Kyle Bass: 'Global markets are at the beginning of a tectonic shift'

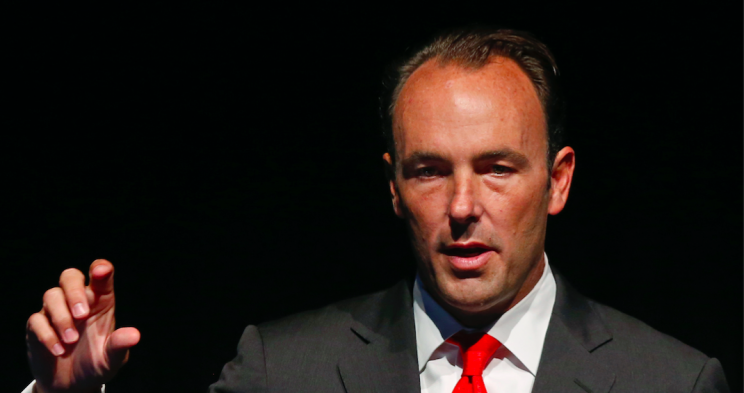

Texan hedge fund manager J. Kyle Bass, the founder of Hayman Capital, says that global markets are at the “beginning of a tectonic shift.”

“Today, global markets are at the beginning of a tectonic shift from deflationary expectations to reflationary expectations. What happens to economies at maximum leverage when interest rates begin to rise? Reconciling the potent strengths of the world’s largest economies with their inherent weaknesses has revealed various investable anomalies. The enormity of the apparent disequilibrium is breathtaking, making today a tremendous time to invest,” Bass wrote in a year-end letter to investors seen by Yahoo Finance.

He added: “One opportunity in particular has the greatest risk-reward profile we have ever encountered in our decade of being a fiduciary.”

He didn’t provide specifics about the opportunity in the letter.

On Tuesday, Hayman launched its third Asia-focused fund, which is “designed to provide investors with nuanced access to perhaps one of the largest imbalances in financial markets history.”

The first Asia-focused fund was the Japan Macro Opportunities Fund, which returned capital to investors after the Japanese yen depreciated 40% from 2012 to 2015. The second Asia-focused fund was the Hayman China Opportunities Fund, which launched in July.

Bass had a knockout 2016, with Hayman Capital’s Master Fund finishing the year with an estimated net-performance of 24.83%, according to the letter. This compares to the S&P 500, which was up a modest 9%.

Meanwhile, the average macro hedge fund returned 0.28% through the end of November, according to HFR. Since Hayman’s inception in 2006, the fund has returned 436.75% and an annualized return of 16.7%.

2016 got off to a rough start for many investors. At the time, Bass returned to his core competency — global macro investing. In the letter, he noted that he expects the next few years to be the best years for macro since the late 1990s.

“We reorganized our portfolio to invest in the macro themes that began to reveal themselves early in the year. Exploiting our reflationary view, we invested in global interest rate markets, currencies, and commodities across the world,” he wrote in the letter.

A number of macro fund managers have voiced concerns about central banks distorting markets with extraordinary monetary policy. This had made macro investing particularly challenging.

“Over the past several years, economic gravity has been pulling one way and central banks have been using aggressive monetary policy to pull the other. Investing in macro, while this phenomenon has existed, has been difficult to say the least,” Bass wrote, adding, “From here-on, we expect to encounter significant changes in global fiscal policies along with a continuation of the upward movement of general price levels for consumers and producers alike.”

Bass has been making a huge bet against China’s “recklessly built” banking system. Back in February, Bass unveiled his case in an investor letter entitled “The $34 Trillion Experiment: China’s Banking System and the World’s Largest Macro Imbalance.”

Bass, who gained notoriety for correctly betting against the US subprime crisis, wrote at the time that similar to the US banking system, China’s banking system has “increasingly pursued excess leverage, regulatory arbitrage, and irresponsible risk taking.” He believes that the Chinese banking system losses will be gargantuan.

Julia La Roche is a finance reporter at Yahoo Finance.

Read more: