Lands' End (LE) to Report Q2 Earnings: What's in the Offing?

Lands' End, Inc. LE is likely to witness a decline in the top line when it reports second-quarter fiscal 2022 numbers on Sep 1 before market open. The Zacks Consensus Estimate for revenues is pegged at $344.9 million, suggesting a decline of 10.2% from the prior-year reported figure.

The Zacks Consensus Estimate for a loss for the quarter under discussion has been stable at 12 cents a share over the past 30 days. It suggests a sharp decline from the earnings of 48 cents reported in the year-ago period. This leading uni-channel retailer of casual clothing, accessories, footwear and home products has a trailing four-quarter negative earnings surprise of 2.7%, on average.

Key Factors to Note

Soft consumer discretionary spending due to the inflationary pressure seen in food prices and fuel costs is likely to have weighed on Lands' End’s second-quarter performance. Also, the ongoing supply-chain issues and an industrywide slowdown in e-commerce traffic, primarily in the apparel category, are likely to have hurt the company’s top line. On its last earnings call, management informed that the second quarter is likely to remain challenged from an in-stock position.

Lands' End forecast second-quarter net revenues between $335 million and $350 million, down from the $384.1 million reported in the year-ago period. Margins are also likely to have remained under pressure due to incremental supply-chain costs. For the second quarter, the company guided roughly $13 million in incremental transportation costs due to global supply-chain bottlenecks. It also estimated the second-quarter loss in the bracket of 9-18 cents a share.

Despite the aforementioned headwinds, we cannot ignore Lands' End's efforts to mitigate challenges. The company’s consumer-centric approach, product initiatives, technological advancements and brand awareness might have provided some cushion. Also, strength in the Outfitters business, driven by the stellar demand from the company’s small and medium-sized business customers, national accounts and school uniform households might have been a contributing factor.

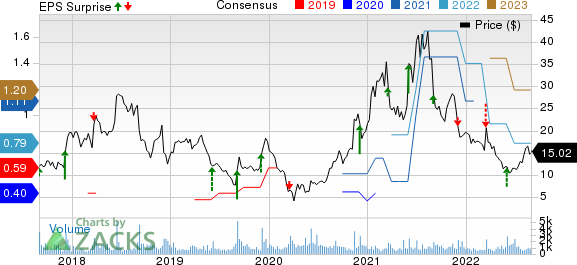

Lands' End, Inc. Price, Consensus and EPS Surprise

Lands' End, Inc. price-consensus-eps-surprise-chart | Lands' End, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Lands' End this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Lands' End has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 Stocks With the Favorable Combination

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Casey's General Stores CASY currently has an Earnings ESP of +24.88% and a Zacks Rank #2. The company is expected to register a bottom-line increase when it reports first-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly earnings per share of $3.32 suggests an increase of 4.1% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Casey's General’s top line is anticipated to have risen year over year. The consensus mark for CASY’s revenues is pegged at $4.6 billion, indicating an increase of 44.4% from the figure reported in the year-ago quarter. Casey's General has a trailing four-quarter earnings surprise of 5.8%, on average.

Dave & Buster's Entertainment PLAY currently has an Earnings ESP of +2.97% and a Zacks Rank #3. The company is likely to register a decline in the bottom line when it reports second-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for the quarterly earnings per share of $1.01 suggests a decline of 5.6% from the year-ago quarter.

Dave & Buster's Entertainment’s top line is expected to have increased year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $432.3 million, which indicates an increase of 14.5% from the figure reported in the prior-year quarter. PLAY has a trailing four-quarter earnings surprise of 41.1%, on average.

Campbell Soup Company CPB currently has an Earnings ESP of +0.60% and a Zacks Rank #3. The company is expected to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 results. The Zacks Consensus Estimate for the quarterly earnings per share of 56 cents suggests an increase of 1.8% from the year-ago quarter.

Campbell Soup’s top line is anticipated to have increased year over year. The consensus mark for CPB’s revenues is pegged at $1.98 billion, indicating an increase of 5.5% from the figure reported in the year-ago quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Lands' End, Inc. (LE) : Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research