Is Kimberly-Clark Corporation a Buy?

Paper towels and toilet paper aren't exactly the most exciting products, but that doesn't mean they aren't good businesses. Kimberly-Clark (NYSE: KMB), whose bread and butter is paper products and diapers, is one of the most stable companies on the market, and pays investors a solid dividend.

But for the stock to be a buy, Kimberly-Clark doesn't just have to be stable -- it has to be priced right as well. Here's a look at whether this stable stock is priced right to be a buy today.

Image source: Getty Images.

A business in decline

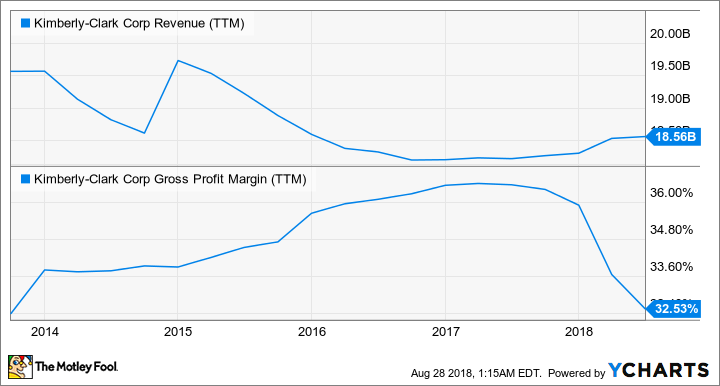

There are two big reasons to be leery of Kimberly-Clark's stock today, and they're both in the chart below. Revenue is stagnant at best and falling long-term at worst, while gross margins are dropping at a rapid rate. Neither is good news, and the pressures on the company's finances don't seem to be subsiding.

KMB Revenue (TTM) data by YCharts

Competition is the first reason sales are struggling even in a good economic environment. Commodity consumer staples like toilet paper and tissues are highly price-competitive, as there's very little that differentiates one company from another. Then there are upstarts like Babyganics, acquired in 2016 by SC Johnson, that are coming after traditionally safe markets like baby diapers. There's little room for volume or price growth under those conditions.

Another big challenge is that raw material costs are rising because economic demand is so strong. Unless we go into another recession soon, there's no reason to think that commodity prices won't remain elevated, putting pressure on margins long-term.

Growth is hard to come by

Consumer goods companies like Kimberly-Clark used to find growth by acquiring and developing products in adjacent markets. The company may have started with toilet paper, but it's since expanded to paper towels and other paper products. The Huggies maker started producing Pull-Ups and Little Swimmers, both market expansions building on existing manufacturing expertise and distribution. There are fewer of these product expansions available than there were in past decades, reducing growth opportunities.

Geographic expansion is getting harder as well. Kimberly-Clark's products are no longer new in markets like South America and Africa, so the company can't grow by simply building sales offices in those regions. If there aren't more markets to address and the ones you are in are getting more competitive, both top and bottom line growth will inevitably suffer.

Where's the value?

Slow growth doesn't have to be a reason not to own a stock, as long as the stock has some sort of value for investors -- but it's hard to see that value with Kimberly-Clark. Shares are trading at over 23 times trailing earnings, and the dividend yield of 3.4% is decent, but not outstanding for a low growth stock.

KMB PE Ratio (TTM) data by YCharts

Add up weakening financials, slow growth, and a high valuation and I don't think Kimberly-Clark is a good buy today. If the stock were half the price it's at today I would reconsider, and I certainly wouldn't short such a stalwart stock; but for now I see value in other places.

More From The Motley Fool

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.