 52,661 apartments were registered across the country’s 150 largest metros during the quarter, per a report from the real estate technology and analytics firm RealPage RP.

This tally is well ahead of the year-ago volume of 29,657 units. Moreover, this year’s first-quarter demand is more than double the average first-quarter demand of about 25,200 units witnessed in the past 10 years. Considering that the first quarter comprises the cold weather months that affect leasing activity, this year’s performance is definitely a notable one. However, this healthy demand has been the most noticeable in the Sun Belt metros. Demand was also impressive in the sub-urban ones though situations still remain turbulent in some of the gateway markets.

The occupancy level was encouraging in March, though the rent results have been mixed. Particularly, March occupancy came in at 95.5% in the United States’ 150 largest metros. This suggests stability and the occupancy level has been somewhere between 95.2% and 95.8% since late 2019. Considering that the world has been battling a pandemic in the meantime, this stability is particularly encouraging.

Nonetheless, considering the annual rent change, it is important to note that with some of the largest markets having suffered significant declines, the national shift in effective asking rents is still a tad negative at -0.7%. Specifically, San Francisco, San Jose and New York saw significant annual declines in effective asking rents. Nevertheless, the U.S. apartment rents moved up in the first three months of 2021, with a 0.2% increase in January and 0.6% in February, prior to the 0.7% rise in March.

Added to this, the struggle to lure renters is likely to have continued in the first quarter as well, as supply volumes were elevated. During the March-end quarter, though demand was solid, apartment absorption still lagged the property completion tally, with new supply aggregating 84,794 units.

Remarkably, Essex Property has a sturdy property base, substantial exposure to the West Coast market and is also banking on its technology, scale and organizational capabilities to drive innovation and margin expansion in the portfolio. The residential REIT is also likely to have maintained decent balance sheet and financial flexibility during the quarter under review.

However, the pandemic’s adverse impact on economy and the job-market environment has been resulting in household contraction and consolidation. Loss of leisure and hospitality, and other services jobs is dampening demand in the company’s markets. A number of factors are affecting rental demand, including work-from-home flexibility that is resulting in a shift of some renter demand away from higher cost and urban/infill markets. In addition, record-low mortgage rates are spurring demand for existing and new-home purchases, mainly for young age cohorts where homeownership rates have started to shoot up.

Further, prevalence of the global health crisis, and the stressful financial condition of the company’s tenants, together with regulations that limit its ability to quickly evict tenants, are likely to have continued to affect the cash flows. Particularly, due to the eviction moratoriums and regulations, delinquencies might have been elevated in the quarter under preview.

Furthermore, concession activity is likely to have been high. Per the company’s preliminary January/February operating update, cash concessions and delinquencies account for -2.8% and -2.1%, respectively, of January and February’s preliminary 8.3% same-property revenue decline compared to the prior-year period.

The Zacks Consensus Estimate of $356.69 million for first-quarter revenues calls for a 9.09% decline year on year. The Zacks Consensus Estimate for quarterly same-property occupancy currently stands at 96%, while the consensus estimate for same property-revenues is presently pegged at $314 million, up from the prior quarter’s $313 million.

Prior to the quarterly earnings release, analysts seem to have become slightly pessimistic about the company’s prospects as the Zacks Consensus Estimate for the January-March quarter FFO per share moved a cent south to $3.04 over the past month. It also suggests a year-over year decline of 12.6%.

For first-quarter 2021, the company projects core FFO per share at $2.96-$3.10.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive surprise in terms of FFO per share for Essex Property this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Essex Property currently carries a Zacks Rank #3 (Hold) and has an Earnings ESP of -0.22%.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Digital Realty Trust, Inc. DLR, scheduled to report quarterly numbers on Apr 29, currently has an Earnings ESP of +1.06% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

CubeSmart CUBE, slated to release quarterly numbers on Apr 29, has an Earnings ESP of +3.14% and carries a Zacks Rank of 3 at present.

Welltower, Inc. WELL, slated to release quarterly earnings on Apr 28, currently has an Earnings ESP of +0.93% and carries a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

RealPage, Inc. (RP) : Free Stock Analysis Report

CubeSmart (CUBE) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research