Keysight (KEYS) Q1 Earnings Beat Estimates, Revenues Up Y/Y

Keysight Technologies, Inc. KEYS delivered first-quarter fiscal 2020 non-GAAP earnings of $1.26 per share, which surpassed the Zacks Consensus Estimate by 16.7%. The bottom line improved 35.5% from the year-ago quarter. The figure was also above the higher end of management’s guidance of $1.04-$1.10 per share.

Non-GAAP revenues improved 9% year over year to $1.095 billion, above the higher end of management’s guided range of $1.045-$1.065 billion. Non-GAAP core revenues (excluding the impact of currency and revenues from acquisitions in a year’s time) increased 8% year over year to $1.088 billion. Meanwhile, GAAP revenues advanced 9% from the year-ago quarter to $1.095 billion.

The Zacks Consensus Estimate for revenues was pegged at $1.061 billion.

Robust adoption of the company’s solutions across diversified end-markets, including 5G, aerospace defense, network visibility and general electronics, primarily drove the fiscal first-quarter results. Further, the company is well poised to sustain momentum, courtesy of its differentiated and broad portfolio of solutions across several end-markets.

Quarter in Detail

Orders grew 12% year over year to approximately $1.141 billion during the reported quarter. Notably, core orders improved 11%.

Beginning first-quarter fiscal 2020, the company’s financial reporting comprises two segments — Electronic Industrial Solutions Group (EISG) and Communications Solutions Group (CSG). Ixia Solutions Group (ISG) segment reporting has been aligned with the CGS segment.

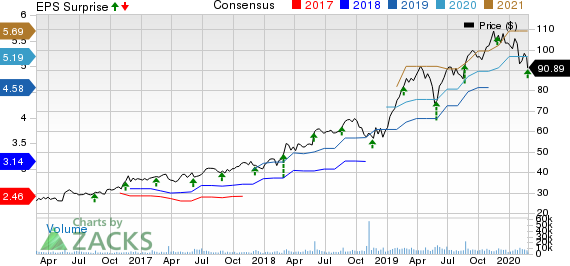

Keysight Technologies Inc. Price, Consensus and EPS Surprise

Keysight Technologies Inc. price-consensus-eps-surprise-chart | Keysight Technologies Inc. Quote

CSG includes commercial communications (CC) and aerospace, defense & government (ADG) end markets. CSG revenues of $818 million improved 9% year over year and 8% on a core basis. CSG contributed 74.7% to total non-GAAP revenues in the fiscal first quarter.

CC revenues of $573 million improved 8% year over year on the back of strong growth in the wireless ecosystem primarily fueled by advancement in 5G investment. Moreover, robust 5G order growth and strong demand for Ixia’s Network Applications & Security solutions favored revenues.

ADG revenues came in at $245 million, increasing 10% year over year. Higher government spending and momentum in investments aimed at technology modernization supported the upside. Management noted demand strength globally.

EISG revenues increased 8% to $277 million. This can primarily be attributed to robust demand for the company’s solutions in process node technology testing, considering semiconductor vertical. Investments in next-generation automotive and energy technologies, and momentum in first-to-market solutions, also contributed to the rally. EISG contributed 25.3% to total non-GAAP revenues in first-quarter fiscal 2020.

Non-GAAP revenues from Americas came in at $447 million, up 10% year over year. Non-GAAP revenues from Europe and Asia Pacific of $179 million and $425 million, improved 4% and 9%, respectively, on a year-over-year basis. Americas, Europe and Asia Pacific contributed 40.8%, 17% and 42.2%, respectively, to total revenues in the reported quarter.

Margin Highlights

Non-GAAP gross margin expanded 280 basis points (bps) to 64.6% during the reported quarter. CSG and EISG’s gross margin of 65.7% and 61.1% expanded 290 bps and 220 bps, respectively, on a year-over-year basis.

Non-GAAP operating expenses increased 3.1% to $433 million. As a percentage of revenues, the figure contracted 220 bps to 39.5%.

Consequently, non-GAAP operating margin expanded 480 bps to 25%.

Balance Sheet & Cash Flow

As of Jan 31, 2020, Keysight had cash & cash equivalents of $1.691 billion, up from $1.598 billion as of Oct 31, 2019.

As on Jan 31, 2020, the company reported long-term debt of $1.788 billion, which remained unchanged sequentially.

Cash flow from operations during the quarter came in at $197 million compared with $263 million reported in the prior quarter.

Free cash flow was $165 million compared with the previous quarter’s $233 million.

During the reported quarter, the company repurchased approximately 730,000 shares for $75 million.

Guidance

For second-quarter fiscal 2020, the company expects revenues to be $1.138-$1.178 billion. The guidance includes impact from ongoing coronavirus crisis. The Zacks Consensus Estimate is currently pegged at $1.15 billion.

Non-GAAP earnings per share are projected to be $1.28-$1.38. The Zacks Consensus Estimate is currently pegged at $1.30.

Conclusion

Keysight is well poised to capitalize on rising demand of its semiconductor measurement solutions on the back of allegiance of semiconductor companies to develop chips on next-generation process technologies.

Moreover, growing clout of company’s innovative PathWave Test 2020 software holds promise. Further, adoption of latest support solutions, including Keysight Care, is expected to lead to gross margin expansion in the days ahead.

Rise in demand for solutions that support electrification of vehicles and advancements in defense is expected to favor growth prospects. Moreover, estimated higher spending on aerospace and defense in 2020 bodes well in this regard. Per the U.S. Department of Defense’s (DoD) fiscal 2021 budget proposal sent to Congress on Feb 10, the Trump administration’s fiscal 2021 defense budget request stands at $740.5 billion. Notably, the 2020 defense budget stands at $738.0 billion. This marks an increase of around $20 billion from the last year.

Nevertheless, the coronavirus outbreak in China is likely to impede Keysight’s near-term growth prospects, as the company is exposed to the demand environment in the country.

Zacks Rank & Stocks to Consider

Keysight currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Inphi Corporation IPHI, Microchip Technology Incorporated MCHP and Model N, Inc. MODN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Inphi, Microchip and Model N is currently pegged at 38.74%, 13.28% and 13%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.