LabCorp (LH) Q1 Earnings Surpass Estimates, Revenues Miss

Laboratory Corporation of America Holdings LH or LabCorp reported first-quarter 2022 adjusted earnings per share (EPS) of $6.11, registering a 30.5% fall from the year-ago quarter figure of $8.79. The adjusted figure excludes the impact of adjustments to operating income and loss from venture fund investments, among others. The bottom line surpassed the Zacks Consensus Estimate by 3.9%.

On a GAAP basis, net earnings for the first quarter were $5.23 per share, down 33.1% year over year.

Revenues

Revenues in the quarter under review fell 6.3% year over year to $3.89 billion. It missed the Zacks Consensus Estimate by 3.5%.

The decline in revenues can be attributed to a 6.3% fall in organic revenues and a 0.4% negative impact from foreign currency translation. However, this decline was partially offset by 0.4% growth from acquisitions net of divestitures. The decline in organic revenues comprises a 9.8% fall in contribution from COVID-19 Testing. However, this decrease in COVID-19 Testing was partially offset by a 3.5% rise in the company's organic Base Business (business operation excluding the company’s PCR and antibody COVID-19 testing).

Segments in Detail

LabCorp reports results under two operating segments — LabCorp Diagnostics and Covance Drug Development.

In the first quarter, LabCorp Diagnostics reported revenues of $2.45 billion, reflecting an 11% fall year over year. On an organic basis, revenues were down 11.5%, partially offset by acquisitions of 0.5%. This decline in organic revenues resulted from a 14.7% fall in contribution from COVID-19 Testing, partially offset by a 3.2% rise in Base Business.

The company witnessed a 5% fall in total volume (measured by requisition) on a 5.3% decline in organic volume, partially offset by acquisition volume growth of 0.3%.Organic volume was primarily impacted by an 8.5% decrease in COVID-19 Testing, partially offset by a 3.1% rise in Base Business.

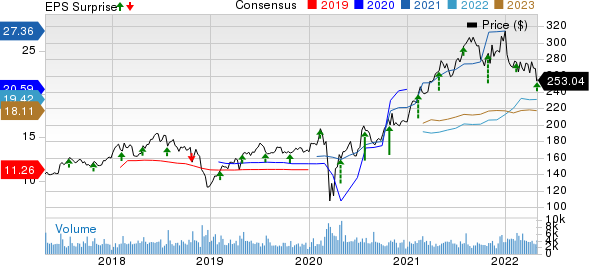

Laboratory Corporation of America Holdings Price, Consensus and EPS Surprise

Laboratory Corporation of America Holdings price-consensus-eps-surprise-chart | Laboratory Corporation of America Holdings Quote

Covance Drug Development revenues grew 1.5% to $1.45 billion in the first quarter on organic Base Business growth of 4.3% and a 0.1% growth of acquisitions net of divestitures. However, this organic growth was partially offset by a 1.7% decline in contribution from COVID-19 Testing performed through LabCorp’s Central Laboratories business and a 1.2% negative impact of foreign currency translation.

Margins

Gross margin contracted 681 basis points (bps) to 31.6% in the first quarter. Adjusted operating income declined 34.2% year over year to $768.8 million. Adjusted operating margin declined 838 bps from the year-ago quarter to 19.7%.

Cash Position

LabCorp exited the first quarter of 2022 with cash and cash equivalents of $1.23 billion compared with $1.47 billion at the end of 2021. Cumulative cash flow from operating activities at the end of the first quarter was $356 million, significantly down from $1.16 billion a year ago. Additionally, at the end of the quarter under review, cumulative free cash flow was $1.23 billion, down from $1.89 billion a year ago.

At the end of the first quarter of 2022, 0.6 million shares were retired under the company’s existing share repurchase program.

2022 View

The company has updated its 2022 guidance.

Total LabCorp Enterprise revenues are expected to decline in the range of 1.5-5.5% (compared to the previously projected range of 1.5-6.5%). This includes Base Business growth in the range of 8-10% (versus the previously projected range of 7.5-10.0%). Meanwhile, COVID-19 Testing revenues are expected to decline in the range of 60-70% (versus the earlier projected decline in the range of 60-75%).

Total Diagnostics revenues are expected to fall in the range of 11.5-15.5% (versus the earlier projected 11.5-17.5%). Total Drug Development revenues are expected to rise in the range of 6-8.5% (versus the earlier projected 7.0-9.5%).

The Zacks Consensus Estimate for full-year revenues is pegged at $15.43 billion.

The company expects full-year adjusted EPS in the band of $18.25-$21.00 (compared to the previous range of $17.25-$21.25). The Zacks Consensus Estimate for the metric is pinned at $19.42.

The company has maintained its projected free cash flow figure in the range of $1.7-$1.9 billion.

Our Take

LabCorp ended the first quarter of 2022 with better-than-expected earnings. Robust performance across the Covance Drug Development segment instills optimism. The continued growth in the company's organic Base Business also appears promising. Revenue contributions from acquisitions are an added upside.

However, LabCorp’s revenues for the first quarter lagged the Zacks Consensus Estimate. The significant year-over-year plunge in EPS is worrisome. Contraction of both margins does not bode well. The ongoing decline in COVID-19 Testing, higher personnel expense, and other macroeconomic headwinds continue to threaten business performance.

Zacks Rank and Key Picks

LabCorp currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are QIAGEN N.V. QGEN, UnitedHealth Group Incorporated UNH and Centene Corporation CNC.

QIAGEN, carrying a Zacks Rank #2 (Buy), reported first-quarter 2022 adjusted EPS of 80 cents, which beat the Zacks Consensus Estimate by 12.7%. Revenues of $628.4 million outpaced the consensus mark by 6.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

QIAGEN has an estimated long-term growth rate of 11.5%. QGEN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 11.7%.

UnitedHealth, having a Zacks Rank #2, reported first-quarter 2022 adjusted EPS of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 1.9%.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Centene reported first-quarter 2022 adjusted EPS of $1.83, which surpassed the Zacks Consensus Estimate by 8.9%. Revenues of $37.2 billion outpaced the Zacks Consensus Estimate by 7.2%. It currently has a Zacks Rank #2.

Centene has an estimated long-term growth rate of 14.2%. CNC has an earnings yield of 6.6% compared with the industry’s 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.