Kirkland's (KIRK) Q2 Earnings: Can Comps Pare Cost Woes?

Kirkland's, Inc KIRK is slated to report second-quarter fiscal 2018 results on Aug 30, before the market opens. This retailer of home decor products has a mixed history of bottom-line surprises in the trailing four quarters. We note that the company’s top line has been gaining from efforts to enhance merchandise assortments, develop e-commerce business and increase store count. On the flip side, higher store occupancy and freight costs have been a drag. With these aspects in mind, let’s delve into how things are shaping up for the upcoming quarterly results.

Efforts to Boost Sales

Kirkland's top line has been rising year over year for ten straight quarters now. Notably, the company has been making several investments for improving merchandise assortments and lowering inventory levels. Moreover, management is impressed with its SKU rationalization plans. Also, the fall in SKU count has enhanced in-stock levels along with increasing clarity of presentations on the sales floor.

Moreover, solid e-commerce business has been aiding comps growth, which in turn has been supporting top-line performance. To sustain online sales growth, the company undertakes initiatives such as expanding third-party partnerships, improving ‘buy online pick up in store’ capability and refining fulfillment processes to increase the profitability of the Ship to Home business. Additionally, the company has redesigned and leveraged the rollout of new information systems to improve online purchase and planning execution.

Kirkland’s has also been strategically expanding its store base, by closing smaller underperforming stores and opening bigger off-mall stores at popular locations that are likely to boost sales. During the first quarter, Kirkland’s introduced 10 stores while shutting three. In fiscal 2018, management intends to open 10-15 stores, with nearly half in the second and the third quarters, each.

We expect such well-spun sales-driving efforts to continue bolstering Kirkland’s comps, which have been rising for more than a year now. We note that comps on a comparable 13-week basis increased 1.4% in the first quarter, backed by solid e-commerce sales that surged 39%. Prior to this, comps increased 2%, 0.7%, 1.2% during the fourth, the third and the second quarters of fiscal 2017, respectively. This indicates that the company’s efforts to drive sales have been yielding and generating positive response from consumers toward its product assortments.

Well, management is committed toward making efforts to attract more customers — online and in stores — and thereby sustain the robust top-line performance. Incidentally, the Zacks Consensus Estimate for sales of $139 million for the impending quarter reflects an improvement of almost 5.4% from the year-ago quarter’s reported figure.

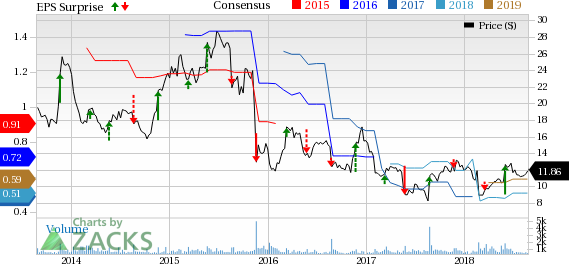

Kirkland's, Inc. Price, Consensus and EPS Surprise

Kirkland's, Inc. Price, Consensus and EPS Surprise | Kirkland's, Inc. Quote

Escalated Costs Likely to Hurt the Bottom Line

While the sales picture looks positive for Kirkland’s, we are somewhat cautious about bottom-line performance in the to-be-reported quarter. The company has been incurring higher store occupancy costs for a while now. In fact, during the first quarter, store occupancy expenses rose 15 basis points (bps) as a percentage of sales. Also, the company witnessed a 65 bps increase in outbound freight costs (including e-commerce shipping) as a percentage of sales. Inbound freight costs and central distribution expenses also soared in the first quarter. Additionally, higher cost of sales has been dampening gross margin performance for a while.

We believe that persistence of such headwinds is likely to dent the company’s profits in the to-be-reported quarter. To top it, the Zacks Consensus Estimate for the first quarter is currently pegged at a loss of 34 cents, wider than the prior-year quarter’s loss of 24 cents. This estimate has been stable over the past 30 days.

What does the Zacks Model Unveil?

Our proven model does not show that Kirkland’s is likely to beat estimates this quarter. This is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Kirkland’s carries a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With Favorable Combinations

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Urban Outfitters, Inc. URBN has an Earnings ESP of +1.66% and a Zacks Rank #2.

Abercrombie & Fitch Company ANF has an Earnings ESP of +62.50% and a Zacks Rank #3.

Dollar General Corporation DG has an Earnings ESP of +0.90% and a Zacks Rank #3.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Kirkland's, Inc. (KIRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.