Largest Insider Trades of the Week

- By Tiziano Frateschi

The GuruFocus All-in-One Screener can be used to find insider trades from the past week. Under the Insiders tab, change the settings for All Insider Buying to "$200,000+," the duration to "September 2018" and All Insider Sales to "$5,000,000+."

Warning! GuruFocus has detected 2 Warning Sign with INTC. Click here to check it out.

The intrinsic value of YMAB

According to the above filters, the following are trades from company insiders this week.

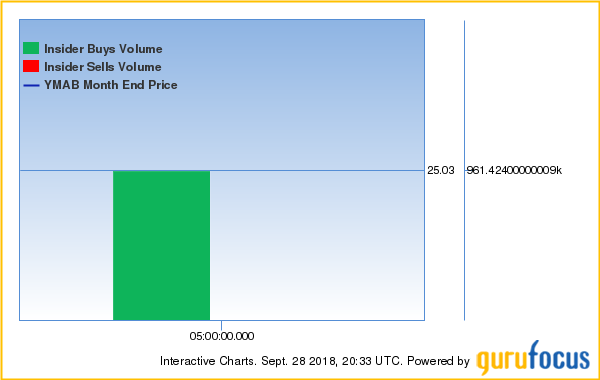

Tyagi Ashu, director of Y-mAbs Therapeutics Inc. (YMAB), bought 430,174 shares for an average price of $16 per share on Sept. 25.

The clinical-stage biopharmaceutical company has a market cap of $911 million. It has an insider ownership of 3.45%.

Over the last 12 months, the stock has gained 11%.

Redmile Group LLC, director and 10% owner of Fate Therapeutics Inc. (FATE), bought 3,703,704 shares for an average price of $13.50 per share on Sept. 25.

The biotechnology company has a market cap of $870 million and an enterprise value of $807 million. It has an institutional ownership of 74.39% and insider ownership of 1.16%.

Over the last 12 months, the stock has climbed 300% and, as of Friday, is 2.16% below its 52-week high and 365% above its 52-week low.

Richard D. Kinder, executive chairman and 10% owner of Kinder Morgan Inc. (KMI), bought 500,000 shares for an average price of $17.55 per share on Sept. 27.

The energy infrastructure company has a market cap of $39 billion and an enterprise value of $77 billion. The company has an institutional ownership of 56% and insider ownership of 12.80%.

Over the last 12 months, the stock has declined 8% and is currently 8.18% below its 52-week high and 20.69% above its 52-week low.

Most important insider sales

Joseph S. Zakrzewski, director, Joseph T. Kennedy, general counsel, and Steven B. Ketchum, chief shientific officer of Amarin Corp. PLC (AMRN) sold a combined 2,458,947 shares for an average price of $10.75 per share on Sept. 24 and Sept. 25.

The biopharmaceutical company has a $4.76 billion market cap and an enterprise value of $4.8 billion. It has an institutional ownership of 36.16% and insider ownership of 0.73%.

Over the last 12 months, the stock has risen 29% and is currently 1.91% below its 52-week high and 51.50% above its 52-week low.

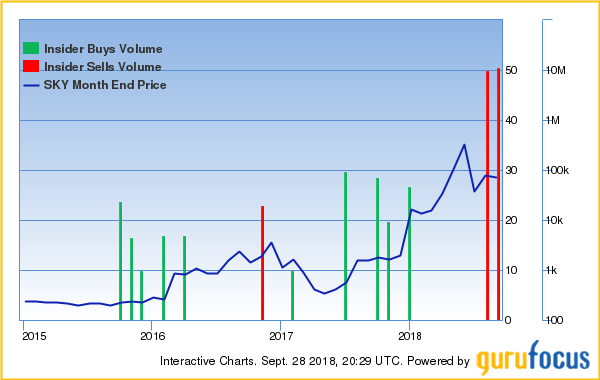

Mak Capital One LLC and Centerbridge Capital Partners, 10% owners of Skyline Champion Corp. (SKY), sold a combined 7,452,008 shares for an average price of $27.93 per share on Sept. 25.

The home builder has a market cap of $1.61 billion and an enterprise value of $1.59 billion. It has an institutional ownership of 78.61% and insider ownership of 50.34%.

Over the last 12 months, the stock has gained 138% and is currently 19.86% below its 52-week high and 177% above its 52-week low.

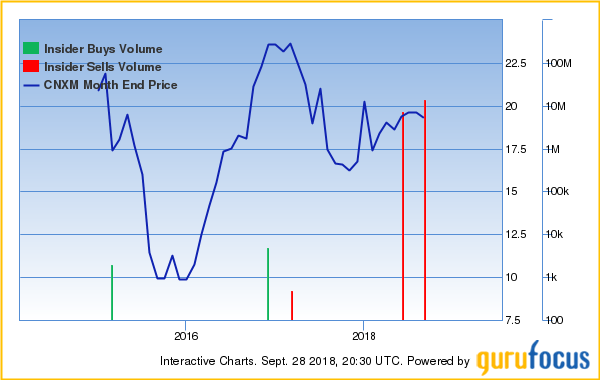

NBL Midstream LLC, 10% owner of CNX Midstream Partners LP (CNXM), sold 14,217,198 shares for an average price of $17.75 per share on Sept. 27.

The midstream oil and gas company has a market cap of $1.23 billion and an enterprise value of $1.7 billion. It has an institutional ownership of 53.46% and insider ownership of 0.19%.

Over the last 12 months, the stock price has climbed 19% and is currently 8.55% below its 52-week high and 26.23% above its 52-week low.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with INTC. Click here to check it out.

The intrinsic value of YMAB