Kratos Defense (KTOS) Q4 Earnings Top Estimates, Revenues Rise

Shares of Kratos Defense & Security Solutions, Inc. KTOS have declined 7.8% to $15.04 since the company released its fourth-quarter 2021 results on Feb 23.

Kratos Defense reported fourth-quarter 2021 adjusted earnings of 11 cents per share, which beat the Zacks Consensus Estimate by 22.2%. The bottom line also improved 37.5% from 8 cents per share reported in the prior-year quarter.

Kratos Defense reported a GAAP loss of 2 cents per share against earnings of 62 cents reported in the prior-year quarter.

The company reported earnings per share (EPS) of 36 cents for full-year 2021, which increased 9.1% from 33 cents reported in 2020.

Total Revenues

Total revenues were $211.6 million, which beat the Zacks Consensus Estimate of $209 million by 1.4%. Total revenues increased 2.5% from $206.4 million in the year-ago quarter. The increase was primarily due to higher revenues generated from the Unmanned Systems, Space, Satellite and Cyber, Microwave Products and Turbine Technologies businesses.

In 2021, KTOS generated revenues worth $811.5 million, up 8.5% from the year-ago figure of $747.7 million.

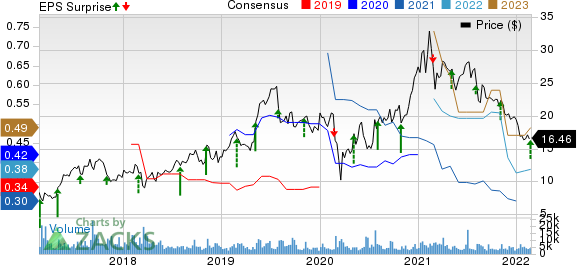

Kratos Defense & Security Solutions, Inc. Price, Consensus and EPS Surprise

Kratos Defense & Security Solutions, Inc. price-consensus-eps-surprise-chart | Kratos Defense & Security Solutions, Inc. Quote

Operational Update

Kratos Defense’s operating expenses were $52.3 million in the reported quarter compared with $45.3 million in the prior-year quarter. SG&A expenses were up 13.6%, while research and development expenses increased 18.4% year over year. Meanwhile, depreciation expenses rose 85.7%, whereas expenses regarding acquisitions and restructuring-related items increased a solid 150%.

The company reported fourth-quarter 2021 operating income of $9.2 million, which increased 2.2% from the year-ago quarter.

The company’s book-to-bill ratio for the fourth quarter of 2021 was 1.5 to 1.0, with bookings of $840 million for the same period.

The total backlog for Kratos Defense at the end of the fourth quarter of 2021 was $953.9 million, up from $839.1 million at the end of the third quarter of 2021 and $922.2 million at the end of the fourth quarter of 2020.

Segmental Performance

Unmanned Systems: Net revenues during the fourth quarter increased 9.9% year over year to $54.4 million.

Government Solutions: Net revenues in the fourth quarter increased 0.2% year over year to $157.2 million, reflecting organic growth in the company’s Space, Satellite and Cyber, Microwave Products and Turbine Technologies businesses.

Financial Details

As of Dec 26, 2021, cash and cash equivalents were $349.4 million compared with $380.8 million as of Dec 27, 2020.

Long-term debt, including net of the current portion, totaled $296.7 million as of Dec 26, 2021, slightly down from $301 million as of Dec 27, 2020.

In 2021, cash generated from operating activities was $35.3 million compared with $44.7 million in the prior year.

Guidance

For the first quarter of 2022, KTOS expects to generate revenues in the range of $190-$200 million. The Zacks Consensus Estimate for first-quarter revenues is pegged at $190 million, which meets the lower end of the company’s projected range.

For 2022, the company expects revenues in the range of $880-$920 million. The Zacks Consensus Estimate for full-year revenues stands at $881.3 million, which lies near the lower end of the company’s projected range.

Zacks Rank

Kratos Defense currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Hexcel Corporation HXL reported fourth-quarter 2021 adjusted earnings of 16 cents per share, which exceeded the Zacks Consensus Estimate of 12 cents by 33.3%. The bottom line also improved from a loss of 18 cents per share incurred in the year-ago quarter.

The Zacks Consensus Estimate for Hexcel’s 2022 earnings suggests an improvement of a solid 359.3% from the prior-year figure. For HXL’s 2022 sales, the Zacks Consensus Estimate indicates growth of 17.5% from the prior-year figure.

Huntington Ingalls Industries, Inc.’s HII fourth-quarter 2021 adjusted earnings of $2.84 per share declined 34.7% from $4.35 reported in the prior-year quarter. Total revenues came in at $2,677 million, lagging the Zacks Consensus Estimate of $2,738.4 million by 2.2%.

The Zacks Consensus Estimate for Huntington Ingalls’s 2022 earnings suggests a decline of 8.4% from the prior-year figure. For HII’s 2022 sales, the Zacks Consensus Estimate suggests growth of 11.3% from the prior-year figure.

Raytheon Technologies Corporation’s RTX fourth-quarter 2021 adjusted EPS of $1.08 beat the Zacks Consensus Estimate of $1.01 by 6.9%. Moreover, the bottom line improved 46% from the year-ago quarter’s adjusted earnings of 74 cents.

The Zacks Consensus Estimate for Raytheon’s 2022 earnings suggests an improvement of 14.4% from the prior-year figure. For RTX’s 2022 sales, the Zacks Consensus Estimate indicates growth of 5.5% from the prior-year figure. Raytheon boasts a long-term earnings growth rate of 10.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research