Lam Research Is a Buy

- By Alberto Abaterusso

Continuing tensions between the U.S. and China have proven to not be good for U.S. equities. The trade war between the two countries began last summer when President Donald Trump disclosed his plans to impose 10% tariffs on an estimated $200 billion worth of imports from China. While many sectors have been affected by this ongoing dispute, semiconductor companies are among those that have been hurt the most.

Warning! GuruFocus has detected 1 Warning Sign with CMA. Click here to check it out.

The intrinsic value of LRCX

As a result, the market has created a buying opportunity for large semiconductor companies like Lam Research Corp. (LRCX).

Last week, investors were hopeful for some relief as the PHLX Semiconductor Sector Index (SOX) rose 2.6% and the Technology Select Sector SPDR (XLK) exchange-traded fund gained 1.9% over a five-day period. Shares of Lam Research soared 5.5% over the same period.

The Fremont, California-based manufacturer of semiconductor processing equipment has an excellent track record. The price chart below shows shares of Lam Research have climbed 173% over the last five years through Jan. 21.

The PHLX Semiconductor index gained 132% and the Technology Select Sector ETF rose nearly 88% over the same period.

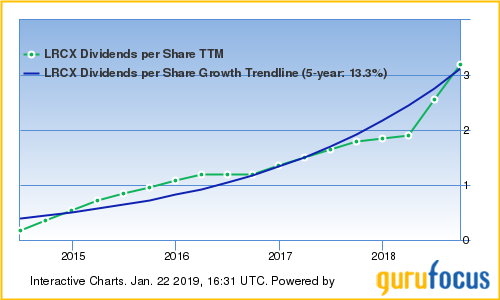

In addition, shareholders of Lam Research have enjoyed receiving dividend since July 2014. The initial quarterly distribution of 18 cents per share has gradually increased to $1.1 per share. As of June 21, the forward dividend yield is 2.98%, beating the industry median of 2.03% and the dividend yield of 2.01% for the S&P 500 index.

Few stocks have experienced such upside. Will Lam Research continue to increase the distribution of free cash flow for its shareholders? I would say so after taking a look at the company's balance sheet, the profitability of its operations as well as the outlook for its industry.

The balance sheet is solid. The semiconductor operator has $3.62 billion in cash on hand and securities, which is enough to cover the dividend for at least five years. Lam Research has about $2.38 billion in total debt, leading to a total debt-to-equity ratio of 45% compared to an industry median of 35%. Does this put the dividend in peril? If the company doesn't have issues paying off its debt and the capital invested yields a higher return of what it costs for interest expenses, the remuneration is safe.

As of Sept. 30, Lam Research Corp's return on invested capital was 52.29% while the weighted average cost of capital was 9.61%. For the same period, earnings before interest and taxes was 32.66 .

GuruFocus has assigned a financial strength rating of 7 out of 10 and a profitability and growth rating of 9 out of 10.

A potential catalyst for the stock is the global adoption of portable and mobile electronic devices. The prevalence of smartphones and other portable devices is gradually getting ahead of desktops, creating a near-term opportunity for Lam Research and other semiconductor companies.

The stock is more appealing after a 31% drop for the 52 weeks through Jan. 21. The share price is below the 200-day simple moving average line, but slightly above the 100- and 50-day lines. The closing share price of $147.55 on Monday was 20.3% above the 52-week low of $122.64 and 59.2% below the 52-week high of $234.88. The market capitalization is about $22.9 billion.

The price-book ratio is 4.25 versus the industry median of 1.85, the price-sales ratio is 2.3 versus the industry median of 1.67 and the price-earnings ratio is 11.16 versus an industry median of 19.55.

The recommendation rating is 2.2 out of 5, and the average target price of $195.34 reflects nearly 32% upside from Monday's closing price.

In December, Needham initiated coverage of Lam Research with a buy rating and $180 price target.

According to thefly.com, the analyst said the semiconductor company is "attractively priced" and "stands to benefit from the increasing etch and deposition intensity associated with 3D NAND and multi-patterning."

Disclosure: I have no positions in any securities mentioned in this article.

Read more here:

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with CMA. Click here to check it out.

The intrinsic value of LRCX