Kimberly-Clark (KMB) Q3 Earnings Miss Mark, Sales Rise Y/Y

Kimberly-Clark Corporation KMB reported third-quarter 2022 results, with the bottom line declining year over year and missing the Zacks Consensus Estimate. Nevertheless, the top line increased and beat the consensus mark. The company generated organic sales growth across all segments. Management reiterated its 2022 organic sales, net sales and earnings.

Quarter in Detail

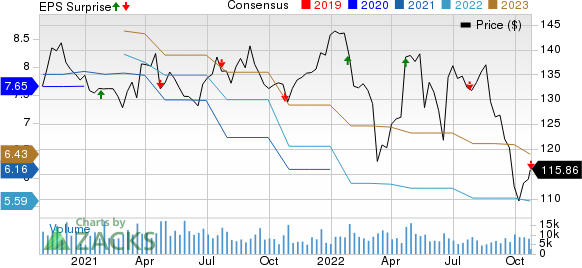

Adjusted earnings came in at $1.40 per share, missing the Zacks Consensus Estimate of $1.48. The bottom line declined 14% from $1.62 per share in the year-ago quarter.

Kimberly-Clark’s sales came in at $5,053 million, beating the Zacks Consensus Estimate of $4,985.1 million. The metric inched up 1% year over year. Unfavorable foreign currency rates affected sales by 4%. Organic sales rose 5%, with net selling prices rising 9% and product mix increasing sales by 1%. However, volumes declined 5%.

In North America, organic sales of consumer products fell 2% year over year, while the same increased 5% in the K-C Professional segment. Outside North America, organic sales went up 11% in the developing and emerging (D&E) markets as well as developed markets.

KimberlyClark Corporation Price, Consensus and EPS Surprise

KimberlyClark Corporation Price-Consensus-Eps-Surprise-Chart | KimberlyClark Corporation Quote

Operating profit came in at $655 million, down from $657 million reported in the year-ago quarter. Kimberly-Clark reported an adjusted operating profit of $745 million in the third quarter of 2022.

The operating profit declined due to a rise in input costs to the tune of $360 million. Reduced volumes, escalated marketing, research and general expenses and unfavorable foreign currency also affected the operating profit. These were somewhat offset by increased net selling prices and cost savings of $80 million from the FORCE (Focused on Reducing Costs Everywhere) program.

Segment Details

Personal Care: Sales of $2,628 million inched down 1% year over year. Net selling prices increased 8%, product mix increased 1% and volume declined 7%. Unfavorable foreign currency rates hurt sales 4%, while the acquisition of the controlling interest in Thinx contributed 1 point to sales. Sales fell 5% in North America but increased 5% in D&E markets. The metric dropped 4% across developed markets outside North America, including Australia, South Korea and Western/Central Europe.

Consumer Tissue: Segment sales of $1,578 million rose 2% year over year. Net selling prices improved sales 9% and volumes fell nearly 3%. Unfavorable currency rates reduced sales 4%. Sales rose 5% in North America, while the metric increased 3% in D&E markets. The metric fell 2% across developed markets outside North America.

K-C Professional (KCP): Segment sales gained 5% to $836 million. Net selling prices increased almost 14%, while the product mix benefited sales by 1 point. Volumes hurt sales by 5% in the segment. Changes in currency rates hurt sales 4%. Sales grew 5% in North America, while the same increased 7% in the D&E markets. The metric grew 5% in the developed markets outside North America.

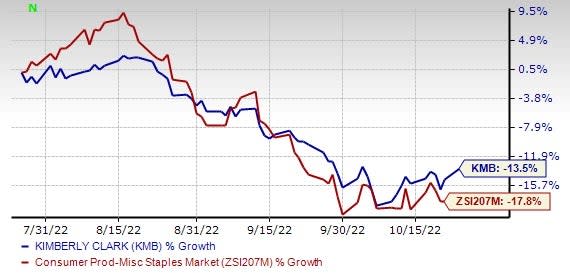

Image Source: Zacks Investment Research

Other Financial Updates

The currently Zacks Rank #3 (Hold) player ended the quarter with cash and cash equivalents of $362 million, long-term debt of $7,62 million and total stockholders’ equity of $583 million. Kimberly-Clark generated cash from operating activities of $798 million during the three months ended Sep 30, 2022. Management incurred capital expenditures of $209 million in the quarter under review. The company expects capital spending of $0.9 to $1.0 billion in 2022.

Kimberly-Clark repurchased 192,000 million shares for $25 million in the reported quarter.

2022 Outlook

Net sales in 2022 are still expected to grow 2-4% from the year-ago reported figure, while organic sales are anticipated to increase 5-7%. Unfavorable foreign currency exchange rates are likely to hurt net sales 3-4%.

Management now expects adjusted operating profit to be down mid-to-high-single digit percent. Earlier, management had expected the metric to be down mid-single digit percent. Kimberly-Clark still envisions 2022 earnings per share (EPS) in the lower end of the $5.60-$6.00 range.

The stock has dropped 13.5% in the past three months compared with the industry’s 17.8% decline.

Some Solid Food Bets

Some better-ranked stocks are Lancaster Colony LANC, TreeHouse Foods THS and The J. M. Smucker SJM.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently sports a Zacks Rank of 1 (Strong Buy). LANC delivered an earnings surprise of 170% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lancaster Colony’s current financial year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

TreeHouse Foods, which manufactures and distributes private-label foods and beverages, sports a Zacks Rank #1 at present. TreeHouse Foods has a trailing four-quarter earnings surprise of 45.2%, on average.

The Zacks Consensus Estimate for THS’ current financial-year sales and EPS suggests growth of 16.8% and 15.1%, respectively, from the year-ago reported numbers.

J. M. Smucker, which manufactures and markets branded food and beverage products, carries a Zacks Rank #2 (Buy). J. M. Smucker delivered a trailing four-quarter earnings surprise of 20.8%, on average.

The Zacks Consensus Estimate for SJM’s current financial year sales suggests growth of 4.4% from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KimberlyClark Corporation (KMB) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research