Kodiak Sciences (KOD) Q4 Loss Widens, Eye Candidate in Focus

Kodiak Sciences Inc. KOD reported a fourth-quarter 2021 loss per share of $1.79, much wider than the Zacks Consensus Estimate of a loss of $1.29. The company reported a loss of 97 cents per share in the year-ago quarter.

Kodiak Sciences currently does not have any approved product in its portfolio. As a result, the company is yet to generate revenues.

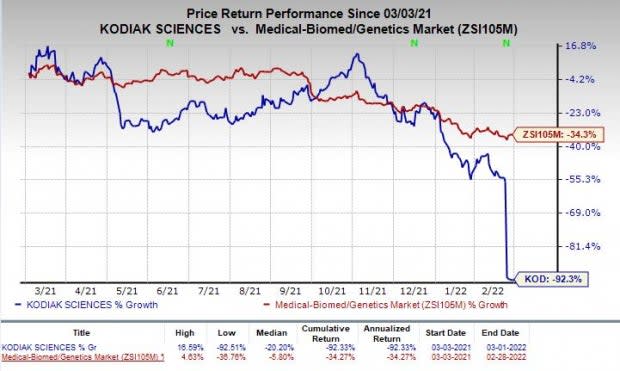

Shares of Kodiak Sciences were down 8.4% in after-hours trading on Tuesday, following the announcement of the earnings results. The stock has plunged 92.3% in the past year compared with the industry’s decline of 34.3%.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development expenses were $75.6 million in the quarter, significantly up from $37.4 million reported in the year-ago period. The increase was driven by higher clinical activities related to KSI-301.

General and administrative expenses were $17.4 million, up 83.1% on a year-over-year basis, driven by higher headcount and stock-based compensation expenses.

As of Dec 31, 2021, Kodiak Sciences had cash worth $731.5 million compared with $799.2 million as of Sep 30, 2021.

Pipeline Updates

In the absence of an approved product in Kodiak Sciences’ portfolio, its pipeline development remains the primary focus, especially its lead eye disease candidate, KSI-301, which is being developed for treating various retinal vascular diseases.

In February 2022, Kodiak Sciences announced top-line data from the phase IIb/III study evaluating the safety, efficacy and durability of KSI-301 for treating wet age-related macular degeneration (wet AMD). The study failed to meet the primary efficacy end-point of showing non-inferior visual acuity gains in subjects dosed on extended regimens versus Eylea (aflibercept) administered every eight weeks. Shares of Kodiak Sciences plunged heavily on the news.

Notably, Eylea is an anti-VEGF treatment developed by Regeneron REGN in collaboration with Bayer’s BAYRY HealthCare unit.

Regeneron/Bayer’s Eylea has been approved by the FDA for multiple retinal indications, including DME, wet AMD and RVO.

While Regeneron records net product sales of Eylea in the United States, Bayer records net product sales of Eylea outside the country.

Enrollment is currently ongoing in the phase III study — DAYLIGHT — a short-interval study evaluating the safety and efficacy of high-frequency KSI-301 in patients with treatment-naïve wet AMD. Enrollment in the study is expected to be completed in the first half of 2022.

In February 2022, Kodiak Sciences completed the enrolment of more than 900 patients with diabetic macular edema ("DME") in two phase III studies — GLEAM and GLIMMER — on KSI-301.

The GLEAM and GLIMMER studies are designed to evaluate the durability, efficacy and safety of KSI-301 in treatment-naïve patients with DME.

The phase III BEACON study is also evaluating KSI-301 to address macular edema due to retinal vein occlusion (RVO). The top-line data from the same is expected in the third quarter of 2022.

Kodiak Sciences is also evaluating KSI-301 in the pivotal phase III GLOW study for treating patients with non-proliferative diabetic retinopathy without DME.

The company remains on course to file a single biologics license application for KSI-301 to treat wet AMD, DME and RVO.

Kodiak Sciences Inc. Price, Consensus and EPS Surprise

Kodiak Sciences Inc. price-consensus-eps-surprise-chart | Kodiak Sciences Inc. Quote

Zacks Rank & Stock to Consider

Kodiak Sciences currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is Vertex Pharmaceuticals Incorporated VRTX, which has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vertex’s earnings estimates have been revised 7.6% upward for 2022 over the past 60 days. The VRTX stock has gained 10.6% in the past year.

Vertex’s earnings have surpassed estimates in each of the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Kodiak Sciences Inc. (KOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research