Is Lamb Weston Holdings, Inc. (LW) Going to Burn These Hedge Funds?

Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors' consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Lamb Weston Holdings, Inc. (NYSE:LW).

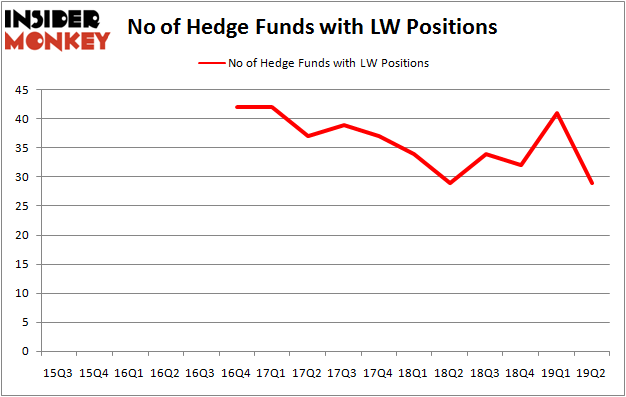

Lamb Weston Holdings, Inc. (NYSE:LW) has experienced a decrease in hedge fund interest in recent months. Our calculations also showed that LW isn't among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are perceived as worthless, outdated investment tools of the past. While there are more than 8000 funds with their doors open today, Our researchers look at the top tier of this club, around 750 funds. These money managers direct most of the hedge fund industry's total asset base, and by tailing their inimitable investments, Insider Monkey has unearthed many investment strategies that have historically defeated the S&P 500 index. Insider Monkey's flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a gander at the recent hedge fund action encompassing Lamb Weston Holdings, Inc. (NYSE:LW).

Hedge fund activity in Lamb Weston Holdings, Inc. (NYSE:LW)

Heading into the third quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in LW a year ago. With the smart money's positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the largest position in Lamb Weston Holdings, Inc. (NYSE:LW). Citadel Investment Group has a $105.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, with a $99.8 million position; 0.1% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions contain John Overdeck and David Siegel's Two Sigma Advisors, Ryan Pedlow's Two Creeks Capital Management and D. E. Shaw's D E Shaw.

Because Lamb Weston Holdings, Inc. (NYSE:LW) has experienced bearish sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their positions entirely in the second quarter. Interestingly, Robert Boucai's Newbrook Capital Advisors sold off the biggest position of all the hedgies followed by Insider Monkey, totaling close to $105.1 million in call options, and Steve Cohen's Point72 Asset Management was right behind this move, as the fund dumped about $34.5 million worth. These transactions are interesting, as total hedge fund interest was cut by 12 funds in the second quarter.

Let's now review hedge fund activity in other stocks similar to Lamb Weston Holdings, Inc. (NYSE:LW). We will take a look at Huaneng Power International Inc (NYSE:HNP), Targa Resources Corp (NYSE:TRGP), Credit Acceptance Corp. (NASDAQ:CACC), and SAGE Therapeutics Inc (NASDAQ:SAGE). This group of stocks' market valuations are closest to LW's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position HNP,3,2350,0 TRGP,18,206424,-5 CACC,27,1103970,-1 SAGE,25,458199,-3 Average,18.25,442736,-2.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $443 million. That figure was $519 million in LW's case. Credit Acceptance Corp. (NASDAQ:CACC) is the most popular stock in this table. On the other hand Huaneng Power International Inc (NYSE:HNP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Lamb Weston Holdings, Inc. (NYSE:LW) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on LW as the stock returned 15.1% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019