All You Need To Know About SINA Corporation’s (NASDAQ:SINA) Financial Health

Stocks with market capitalization between $2B and $10B, such as SINA Corporation (NASDAQ:SINA) with a size of $7.46B, do not attract as much attention from the investing community as do the small-caps and large-caps. Surprisingly though, when accounted for risk, mid-caps have delivered better returns compared to the two other categories of stocks. Mid-caps are found to be more volatile than the large-caps but safer than small-caps, largely due to their weaker balance sheet. I recommend you look at the following hurdles to assess SINA’s financial health. View our latest analysis for SINA

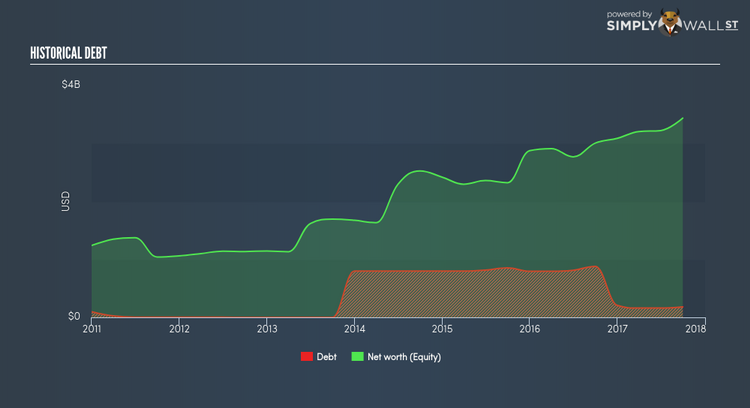

Does SINA face the risk of succumbing to its debt-load?

While ideally the debt-to equity ratio of a financially healthy company should be less than 40%, several factors such as industry life-cycle and economic conditions can result in a company raising a significant amount of debt. In the case of SINA, the debt-to-equity ratio is 5.28%, which indicates that the company faces low risk associated with debt.

Can SINA pay its short-term liabilities?

Another important aspect of financial health is liquidity: the company’s ability to meet short-term obligations, including payments to suppliers and employees. If an adverse event occurs, the company may be forced to pay these immediate expenses with its liquid assets. We need to assess SINA’s cash and other liquid assets against its upcoming expenses. Our analysis shows that SINA does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

Next Steps:

Are you a shareholder? SINA’s high cash coverage and low levels of debt indicate its ability to use its borrowings efficiently in order to produce a healthy cash flow. Since SINA’s financial position may change, I suggest exploring market expectations for SINA’s future growth on our free analysis platform.

Are you a potential investor? Although investors should analyse the serviceability of debt, it shouldn’t be viewed in isolation of other factors. Ultimately, debt financing is an important source of funding for companies seeking to grow through new projects and investments. SINA’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.