Kimberly-Clark (KMB) on Track With Saving Efforts Amid Cost Woes

Kimberly-Clark Corporation KMB has been focused on its three growth pillars as well as the K-C Strategy 2022. These, along with saving endeavors are likely to keep aiding the company, which is battling elevated costs and soft Consumer Tissue volumes. We note that on its last earnings call, Kimberly-Clark lowered the 2021 outlook due to a tough near-term environment, including input cost inflation as well as the pandemic-related demand volatility.

Net sales in 2021 are now expected to grow 1-4% year over year compared with the 3-5% increase expected earlier. Organic sales growth is now expected to be flat to 2% down compared with flat to 1% up forecasted before. The company now envisions the 2021 adjusted earnings per share of $6.65-$6.90, down from the previous expectation of $7.30-$7.55. That said, Kimberly-Clark raised its 2021 savings target. It now expects a total cost savings of $520-$560 million in 2021, including $400-$420 million from the Focus on Reducing Costs Everywhere (or FORCE) Program, and $120-$140 million from the 2018 Global Restructuring Program. Earlier, Kimberly-Clark had projected total savings of $460-$520 million.

Factors Hurting Kimberly-Clark

The company has been encountering high input costs and escalated other manufacturing expenses for the past few quarters. The trend prevailed in the second quarter of 2021, wherein the adjusted operating profit of $676 million fell from $1,012 million in the year-ago period. This was accountable to a rise in input costs (to the tune of $345 million) as well as reduced sales volumes. Increased pulp, other materials and distribution costs led to a rise in the input costs. Also, a rise in other manufacturing costs like inefficiencies from lower production volumes caused the downside. The key input costs for 2021 are now estimated to flare up $1,200-$1,300 million compared with the $900-$1,050 million projected before. The updated input cost guidance is attributable to higher polymer-based materials and pulp costs.

Moving on, the company’s organic sales in second-quarter 2021 declined year over year, largely affected by soft consumer tissue volumes in North America. Consumer tissue volumes are declining from the record jump in the year-ago period, with retailers and consumers in North America curtailing inventory and at-home stocking. During the second quarter, the Consumer Tissue segment sales of $1,424 million fell 13% year over year, including a nearly 3% positive impact from currency rates. Volumes fell 15% due to lower shipments in North America, which, in turn, stemmed from category softness with retailers curtailing inventory and consumers cutting down at-home consumption and pantry loading. The persistence of this trend remains a concern.

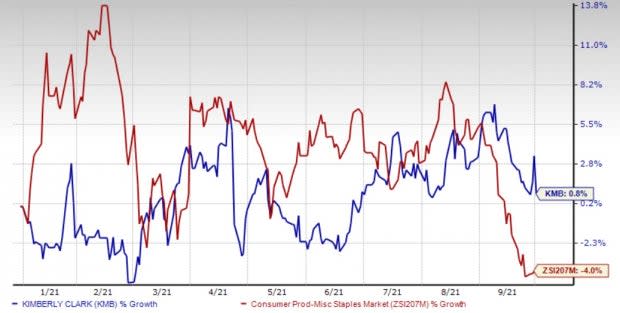

Image Source: Zacks Investment Research

The Brighter Side

Kimberly-Clark has been committed toward its three key strategic growth pillars. These include focus on improving its core business in the developed markets; accelerate growth of the Personal Care segment in the developing and emerging markets, and enhance the digital and e-commerce capacities. The company expects to meet these objectives through product development across different categories, and leveraging capabilities in marketing and sales. The company has been progressing well with these objectives, which have been aiding the portfolio and expanding its global business. Notably, Kimberly-Clark recently completed the acquisition of Softex Indonesia — a leading player in the Indonesian personal care market. Management expects the Softex Indonesia acquisition to boost the overall sales by 2% in 2021.

Additionally, the company has been taking robust steps to lower costs. This is highlighted by the 2018 Global Restructuring Program as well as the Focus on Reducing Costs Everywhere or the FORCE Program. The 2018 Global Restructuring Program is focused on lowering the company’s structural costs and improving financial flexibility. Management anticipates annual pre-tax cost savings of $540-$560 million from this program by 2021-end. Apart from this, Kimberly-Clark is aggressively cutting costs and enhancing supply-chain productivity through its FORCE Program. During the second quarter, the company generated cost savings of $115 million and $30 million from the FORCE Program and the 2018 Global Restructuring Program, respectively. These, together with higher net selling prices, offered respite to the company’s adjusted operating profit that was otherwise battered by elevated input costs.

While input costs are expected to shoot up in 2021, management, on its second-quarter earnings call, stated that is focused on undertaking relevant pricing actions to counter inflation and efficiently manage costs. The company also said that it intends to remain committed to its K-C Strategy 2022, which is focused on generating balanced and sustainable growth to return value to shareholders in a tough environment. The program concentrates on strengthening the company’s brand portfolio, undertaking efficient capital allocation and executing robust cost discipline.

Shares of the Zacks Rank #3 (Hold) company have gained 0.8% year to date against the industry’s decline of 4%.

3 Solid Consumer Staple Stocks

Darling Ingredients DAR, sporting a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 39.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sysco Corporation SYY, with a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 13.3%, on average.

Medifast, Inc. MED, currently carrying a Zacks Rank #2, has a trailing four-quarter earnings surprise of around 16%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KimberlyClark Corporation (KMB) : Free Stock Analysis Report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research