Is Kimberly-Clark's Pullback an Opportunity to Buy?

- By Nicholas Kitonyi

Shares of household and personal products company Kimberly-Clark Corp. (NYSE:KMB) are down nearly 7% since reporting its most recent quarterly results. The company announced fiscal third-quarter earnings results before the opening bell on Thursday.

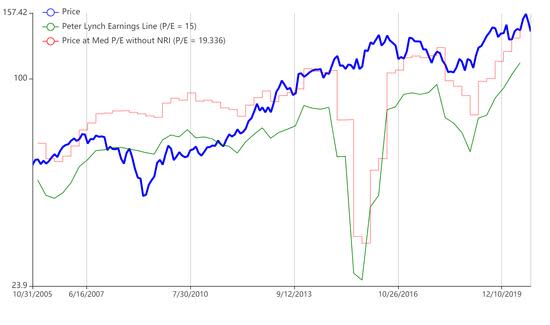

Shares of the company are now down more than 10% since last week. The year-to-date gain of just 1.63% is also lower than the S&P 500's return of 6.3%. This could imply that there is an opportunity to buy. However, when you look at the company's Peter Lynch earnings line, Kimberly-Clark still looks overvalued.

Highlights from recent quarterly results

For the most recent quarter, Kimberly-Clark posted adjusted earnings of $1.72 per share on revenue of $4.68 billion. Analysts polled by FactSet were expecting an average bottom line of $1.76 per share on $4.60 billion in sales.

Despite what looks like a disappointing quarter, Kimberly-Clark CEO Mike Hsu said that the company expects to post improved earnings per share in the range of $7.50 to $7.65 for fiscal 2020. This is a slight upward revision from the previous guidance of $7.40 to $7.60 per share, but is still below the consensus FactSet guidance of $7.71. The company's (median) guidance on the top line of about 2.5% growth is slightly better than the consensus Factset of 2.3%.

Looking ahead, the company said it expects to incur charges in the range of $1.7 billion to $1.9 billion when the ongoing restructuring process is completed at the end of fiscal year 2021, which could affect earnings growth. Kimberly-Clark expects the process to yield annual pre-tax benefits in the range of $500 million to $550 million.

Valuation

Kimberly-Clark appears to face some performance bottlenecks that could put a ceiling on its upside potential in the short term. The company's stock trades at a trailing 12-month price-earnings ratio of about 20.04, which is relatively better than the price-earnings ratios of close industry peers.

For reference, global conglomerate Proctor & Gamble Co. (NYSE:PG) trades with a price-earnings ratio of 27.05, while Johnson & Johnson's (NYSE:JNJ) equivalent is 22.81. On the other hand, 3M Co. (NYSE:MMM) trades with a slightly better price-earnings ratio of 19.38.

Kimberly-Clark's forward price-earnings ratio of 17.70 is only surpassed by Johnson & Johnson, which trades at 16.05. On the other hand, Procter & Gamble and 3M are priced at 26.45 and 18.15 times forward earnings.

In summary, Kimberly-Clark looks to be optimally valued compared to close industry peers. There is nothing much in terms of differences in price-earnings ratios, which means that the short-term upside potential could be limited.

However, with the company averaging a dividend yield of about 3.10% over the last five years, an increase in the dividend paid could boost the stock heading into the tail end of the year.

Disclosure: No positions in the stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.