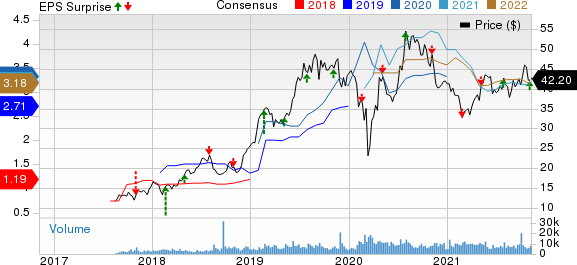

Kirkland Lake Gold (KL) Earnings and Sales Top Estimates in Q3

Kirkland Lake Gold Ltd. KL reported net earnings of $254.9 million or 96 cents per share in third-quarter 2021 compared with $202 million or 73 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 91 cents that topped the Zacks Consensus Estimate of 81 cents.

The company recorded revenues of $667 million, up 5.4% year over year. The figure surpassed the Zacks Consensus Estimate of $619.2.

Kirkland Lake Gold Ltd. Price, Consensus and EPS Surprise

Kirkland Lake Gold Ltd. price-consensus-eps-surprise-chart | Kirkland Lake Gold Ltd. Quote

Operational Highlights

Total gold production was 370,101 ounces in the quarter, up 9% year over year. Average realized price of gold was $1,791 per ounce, down 6.1% year over year.

Operating cash costs per ounce for gold rose 7.8% year over year to $438. All-in sustaining costs (AISC) for gold fell 16% year over year to $740 per ounce in the quarter.

Financial Position

At the end of the third quarter, Kirkland Lake Gold had cash and cash equivalents of $822.4 million compared with $858.4 million as of Jun 30, 2021.

Net cash provided by operating activities declined 25% year over year to $323 million in the quarter.

Guidance

For 2021, the company expects total gold production between 1,300,000 ounces and 1,400,000 ounces. AISC for gold is expected between $790 and $810 per ounce for 2021. Operating cash costs per ounce sold is projected in the range of $450-$475.

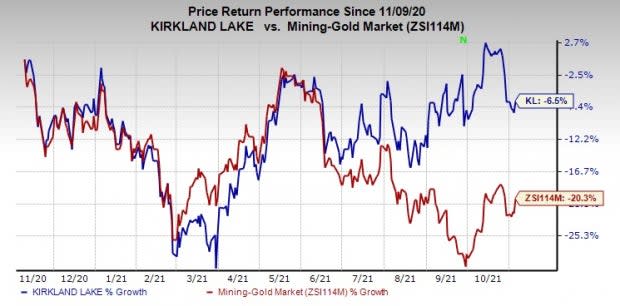

Price Performance

Shares of Kirkland Lake Gold have declined 6.5% in the past year against a 20.3% fall of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Kirkland Lake Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Olin Corporation OLN.

Nucor has a projected earnings growth rate of around 583.5% for the current year. The company’s shares have soared 121% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.9% for the current year. The company’s shares have gained 47.1% in the past year. It currently carries a Zacks Rank #2 (Buy).

Olin has an expected earnings growth rate of around 740% for the current year. The stock has surged 204.8% in the past year. It currently flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research