Key Reasons Why GATX Stock Should Grace Your Portfolio Now

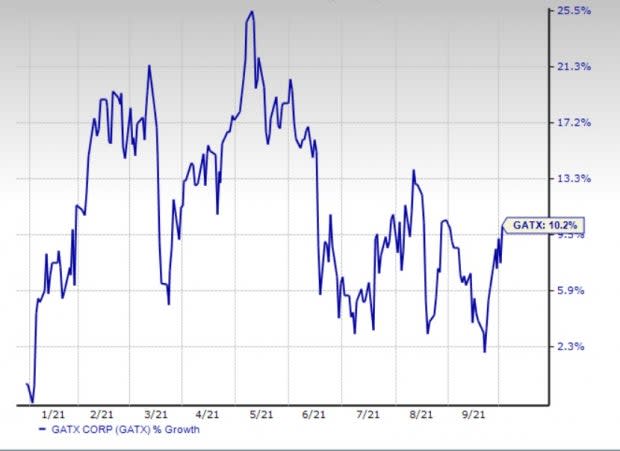

Shares of GATX Corporation GATX have been performing well on the bourses, gaining 10.2% year to date.

Image Source: Zacks Investment Research

Let’s look into the factors that are working in favor of the currently Zacks Rank #2 (Buy) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Northbound Earnings Estimates: The Zacks Consensus Estimate for current-year earnings has been revised 7.8% upward over the past 90 days. For 2022, the consensus mark for the metric has moved 1.9% north in the same time frame. Such favorable estimate revisions reflect brokers’ confidence in the stock.

Given the wealth of information at the brokers’ disposal, it is in the best interest of investors to be guided by their expert advice and the direction of their estimate revisions. This is because the same serves as a key indicator in determining the price of a stock.

Solid Industry Rank: The industry to which GATX belongs, currently has a Zacks Industry Rank of 9 (of 250 plus groups). Such a solid rank places the company in the top 22% of the Zacks industries. Studies show that 50% of a stock price movement is directly related to the performance of the industry group it hails from.

In fact, an ordinary stock within a strong group is likely to outshine a robust stock in a weak industry. Therefore, taking the industry’s performance into account becomes imperative.

Other Tailwinds: We are bullish on GATX management’s decision to raise its earnings per share guidance for 2021. Improvement in the railcar leasing market in North America was the primary reason behind the guidance hike. The company now expects current-year earnings per share in the $4.30-$4.50 range (earlier view: $4-$4.30). Efforts to reward its shareholders despite the current challenging scenario are also highly commendable. In January 2021, the company raised its quarterly dividend by 4.2% to 50 cents per share. GATX's sound liquidity position is an added positive.

Other Stocks to Consider

Investors interested in the Zacks Transportation sector may also consider Schneider National SNDR, Werner Enterprises WERN and Landstar System LSTR, all stocks currently carrying the same bullish rank as GATX.

Long-term expected earnings per share (three to five years) growth rate for Schneider National, Werner and Landstar is pegged at 17.9%, 13.1% and 12%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research